Vizsla Silver (VZLA)* $1.15

Vizsla Silver (VZLA)* $1.15

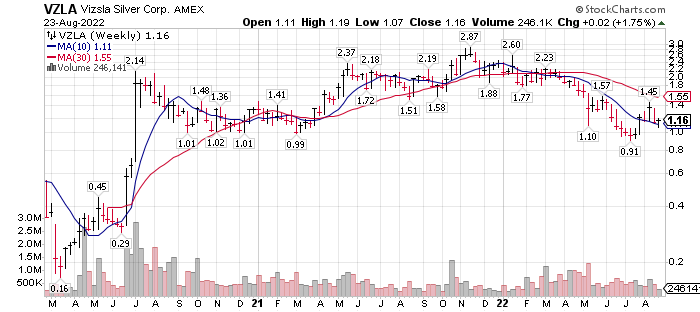

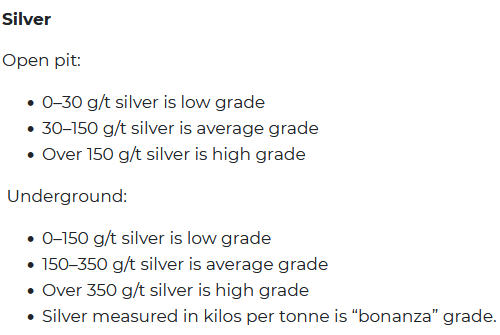

In the coming weeks and months, you will hear more and more about the world class discovery that Vizsla Silver is uncovering 45 minutes east of Mazatlan Mexico. This is a truly magnificent discovery and opportunity. The official reserve numbers are yet to be announced so I am not going to try and make projections about the size. All one has know is that the core samples that are coming in with the grams per ton (g/t) readings above 1000 g/t AgEq are constant. Here is a quick look at the headlines on the company website.

Things to look for in a silver company’s press release.

- Grams per ton is attention getting. But how wide or deep is the vein?

- How deep is the vein from the surface. Open pit is much less expensive than underground mining. 300 meters, depending on the surrounding landscape is a guideline for an open pit.

- Since a core sample is one vertical drill sample, what is the vertical length of the grade of silver found? This is very important as the cost of an underground mine is expensive and separating a short or narrow width of silver from dirt and rock is not feasible. We are talking hundreds of meter or more distance underground. Then the company has rock and dirt, mostly rock, to bring back to the surface to be milled. This is a very costly process so the quantity of high grades samples in a condensed area is noteworthy.

- AgEq – Silver equivalent means it is not all silver. All minerals cannot be recovered equally. A miner has to choose which mineral is “the” mineral they wish to focus on for recovery. Minerals not focused on have some degree of recovery but not as much as if it was “the” mineral.

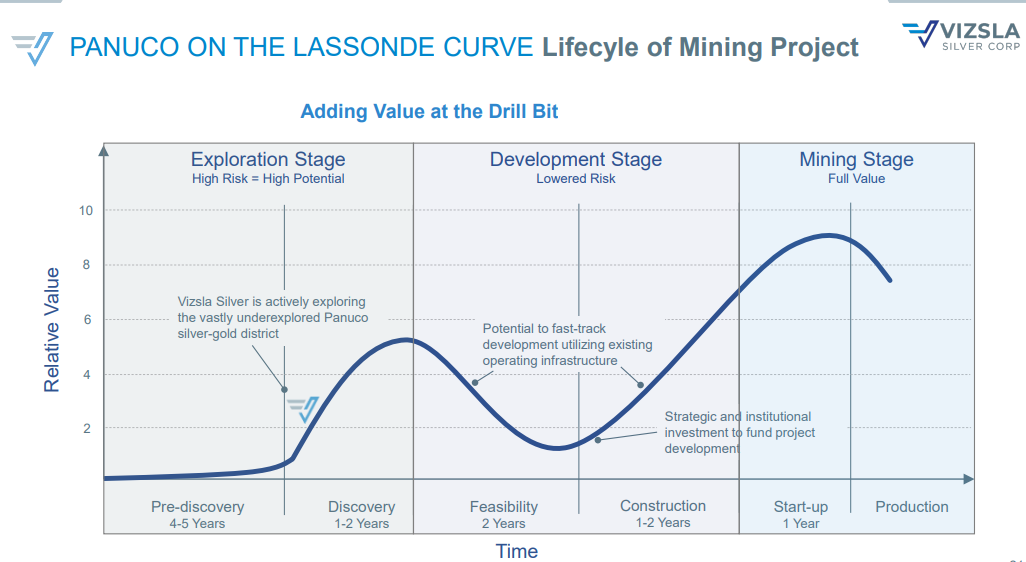

The Lassonde Curve suggest four plus years before production will begin at Vizsla’s Panuco project. This is important and we’ll comeback to this and the stock price at the end.

Vizsla has milling operations on site from prior owner’s operations that leads them to project shorter and a lower cost development stage. Never the less we are looking at a minimum time to production period of four to five years.

Using the Lassonde Curve from Vizsla’s website and posted below we have the following schedule.

- 2022 & 2023 for exploration phase

- 2024 for feasibility study

- One year to 18 months for construction. 2025 and possibly 2026.

- Startup and Production. 2026 and 2027.

In between now and production, the price of the stock will move along with the price of physical silver. There is also the potential that Vizsla management team will choose not to take Vizsla into the production Phase and sell the asset somewhere between now and production. Hence, we can plan on price volatility to provide opportunities to move in and out of the stock between now and production. So far, all comments from management are that this is an extraordinary property, and they are taking it into production themselves.

Point one:

What is a high grade silver discovery?

From Lobo Tiggre’s website, “What is High Grade”

1,000 grams is a Kilo.

Remember I said. Vizsla is discovering 1,000 g/t AgEq consistently. Now reread Lobo’s definition of a High Grade silver core samples.

- Vizsla has many, many “bonanza” core samples. This is a big deal from the discovery perspective.

Point two:

In the mining industry, the stock price is most active in the Discovery Phase and in the Production Phase. Refer back to the Lassonde Curve. The period between the Discovery Phase and the Production Phase can be two to four years. This development Phase is a low price activity, low investor interest, low volatility phase for the stock. This is why the character, and the intent of management is important to know. For some exploration companies discovery and selling the property is the plan. For other exploration companies, building a company and not a transaction is the goal. These two paths might shade your stock strategy. Are you a transaction focused stock person or are you wealth building. No right or wrong answer, but to keep from being frustrated, it is important to Know Yourself and What You Want. Trader or wealth builder, it is important to know about the Lassonde Curve and its relationship to a mining stock’s price action.

Stock Price Strategy for Exploratory Miners:

IMO it is ok to dollar-cost -average into exploratory companies like Vizsla that are that are proving up their properties with High Grade core sample discoveries. The trick to discovering happiness with the stock price is to sell some shares in a rally phase. For this we will refer you to a recent blog posting of ours:

- Scaling out of a position as its price hits designated levels of appreciation by LOTM – Aug 16, 2022.

A mechanical plan works best so you turn off your emotions. Greed and Fear are our own worst enemies when it comes to making money in the market.

The scaling out article linked above gives three different examples based on conservative to higher risk levels. The middle of the road example is what I try to use most of the time. The volatility factor of the stock might play into your deciding which scaling out example to use. In a high volatility stock, I will target bigger price swings before sell and in low volatility stock I will narrow my price range to scale out.

Point three:

The mineral discovery for Vizsla is so big that if this management group takes Vizsla into production, it will have a twenty-year or more mine life. That means you have the opportunity to work this stock over a long time frame. The longer you trade the stock, the more you come to be in harmony with the stock price movement, the better your ability to buy low and sell high with comfort and familiarity. A knowingness. A simplicity of trading. You don’t have to think about the decision making process. You just do. Wouldn’t that be nice?

Have a great day! Oh, Vizsla Silver has been added to the LOTM: Ten Under $10 for the double list. We think this is an excellent time to be buying the shares, but that is only my opinion. Here is a PDF link to get the company’s perspective. It was just posted and dated August 2022.

Written Aug 23, 2022, by Tom Linzmeier, editor of www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,386 total views, 4 views today