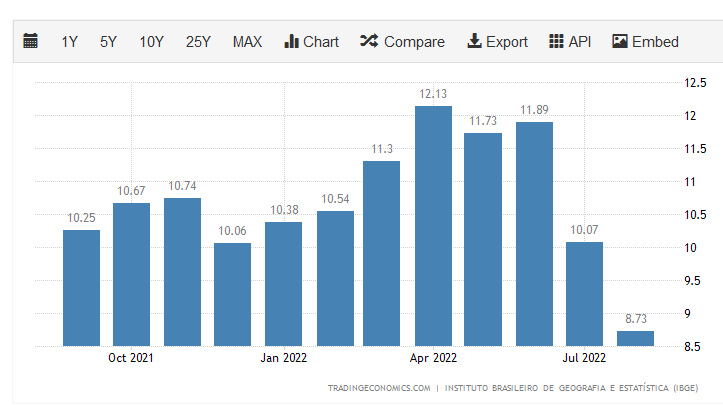

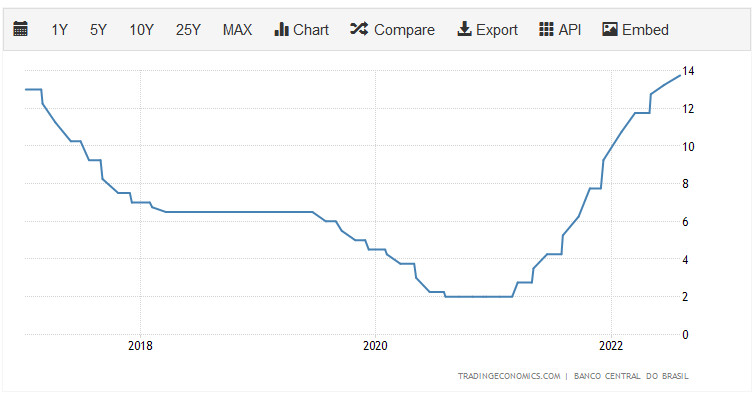

Inflation in Brazil has dropped dramatically. Interest rates are still high. If Brazil gets a third month of falling inflation it could end their interest rate hiking cycle. This would be very bullish for Brazilian bonds and equities.

Inflation rate in Brazil

The Central Bank of Brazil unanimously decided to lift the Selic rate by 50 bps to 13.75% on August 3rd, 2022, as expected. It was the 12th consecutive interest rate hike since it started tightening in March of 2021, to fight soaring inflation. Brazil’s inflation rose to 11.89% in June of 2022 from 11.73% in the prior month, marking the 10th consecutive month of double-digit inflation and the second highest figure since 2003. Policymakers said the decision reflects the uncertainty around its scenarios for prospective inflation, an even higher-than-usual variance in the balance of risks and is consistent with the strategy for inflation convergence to a level around its target throughout the relevant horizon for monetary policy, which includes 2023 and, to a lesser extent, 2024. With regard to forward guidance, the Committee said will evaluate the need for another hike of smaller magnitude at its next meeting in September. source: Banco Central do Brazil

Interest rate in Brazil

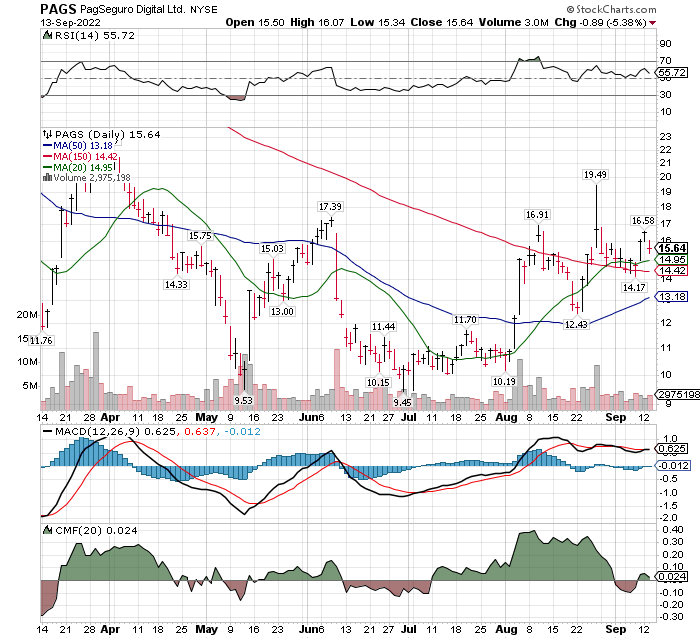

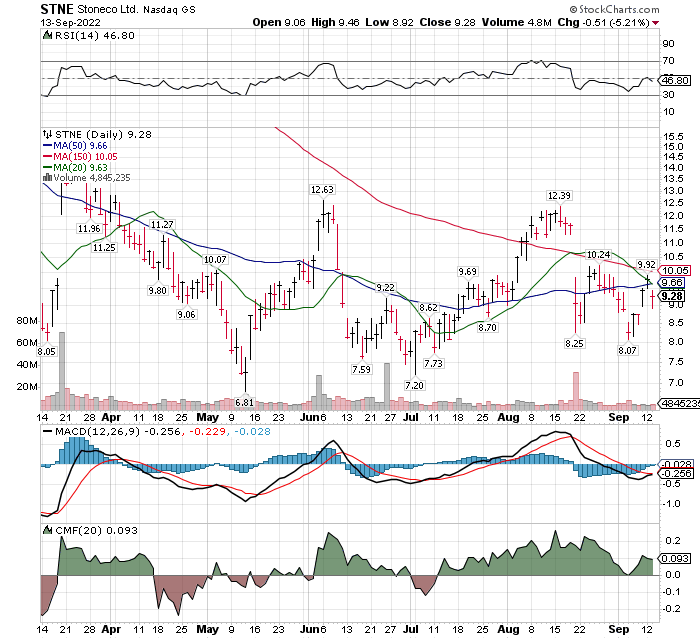

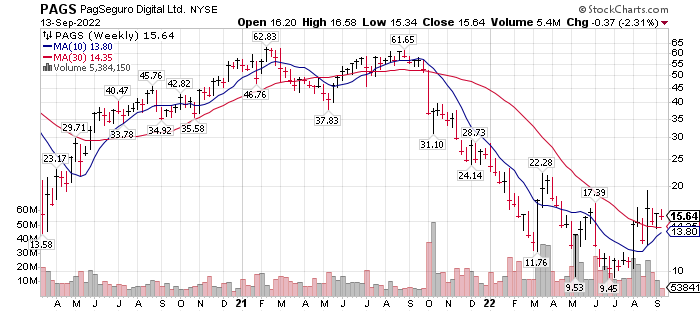

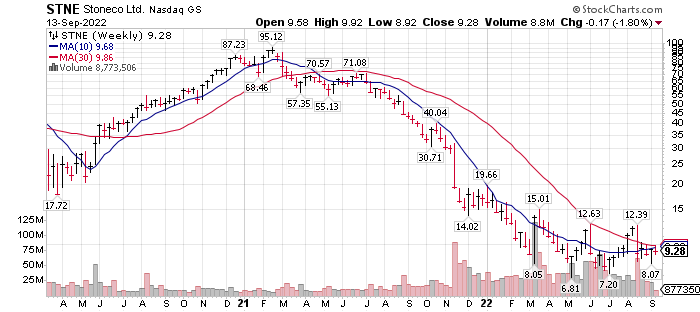

Technicals on two Brazil stocks – PagSeguro (PAGS)* and StoneCo (STNE),*

Preferred Technical Indicators for PAGS:

- Price crossing 50-day moving average – Yes

- Moving averages crossing other moving averages. Yes 20-day MA is above both the 50-day and 150-day MA.

- Relative strength (RS) Vs the overall market. Rising and at 49.75 % – Yes

- MACD – potential to go positive in one or two days if the price is positive.

- Chaikin Money Flow. positive

Comment: this could go on positive five buy signals this week. We would be a buyer now in anticipation.

The Complete List of Brazilian ADRs trading on the US Exchanges as of Sept 9, 2022, are linked here:

Preferred Technical Indicators, below for STNE:

- Price crossing 50-day moving average – No

- Moving averages crossing other moving averages. Yes 20-day MA is above the 50-day but falling. Numbers are bunched close enough that will an uptick in the share price the 20-day could easily reverse and be above both the 150-day and 150-day MA.

- Relative strength (RS) Vs the overall market. Rising and at 49.75 % – Yes

- MACD – No but close to going positive.

- Chaikin Money Flow. Positive, and note that it has been through the latter half of the basing chart pattern. This signal accumulation of shares rather than distribution of shares.

Stats and News for StoneCo linked here for Finviz.

Stats and News for PagSeguro linked here for Finviz.

Two year weekly chart views for long term perspective on PagSeguro and StoneCo.

I believe both stocks can be bought here, but if choosing one of the two I would choose PAGS. It seems a bit more predictable in its price behavior. My bottom-line is this, I think they both work as a short term trade and longer term investment.

The macro view of inflation falling in Brazil and is now well below interest rates suggest an upward move on the Brazilian market in general. Should the US $ weaken it could add some fuel to the shift into Emerging Markets.

In the next two months, you will likely see the same happen in the USA.

For the link to Brazil companies above that trade in the USA, you should be able to get charts on most at www.Stockcharts.com. The four letter symbols are at www.finviz.com and all charts are available at www.TradingView.com.

Written Sept 12, 2022, edited post market Sept 13, 2022, by Tom Linzmeier for Tom’s Blog at www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

976 total views, 2 views today