Technical Comment:

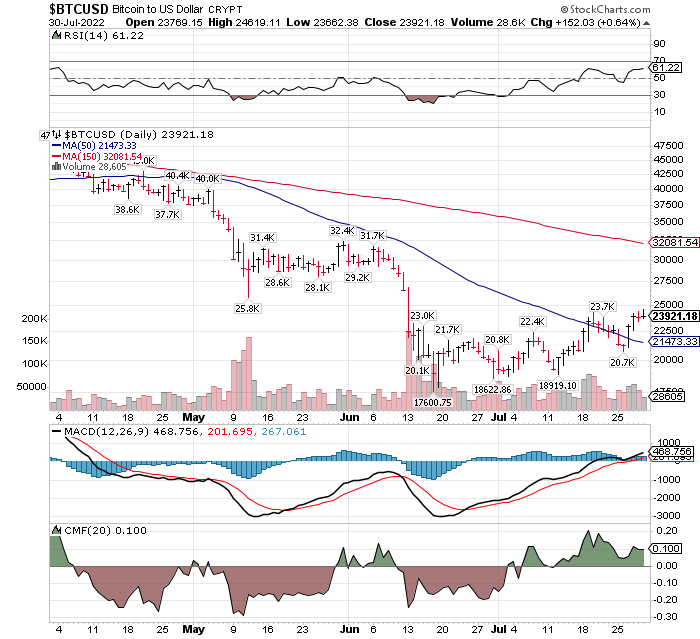

“You Know the Drill.” To get a two to four-month “buy the trend” signal, we need these four things to happen:

- Relative strength (RSI) above 50% of the market – Positive

- MACD Crossover – Positive

- CMF above the Zero Line – Positive

- Price above 50-day moving average – Positive

Risk management:

- Traders -trailing stop loss 1/3 of your predetermined minimum sell goal. We suggest staged selling, 1/3 – 1/3 – 1/3. Example 15% minimum targeted gain translates to a 4.95% stop loss on cost, and then followed up with a trailing stop. This allows you to lose on two of three trades and still make money. Best for short-attention span market participants. Short-attention spans are not a negative. Use who you are as your strength! If that is who you are, use it, but channel it!

- Investors and Speculators – if you like the macro and fundamental set-up for the industry and company, you might use dollar-cost-averaging risk management strategy instead of using a stop loss. This is the best risk management tool for wealth building. Best for people comfortable with delayed gratification returns.

Advertisement:

Our goal is to get you profitable and independent. Inflation and government spending is real and not going to change. If you struggle with implementing this strategy, schedule a coaching secession. LOTM will provide you with the Technical signals, you execute the plan. If you need help, Coaching and Training is what we do.

Coaching is including in our LOTM: Level I program at an annual cost of $1,200, one-time payment. This offer is valid until Aug 7th at midnight. Price will increase to $1,550 after August 7th. Text 651 245 6609 for more info or to set-up an intro conference call. Our goal is to replicate what was once known as the ‘Customer’s man’ relationship where we bring you the ideas and walk you through the trade, but all decisions and actions are yours. Consider it a combination of real-time coaching, training & research driven Membership Club. This is Club is not intended to be a mass media service. Club membership will be limited in number to provide one-to-one personalized service. Prices will increase over time, based on time available to provide quality service.

At this time, LOTM remains a free blog. Level II, when implemented, is anticipated to be a $239 annual fee newsletter.

Why we like Bitcoin and Commodities Now!

One of the Biggest Debtor Nations

The USA has “debt to GDP of more than 130 percent. That almost never ends without hyper-inflation or debt restructuring.” Mike Novogratz Founder/CEO Galaxy Digital, former partner at Goldman Sachs. July 30, 2022.

In such an environment, Bitcoin with its limited issuance size, and commodities, with gold and paid for property being the most stable, as the best places to be invested. LOTM.

Specific to Crypto:

When a market – any market – has a liquidity and debit crisis with multiple industry leaders in liquidation or bankruptcy, it marks the end of the downward cycle. Always volatile, Bitcoin has a high probability of being past its cycle low prices. As shown in the chart above, Bitcoin is on an intermediate term buy signal. We do not know at this time if this buy signal will turn into a long-term trend buy. We need time for the trend to develop. Technical chart patterns can be destroyed by adverse news or events at any times. Position your personal risk factor to match the possibility of such a Black Swan event.

Supporting Opinions:

Galaxy Digital’s Novogratz on “Crypto Winter”

Jul 19, 2022, Bloomberg – 22 minutes

Summary of the Liquidity crisis in Blockchain and Crypto. Novogratz’s believes 90% or more is behind us. The Bitcoin market could be choppy until a new narrative develops. The USA has “debt to GDP of more than 130 percent. That almost never ends without hyper-inflation or debt restructuring.” Mike Novogratz Founder/CEO Galaxy Digital, former partner at Goldman Sachs. July 30, 2022.

Weekly Roundup” Blockworks Macro

July 30, 2022, Mark Yusko, Morgan Creek founder, believes the Crypto Winter lows are behind us. Video 1:04 hour linked in the header. Mark is a long time venture investor, money manager involved in both crypto and traditional investments. Mark is the co-host on Blockworks Macro’s weekly presentation.

‘Crypto Winter Could Be Over’ If Bitcoin’s Price Does This, According …

Jul 19, 2022, Next Advisor/Time: If bitcoin’s price stabilizes over the next two weeks, the prolonged crypto bear market — also known as crypto winter — could end as quickly as it started. That’s according to Edward Moya, senior…

Bitcoin sees best day in over a month after ‘crypto winter’

Jul 18, 2022, Fortune: Bitcoin surged above $22,500 early Monday, hitting its highest price in over a month. The largest cryptocurrency by market capitalization was trading at $21,696, up 3.1% over the past 24 hours.

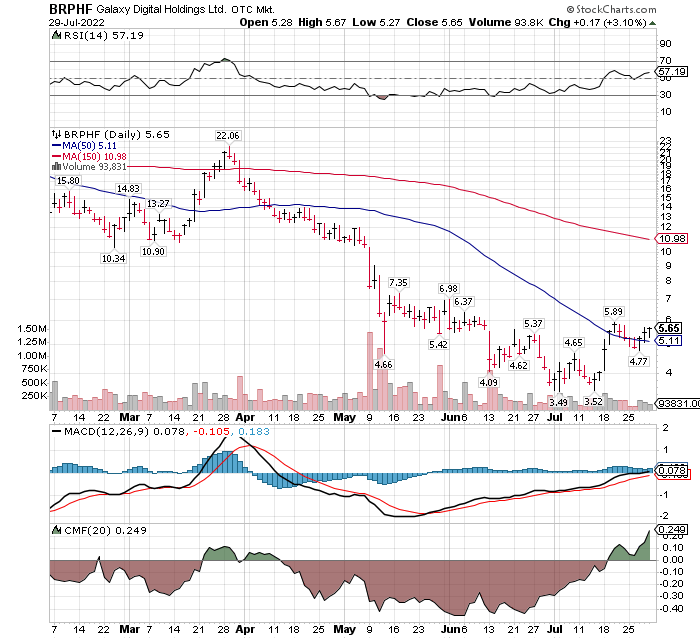

LOTM’s favorite equity play in the Blockchain/crypto space is also the best global Institutional Investment Banker in Blockchain & Crypto – Galaxy Digital (BRPHF)* $5.65.

Check Galaxy’s technical factors and qualifiers for as in the chart of Bitcoin above. All indicators are a positive match. TipRanks continues to have a $23.81 price target (see Galaxy’s name link).

Happy Investing!

Written July 31, 2022, by Tom Linzmeier, editor, LivingoffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,064 total views, 6 views today