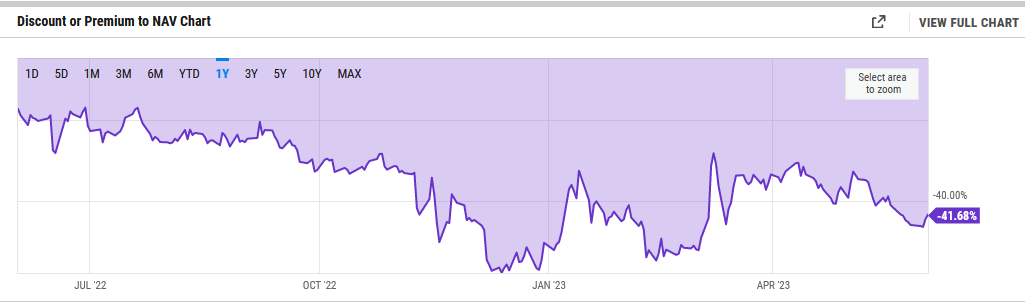

Grayscale Bitcoin Trust (GBTC is the largest holder of Bitcoin in a accessible public vehicle in the world. GBTC today trades at a discount to it Net Asset Value (NAV) of 41.68%. The number of Bitcoins owned by GBTC is approximately 633,000.

Source (Y-Chart)

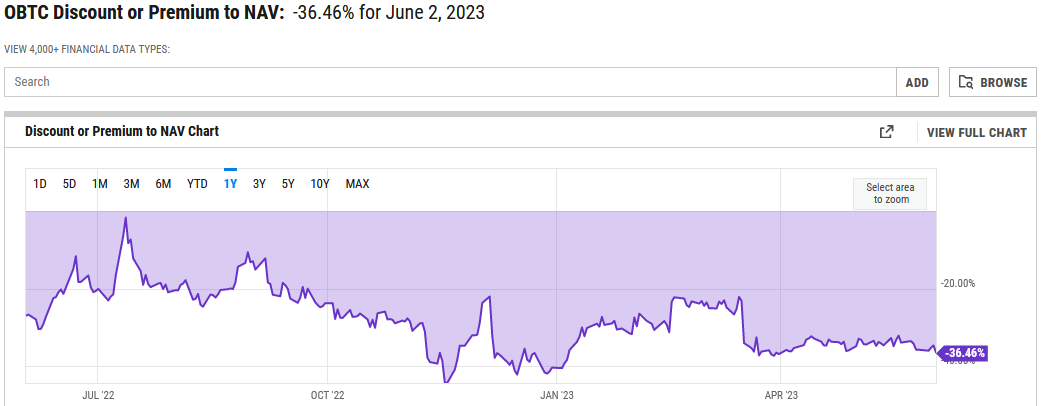

There is another Trust that trades in the USA the only owns Bitcoin. That trust is Osprey Bitcoin Trust (OBTC). It also trades at a discount though not as large a discount as GBTC. The OBTC discount to NAV is 36.46%.

At one time, OBTC traded at a premium to its NAV of Bitcoin while GBTC traded at a discount to its NAV of Bitcoin. Not true anymore. Bear markets have a way of leveling the playing field within an industry. GBTC at 41.6 percent discount to NAV VS OBTC’s discount of 36% to NAV, brings the valuation metrics on the two trusts closer together.

Perhaps the real difference maker is the annual management fees charged by each. If you are trading ether Trust, the annual fees impact, diminish. If you are going to own ether trust long-term, the annual management fees do matter. GBTC charges 2% on the NAV (not the market price) of the Bitcoins it holds. Osprey charges 0.49% on the NAV of the Bitcoins it holds. Please note that I said the management fee is on the NAV – not the market value of the Trust. That means you are paying a management fee on the 42% and 36% discount to NAV. In this case the scale tips to Osprey as the more attractive Trust to own long-term.

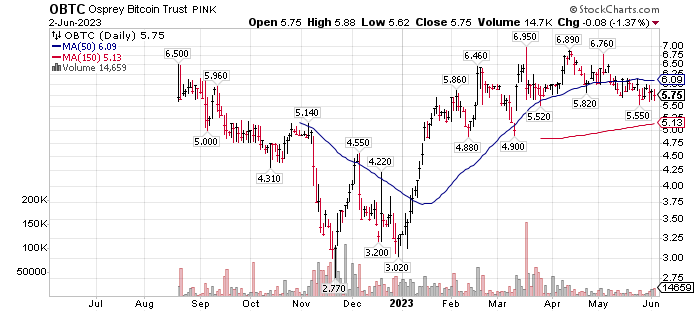

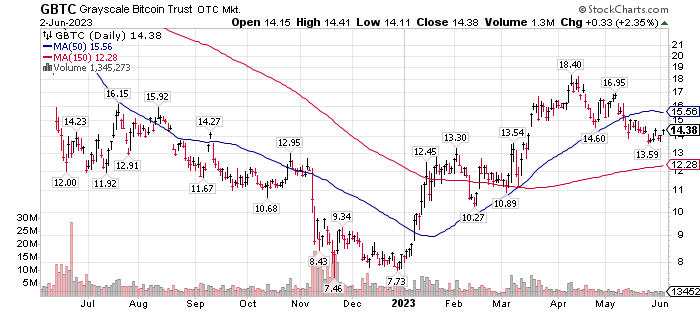

If you are interested in trading shorter term, The scale tips back to GBTC. The liquidity factor daily share traded on a ten day average of Osprey (OBTC) is low VS Grayscale (GBTC). OBTC currently trades a small, 7,168 shares per 10-day average while GBTC trades 1.47 million shares per its ten-day average. If liquidity is the major factor for you as it should be for all traders, then GBTC is your choice.

As to market cap comparisons, Grayscale (GBTC) has a market cap of $10-billion. Osprey (OBTC) has a market cap of $48-million – much smaller. Market cap is related to liquidity simply due to size. Since the underlying asset is the same, market cap isn’t a big concern as a smaller owner of the shares. It would be a big concern, however, if you are expecting or wanting to quickly exit the OBTC position.

One-year daily chart for OBTC:

One-year Daily chart for GBTC:

For actionable Stock Market Ideas and strategy, consider a one-month subscription for Tom’s LOTM Blog at Substack. Try us out. The one month payment is refundable if you are not happy with the service.

Our LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written June 3, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

986 total views, 2 views today