Bill Powers from Mining Stock Education, released a video Friday 2.16.24 – “How To Make Your First Million Dollars via “Junior Mining Stocks.” The video is linked here. It is excellent. I suggest watching the Vid if you want to compound wealth faster than normal. One can remove “Junior Miner” and substitute any sector or industry and slightly modify the structure Bill uses.

This is a speculator’s approach, and he does not sugar coat this process. Botton-line, Bill structures a process for building wealth with the goal of reaching more than one million dollars.

Bill touches on one part that of his process structure in the Video that LOTM also has as a first “Profiling” step process.

You might add this to Bill’s process structure approach. I’ll refer to it as Capital Structure Profile.

Capital Structure Profile and what is attractive to the LOTM Profiling.

- The number of shares outstanding in a capital structure is what gives us price leverage, so a small number of shares outstanding on a fully diluted basis, is where we get leverage from. Smaller the number of the better, with consideration given to daily liquidity when compared to our position size.

- Insider ownership: We want Insiders to own 10% of the company or more as a benchmark. Put simply. Skin in the Game” links management with shareholders.

- A modest Institutional ownership is desired, but we don’t want a very high institutional ownership number. It is a plus when new institutions “discover” the company driving up the price. Conversely, we don’t want a large institutional ownership number, if or when Institutions decide they want to exit.

- Low debt or no debt is desired. If there is debt or interest payments on other obligations such as preferred shares. Clean and simple capital structure.

- Market Cap is very important. Every $1 the shares increase times the total shares changes the market cap. Therefore, a low share count allows for the market cap to rise faster and farther than a company with a high share count. If a company has 750 million shares outstanding, every dollar the price goes up is an increase in the market capitalization of $750 million dollars. We lose our price leverage very quickly when looking for doubles and triples. A high share count might be of use as a trading idea if the share price is violative, as the trading liquidity would be very good.

EXAMPLE: A Clean and simple capital structure is desired with skin in the game by management. A name that we like and own for fitting this capital structure profile is VersaBank (VBNK*). We will point out what we look for and where we find the data below.

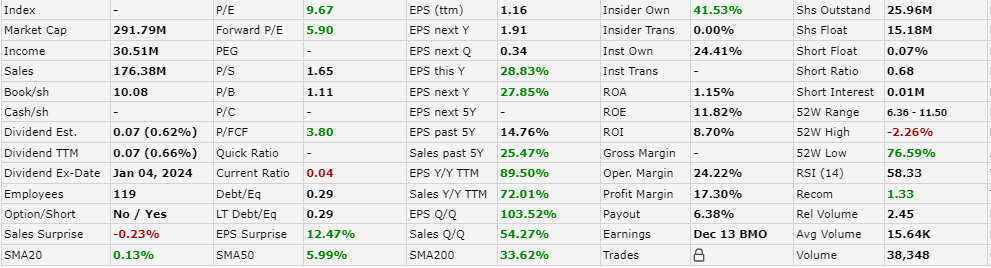

VersaBank (VBNK*) $11.24 – sourced from Finviz.com

VersaBank is a FinTech company that has no physical branches and only does Business 2 Business banking.

From Finviz data for VBNK (linked), I can eye ball the capital structure very quickly.

I: Share count: 25.6 million shares

II: Insider ownership: 41.53% means the float is small at 15.18 million shares and management has incentive to see the price rise.

III: Institutional ownership: 24.4% 70% to 90% suggests the idea is well known to institutional buyers.

IV: Low debt: 0.29 debt to equity is VBNK’s number. We have to dig further for the actual number, but a bench mark of 0.30 and lower is ok. We don’t feel a need to look further at this time.

V: Market Cap: $290 Million market cap is ok. Does the company have a path to One Billion? Yes, is the answer without going deeper at this time.

My goal when looking at a company is to ask myself if I am comfortable owning this as an asset rather than a stock number I am trading. I may choose to trade the stock, but would I own the asset long-term as a back stop to a market or economic surprise. Second question is, if the price dropped 50% would I buy more if there was not a material change in operations or the industry. I want to answer this before I buy. In the case of VBNK I would welcome the opportunity.

In a different blog I will go over the other categories in LOTM’s profiling of a company. I would like you to hear what Bill Powers has to say first.

Written Feb 17, 2024, by Tom Linzmeier

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog at LIVINGOFFTHEMARKET

166 total views, 2 views today