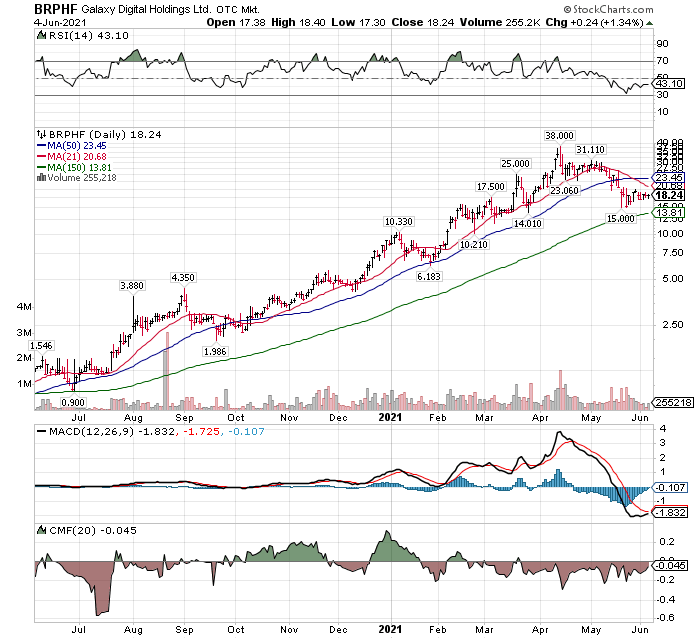

Galaxy Digital (BRPHF)* $18.24

It is a good probability that Galaxy will attract buyers from these two presentations (posted below) are completed in the next two weeks. We will project that share bought under $18 will trade higher (not going to speculate how much) following these two events. Our view on Galaxy is that it is a core holding and unless the story changes drastically, we are buyers and accumulators of shares on weakness. Position building. Our long-term goal is a minimum appreciation of two-to-three times the current price in the next two-to-three year period.

Better stated, we think we can buy, accumulate & trade this stock for the next decade or two. Galaxy is a very dynamic growth vehicle in a rapidly growing and evolving industry – Blockchain & Crypto Currencies. That is what a core holding is. A company for building wealth and assets – trading is secondary.

- Galaxy Digital to Present at Piper Sandlers Global Exchange

5:00 PM ET 5/25/21 | Dow Jones

NEW YORK, May 25, 2021 /CNW/ – Galaxy Digital Holdings Ltd. (TSX: GLXY), a financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sectors, today announced that Mike Novogratz, Founder, CEO and Chairman, will present at Piper Sandler’s Global Exchange & FinTech Conference on Wednesday, June 9, 2021, at 10:30 a.m. ET. Mike is expected to provide a general overview of Galaxy Digital’s strategy and his views on the cryptocurrency industry.

A link to the live webcast of the presentation will be available on Galaxy Digital’s Investor Relations website: https://investor.galaxydigital.io/. For those unable to listen to the live audio webcast, a replay will be available on Galaxy Digital’s Investor Relations website shortly after the event.

- Galaxy Digital to Present at Morgan Stanleys Financials, Payments

5:00 PM ET 6/3/21 | Dow Jones

NEW YORK, June 3, 2021 /CNW/ – Galaxy Digital Holdings Ltd. (TSX: GLXY), a financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sectors, today announced that Mike Novogratz, Founder, CEO and Chairman, will present at Morgan Stanley’s Financials, Payments & CRE Conference on Monday, June 14, 2021, at 2:45 p.m. ET. Mike is expected to provide a general overview of Galaxy Digital’s strategy and his views on the digital asset’s ecosystem.

A link to the live webcast of the presentation will be available on Galaxy Digital’s Investor Relations website: https://investor.galaxydigital.io/. For those unable to listen to the live audio webcast, a replay will be available on Galaxy Digital’s Investor Relations website shortly after the event.

MACD (chart below) is a higher probability short-term trading signal. It is likely to go on a buy signal (black crossing red) as we head into the piper Sandler conference.

Chart View by Tom:

- Price relationship to Moving Averages:

Long-term the share price is still above its 150-day moving average so the trend is up.

Intermediate-term (two weeks to three months) suggest a normal correction within an uptrend. Granted the correction is a 50% retreat from its high of $38… but do you see where this stock came from in one year. This stock and company are hot, and these types of moves come with the territory. A price break of the 150-day MA would be our indicator that the long-term uptrend is broken.

- MACD: MACD (chart below) is a higher probability short-term trading signal. The MACD current set-up, suggests the indicator goes on a buy signal (black line crossing red line) as we head into the Piper Sandler conference.

- RSI: RSI does not tell us anything. Neutral at best.

- Support and Resistance lines

The tight trading lines between $15 and $18 initially, and now $16 and $18, suggests to us that the shares are under accumulation. The tight price action is likely accumulation in preparation for the two upcoming conferences mentioned in this writing – Piper Sandler and Morgan Stanley.

- CMF: Chaikin Money Flow (CMF) suggests distribution is diminishing and support our projection that the shares are close to ending its correction.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

466 total views, 2 views today