Free Enterprise has given way to Crony Capitalism in the USA

Crony Capitalism – an economic system in which businesses thrive not as a result of free enterprise, but rather as a return on money amassed through collusion between a business class and the political class. This is often achieved by the manipulation of relationships with state power by business interests rather than unfettered competition in obtaining permits, government grants, tax breaks, or other forms of state intervention over resources where business interests exercise undue influence over the state’s deployment of public goods, for example, mining concessions for primary commodities or contracts for public works. Money is then made not merely by making a profit in the market, but through profiteering by rent seeking using this monopoly or oligopoly. Entrepreneurship and innovative practices which seek to reward risk are stifled since the value-added is little by crony businesses, as hardly anything of significant value is created by them, with transactions taking the form of trading.

The above is a definition of Corny Capitalism. This is what I have come to believe we have in the USA.

LOTM: Crony Capitalism shows up in many ways. One way is in the stifling of innovative businesses in favor of established but less efficient business. Rewards for size or longevity Vs Innovative and more efficient businesses. This is what is happening with Blockchain and Crypto. $2.4 Billion was invested in Blockchain & Crypto in Q1 2023. This is a large amount of money but down substantially from 2021 and 2022. Because of the current USA regulatory policies on this subject Vs how some in other parts of the world are regulating Blockchain & Crypto, this industry is starting to expand outside the USA. Crypto & Blockchain businesses will grow and succeed but at the expense of USA economy and the benefit to US people.

Galaxy Digital (BRPHF)* will move more of its operations offshore (USA) because of a ‘regulatory headache’ in the US, billionaire crypto bull Mike Novogratz says.

Excerpts from this May 2023 Interview:

Crypto investing giant Galaxy Digital is set to move more of its operations offshore because of a difficult regulatory environment in the US, its CEO Mike Novogratz said Tuesday.

The billionaire investor and bitcoin bull told analysts that the collapse of high-profile digital asset firms including failed exchange FTX have led to a crackdown in the US, leading to Galaxy focusing on accelerating growth abroad.

“When I look at the short term, we still have a regulatory headache in the United States,” Novogratz said on a conference call after the firm published its first-quarter earnings. “I don’t see that breaking anytime soon.”

Galaxy recently added a new team of traders in Hong Kong, while Coinbase CEO Brian Armstrong told Bloomberg TV on Monday that his firm is evaluating the United Arab Emirates as a potential new crypto hub.

Galaxy Conference call May 9, 2023, link https://investor.galaxy.com/overview/default.aspx. Mike Novogratz discussed in the conference call their move to expand outside the USA and Canada.

LOTM: Galaxy will be more than fine as a company. Their recent, exclusive partnership with DWS in Europe, is another step in diversifying away from the USA and into countries with more favorable regulatory policies. DWS manages one trillion dollars of assets. This a move of strength for Galaxy and recognition that Blockchain and Crypto is a necessary asset class to offer clients by DWS.

Gary Gensler, SEC Tells Coinbase there is no need for more clarity of regulation.

May 15, 2023 10:55 AM EDT · 1 min read

SEC Chair Gensler Argues That Rules Already Exist To Regulate Crypto in Light of Coinbase Pushback

US Securities and Exchange Commission’s Chair Gary Gensler pushed back against Coinbase’s call to have the agency propose and adopt rules for digital assets.

Gensler was asked on Monday during Atlanta Fed’s 2023 Financial Markets Conference to comment on the dispute with Coinbase why the SEC doesn’t want to publish crypto rules.

The rules have already been published, Gensler said.

“To make it quite direct, this is a field that has been operating largely noncompliant,” Gensler said.

Rules are already out there governing exchanges, broker dealers, advisers, custodying assets and how to register securities offerings, he said.

There is nothing about a new technology that makes it non consistent with public policies, Gensler added.

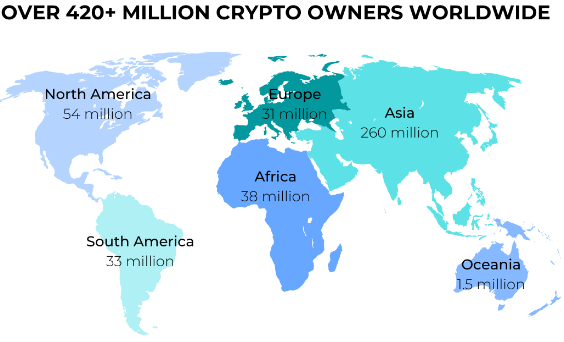

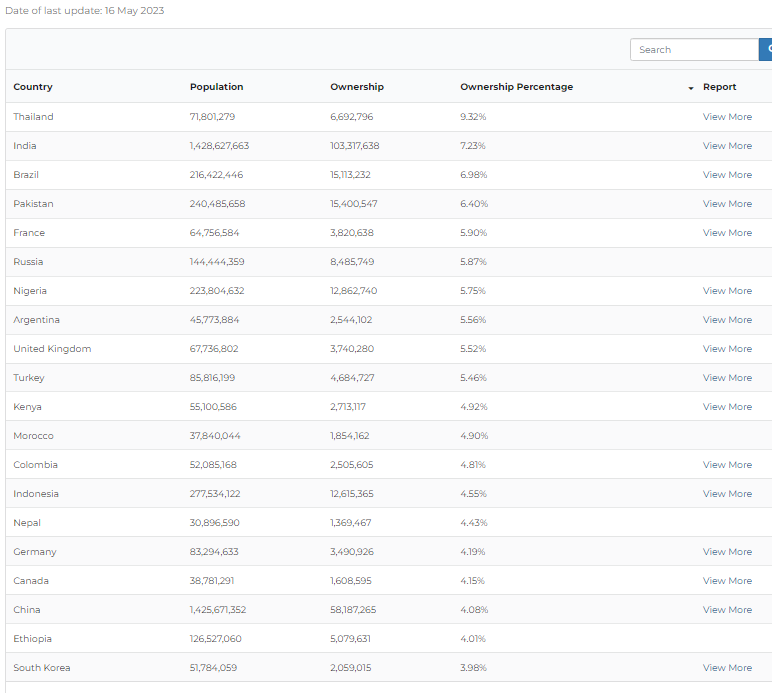

Ownership of Crypto assets has grown from about 270 million to 420 million in roughly the past 15 months.

Source: https://triple-a.io/crypto-ownership-data/

The Crypto market appears to be doing very well outside the USA.

Source: https://triple-a.io/crypto-ownership-data/

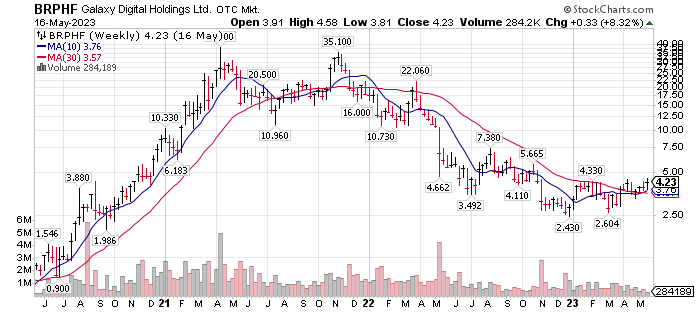

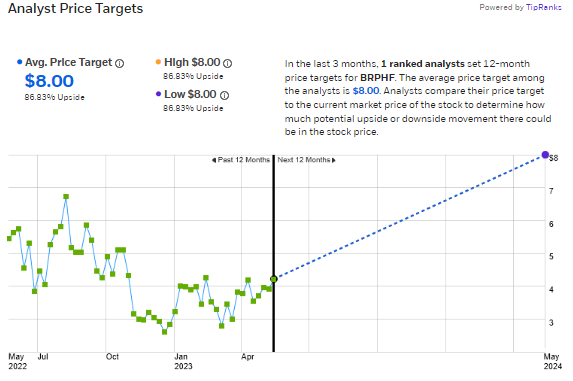

Galaxy Digital* stock’s three-year chart:

Galaxy is starting to leave the Stage 1 chart pattern and enter a Stage 2 chart pattern.

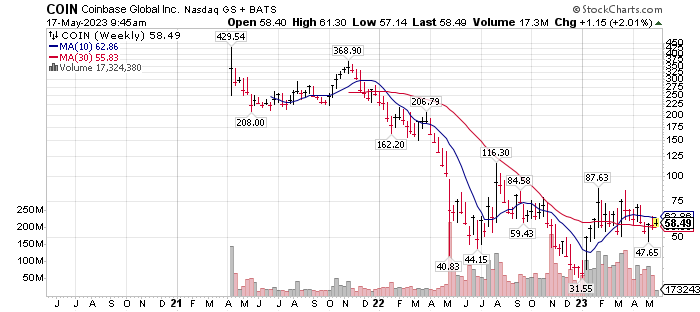

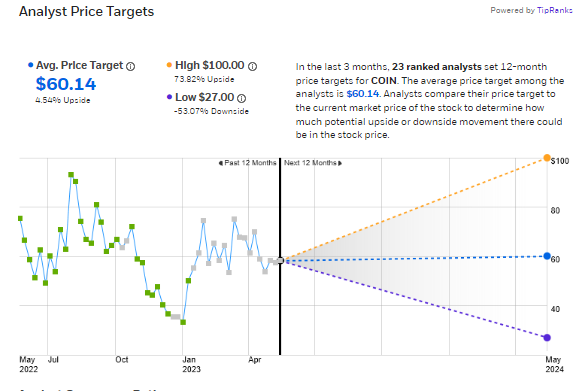

Coinbase stock’s three year chart:

Coinbase is still in a stage 1 chart pattern.

Conclusion: Blockchain & Crypto are growing rapidly in areas other than the USA. Companies and skilled workers will go to where they are treated the best. Coinbase and Galaxy will do what they need to do to survive and prosper. They will go to where the market treats them best.

Bitcoin: Bigger and Faster than Visa and Mastercard:

Bitcoin market cap surpasses that of Visa – The Cryptonomist – February 2023

Bitcoin, the world’s most popular digital currency, has surpassed Visa and Mastercard in terms of market capitalization.

₿REAKING: The Bitcoin Network processed more transaction value than …

Jan 25, 2023 The Bitcoin network processed 33% more in transaction value when compared to VISA and three times more than MasterCard.

Bitcoin Lightning Network Faster Than Visa And Mastercard

July 26, 2022. The Bitcoin Lightning Network can settle payments faster than traditional payment networks such as Visa and Mastercard, a video reveals.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written May 17, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

756 total views, 2 views today