There are four items to look at in selecting a Bitcoin Spot ETF for ownership:

- Management Experience and Credibility

- Management fees

- How close does the ETF track the Price of Bitcoin

- Liquidity – The ability to sell when you want to sell.

Let’s take # 4 above, first – Liquidity.

As the title below states, Blackrock and Fidelity dominate in daily volume. Numbers three and four in volume of shares trading are Ark’s ETF’s ARKF and Bitwise’s Bitcoin ETF, BITB.

- BlackRock and Fidelity are dominating the ‘two-horse race’ for Bitcoin ETF billions January 16, 2024

#3 Tracking the ETF’s price with the price of Bitcoin. The clear winner here is Galaxy Digital. Galaxy Digital sub-Advisor or partners with three existing Spot Bitcoin ETF’s that trade outside the USA. The history of their tracking Bitcoin in existing ETF outside the USA is near perfect. Invesco/Galaxy ETF is BITO.

Video of Mike Novogratz founder CEO of Galaxy Digital talks about tracking Bitcoin price closely.

- Galaxy Digital’s Michael Novogratz on bitcoin ETFs: An amazing product for consumers & institutions 7 minutes – CNBC interview

#2 – Management fees.

This is a simple one The management fees are an expense on a commodity product. The lowest fee is the best. Variables to consider are experience, size and liquidity.

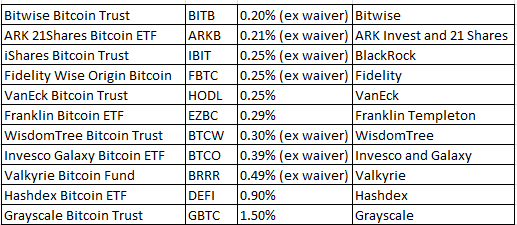

The fees on the eleven ETFs are as follow:

#1 Management Experience and Credibility?

The three Spot Bitcoin ETF management teams with the most Crypto / Blockchain experience are

#1 Invesco/Galaxy (BTCO)

#2 Bitwise (BITB)

#3 Fidelity FBTC)

Certainly, asset managers Blackrock, Franklin, Van Eck, WisdomTree and Ark 21Shares (ARKB) have been around a long-time in TradFi, so there is no lack of experience at these firms. I would prefer a company with Crypto and Blockchain experience – in addition to TradFi experience.

SUMMARY:

Fidelity would be my Number one choice as a Bitcoin Spot ETF. The biggest factor for me that set Fidelity apart from my # 2 choice – Invesco/Galaxy is daily trading volume. Invesco/Galaxy is certainly connected. Invesco has about $1.6 trillion dollars under management. They have great crypto and blockchain experience in Galaxy Digital (BRPHF)* $6.40 as partner to Invesco. Invesco/Galaxy trading volume, however, is lower than the top four companies as listed in #4 above.

ADDITIONAL VIEWS:

I: Decisions, Decisions: Discover the 3 Spot Bitcoin ETFs I’d Consider Buying – Motley FOOL – By RJ Fulton – Jan 16, 2024

The three Spot Bitcoin ETFs suggested by The Motley FOOL are, in order”

- Bitwise’s Bitcoin ETF (BITB)

- Fidelity with its Wise Origin Bitcoin Fund (FBTC)

- VanEck’s Bitcoin Trust (HODL

I shy away from VanEck as their investment style has been to own the largest market caps in a particular focused ETF. That does not apply in this case, but it is my bias towards VanEck. I am a fan of actively managed ETFs. VanEck manages by largest market.

II: 11 ETFs Unleashed! What It Means for YOU – Mark Moss on the Spot Bitcoin ETFs – 35 minutes in length. The single Spot Bitcoin suggested by Moss is Fidelity (FBTC).

There is no other investment for the masses like Bitcoin.

There is a fixed number of supply, 21 million shares/coins. There is nearly an unlimited number of potential $’s available of demand. Central banks will keep printing fiat currency. That is what central bakers do. This weakens the purchasing power of fiat currency. As more and more of the 8 billion people on planet Earth realize they can preserve or gain their purchasing power with bitcoin – the price can only go higher.

This makes bitcoin the same as a “one of a kind” collectible. It is early days. Blackrock, the largest asset manager in the world, Fidelity the fourth largest asset manager in the world and Invesco, the eight largest asset manager in the world, are each approved for a bitcoin spot ETF. There are eight other asset managers globally now approved. The sales force marketing bitcoin, a new asset class, is very large. Eventually everyone will own bitcoin. We might as well surrender now.

In the video above by Mark Moss, Moss suggests the bitcoin spot ETF to buy is Fidelity – symbol FBTC.

I agree with Moss, but I also like Invesco/Galaxy bitcoin ETF symbol BTCO. Bitwise Bitcoin ETF is another and third expert in crypto / blockchain. Its ETF symbol is BITC. These three have extensive experience in crypto and blockchain. To keep things simple, we suggest Fidelity if liquidity for size is needed. Invesco/Galany would be our send. Eventually we will own both. We also have some GBTC (Grayscale Bitcoin Trust) and Osprey Bitcoin Trust (OBTC) that we will continue to own in taxable accounts because we do not want to sell and pay the capital gain tax.

Hope this is of help.

#blockchain #crypto #bitcoinspotetf #investing #stocks #bitcoin

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Written January 18, 2023 by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page LivingofftheMarket

262 total views, 4 views today