Summary:

- Mark Moss Video at the Vancouver Resource Conference, discusses the Crypto Eco-system

- Public companies that give us exposure to Venture capital pools of #Blockchain Eco-systems

- Articles mentioning multiple Blockchain investment ideas

Vancouver Resource Investment Conference: Mark Moss shares his thoughts on focusing on the Ecosystem that a particular asset unleashed. EXAMPLE: Oil & Gas unleased the petro chemical industry. In this quick information packed video Mark present the eco-system about to be released around Crypto and Bitcoin. The Eco Systems that build around a specific resource or technology are far bigger that the resource or Technology itself. It is a very enlightening presentation that exposes us to break through thinking for longer-term investment planning in building wealth.

Hidden Investments In Worlds Best Asset Class: Mark Moss 20 minute video –

February 3, 2024

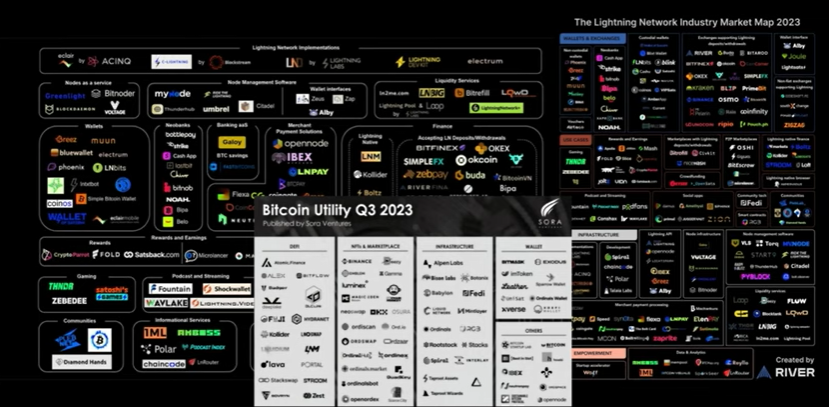

Eco-system around crypto today presented in the video linked above. Image created by River.com

Three public companies that are actively investing in the crypto/blockchain eco-system being developed around crypto are Galaxy Digital (BRPHF*), Byond (BYON) and Coinbase (COIN). These companies are small enough that the impact of Blockchain will impact the share price. To the best of our knowledge these are all pre-IPO portfolio companies owned in Venture Capital pools at the respective companies. It is the only way non-accredited investors can gain access to such companies. Repeating, the portfolio companies in these respective venture funds are still private companies.

Galaxy Digital website source and link

Bakkt (BKKT*) is a digital asset company 60% owned by Intercontinental Exchange (ICE) – owner of the NYSE – that has come public and is opening crypto exchanges around the world except in the USA. BKKT is waiting for the SEC in the USA to clarify the regulations covering crypto. Many other countries have clarified crypto regulation in their respective countries already. BKKT has opened five exchanges around the globe in the last 70-days. Link to this announcement here.

Marathon Digital (MARA) is a leading firm in Crypto mining and eventually batch computing for other uses.Batch Computing Data centers are acting as Batteries for Wind and Solar farms. Software has been created that allows for the seamless switching of power from providing electricity for batch computing facilities to the grid system and back to batch computing. This is a innovative use of power that otherwise would be wasted.

Having listened to various MARA presentations by its CEO, Fred Thiel, I am now a believer in owning (and or trading) MARA shares long-term. Thiel discussed Marathon’s positioning a very large cash balance, their intent to consolidate the industry, holding second largest Bitcoin position as a public company behind Microstrategy. I am convinced that personally, I want to own MARA stock. Thiel also see Central Banks becoming miners of bitcoin to facilitating the trading and ownership of Bitcoin as a Treasury Reserve Asset. He’s ahead of most of us in seeing trend development within the crypto industry.

Outside of owning crypto directly – I would like positions in Galaxy, MARA, at least two Digital Asset ETF’s ARKF and BITQ as owners of Digital Asset company portfolios. I also see Beyond (BYON) as a undervalued on-line retailer that will benefit from its buying of Bed Bath and Beyond from bankruptcy, in addition to quietly holding partial ownership positions in 19 different Digital Asset companies.

There are bigger companies that are the dominant investors in Blockchain, but Blockchain, as a precent of the company, would have lower impact than on some of the ones listed above. For EXAMPLE. Beyond (BYON) has a market cap of about $1.2 Billion. They have nineteen company portfolio invested in Blockchain with one of the nineteen being labeled a Unicorn. A Unicorn stock is a private company that is valued above a billion dollars. A company like this would have a much grater impact on another billion dollar valuation than on a company the size of Visa or Mastercard.

One I would likely trade the two Etfs based on technical charts patterns and probably do the same with BYND. I like DAPP as a Digital Asset ETF area also, so will likely be active as a trader attempting to catch a trend move in all three of the Digital Asset ETFs. It is the “catching a trend” that makes “Traders,” the most profit.

Top 101 Blockchain Companies (includes crypto) Shaping The Future Of Digital Transformation

Open Business Counsel – September 5, 2023 source linked

Link to 20 Biggest Blockchain Companies in the World in 2023 , shared by Yahoo Finance

Top Five

#5 Intel (INTC)

#4 International Business Machines (IBM)

#3 Mastercard (MA)

#2 J.P. Morgan Chase (JPM)

#1 Visa (V)

#blockchain #crypto #stocks #investing #growthstocks #bitcoin #etherum

Experience Plus Knowledge is Wisdom

Available for Coaching, Training or Mentorships

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases.

Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared.

We like Long-term Gains and think in two to four year time-lines.

We let our winners win, as much as possible. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Ideas in this blog are concentrated holdings, highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

438 total views, 2 views today