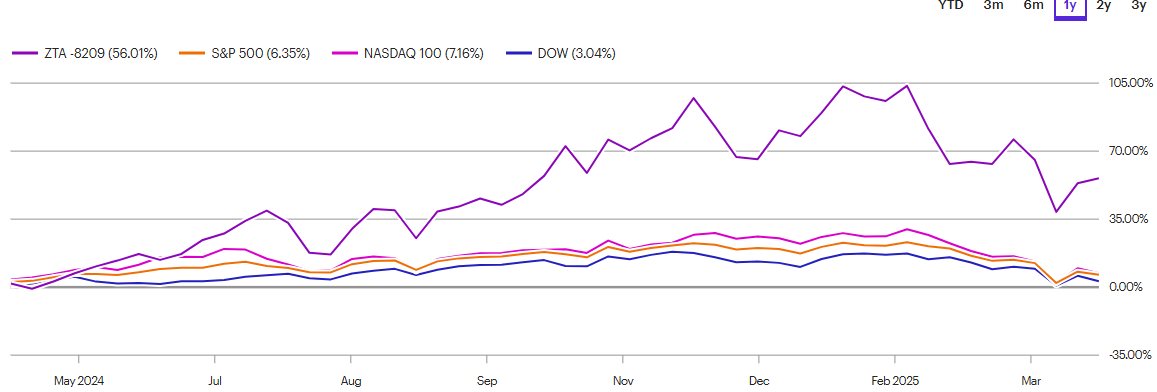

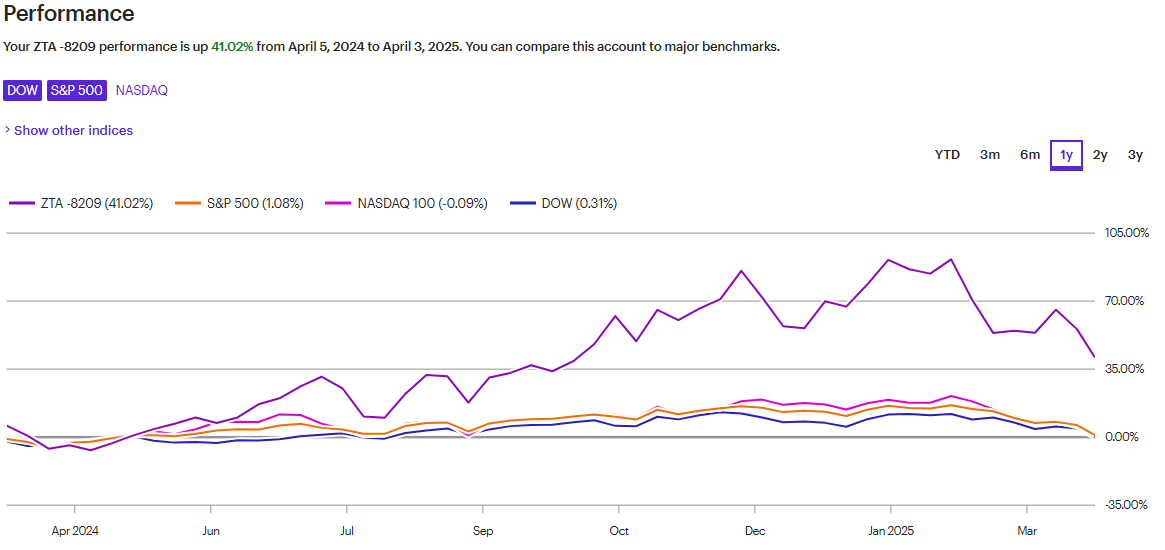

Comments on three Uranium/Nuclear positions and on two newly acquired positions in Bitcoin Treasury stocks.

For forward Information: LOTM does not have a very big positions in the Nuclear industry.

Accounts related to LOTM own small positions in:

- Cameco (CCJ*) $57.40

- VanEck Uranium & Nuclear ETF (NLR*) $95.77

- BWX Technologies (BWXT*) $114.74

We are treating the three companies as one industry focused position. If we see weakness in the general market that causes us concern, we will sell these position very quickly to reduce margin. We might sell these three if we see something more interesting as well. News out of D.C. has these stocks strong at present. These are some of the highest quality ideas in the Uranium/Nuclear space. Continue reading

![]()