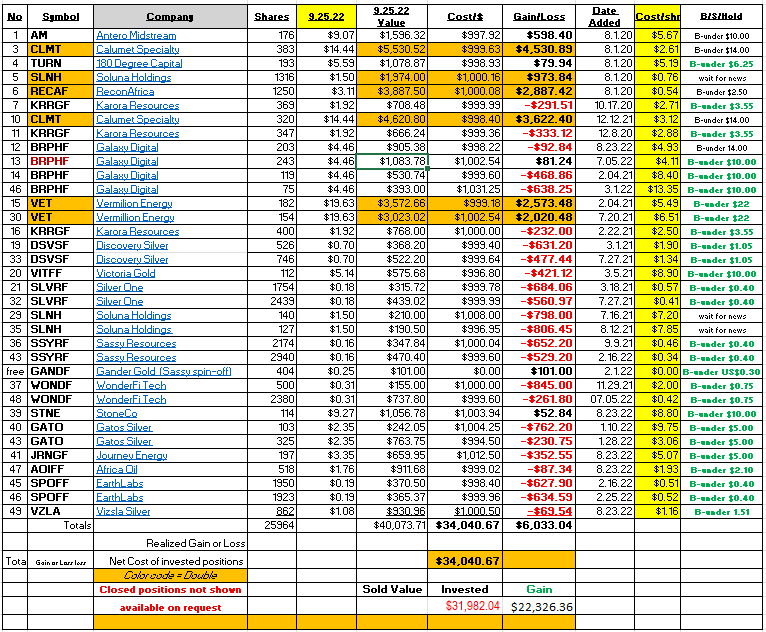

The market has not been kind to the LOTM: Ten Under $10 positions. That is an understatement. April to now has been brutal. Mining companies and Crypto companies alike, which remain the focus of LOTM.

This might sound a bit odd, but we still like the companies we own. With the exception of Soluna, we have the view that the stocks are down because of market movement rather than company problems. In the case of Soluna, Soluna has serious company cash flow problems. Their survival is out of their hands in the short-term. The company is near term outlook is dependent on others. Never a comfortable place to be.

Soluna needs cash to continue forward. They are in discussions for financing and partners. Their Investment banker is Truist Securities. Soluna has stated they are in discussions, but no conclusion is imminent. They suggest before year-end. Soluna needs the approval of the Texas Energy Board also known as ERCOT. Soluna has Phase one of its Texas Project waiting for activation with approval of ERCOT. There has been a delay in approval, but it has little to do with Soluna. The issues are with solar power and wind power not blending into the Texas energy grid. Soluna is in financial trouble without these two events coming to conclusion. What Soluna has been able to deal with inhouse, and there have been issues, Soluna has resolved successfully. So, they wait, and hence our comment to wait for news before buying more. Even if the stock doubles from today’s price it is cheap with successful resolutions. I am hopeful they can resolve their challenges but can offer no assurances they will conclude successfully. These times are very uncertain. Plan B for me is to rotate Soluna funds into one or more of Vizsla Silver, Africa Oil or Karora Resources. All are solid companies with excellent management and two to three times current price upsides.

When and how this current selloff ends, we cannot say. I think it will be in October ’22. From what price level I do not know. We seem to be getting some panic in the market. The first signal of a reversal, will probably come from falling interest rate yields on the two-year and ten-year treasuries. Falling rates in these two maturities will be the signal that Risk-off trades are rotating to Risk-on trades. These two rates are usually front runners to what the Federal Reserve does with Fed Funds.

Hang on to your seats. While concerned about Soluna, the remaining companies though volatile, appear solid. They “should” ride out the storm and do well in a Risk-on cycle that follows what is happening now.

Written September 25, 2022, by Tom Linzmeier for Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,288 total views, 2 views today

Pingback: Bottlenecks in Energy Creates Opportunity -