Washington Post, September 26, 2022

Bloomberg September 22, 2022.

- “Super-Strong US Dollar Is De-Stabilizing All Other Fiat Currencies – When Will It End? | Gordon Long” YouTube 48 minute video. Wealthion Sept 27, 2022, release date.

Currency problems and Global financial system problems will create a “cause and effect” reaction to the Federal Reserve’s raising interest rates (cause) and then pausing (effect) its hiking of interest rates. Rapid increases (3/4% multiple times in a row) are very traumatic for countries who hold dollar denominated debt or treasuries. Dollar and interest rates up/US Treasuries down. Cost to repay US Dollar denominated loans, get very expensive.

“If’ the Fed pauses, it would be the catalyst for a stronger risk-on markets. It is what I have been looking for in a return of money flowing into precious metals and bitcoin.

Link to Currency futures at Finviz.com. Here is a quick view of the US Dollar.

To see the other side of the coin, you might click on the other currencies (in the link above) to see the damage caused internationally by the strong US Dollar. This fosters the attitude that “we have to get away from the US Dollar” as the world’s global currency.

Risk-on assets, Growth Stocks, Crypto and Metals as well as two-year to ten-year treasuries will appreciate “when” the Federal Reserve pauses or allows interest rates to decline. This might be the edge of the cliff for other currencies that forces the Fed to change course.

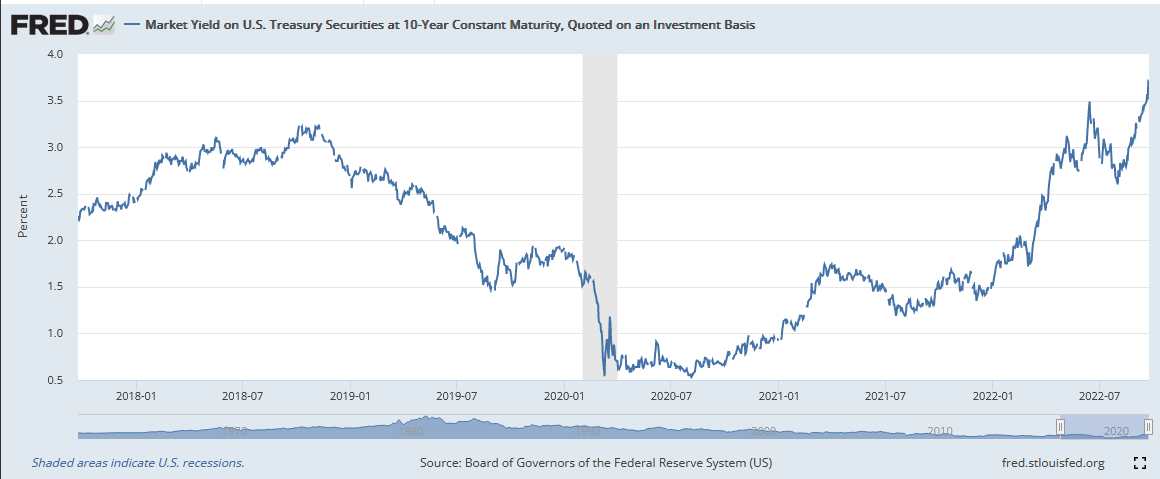

You will also want to watch the ten-year treasury. The ten-year Treasury is a “leading” indicator to what the market believes the Federal Reserve will do with Fed Funds rate. A reversal of the current rising trend in ten-year Treasury rate is what is needed to cause the equity and risk-on markets to rally.

Current interest rate chart for Fed Funds:

Good Luck and Good fortune.

Written, September 27, 2022, by Tom Linzmeier for Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

844 total views, 4 views today