Category –

I: Price trends of various asset classes.

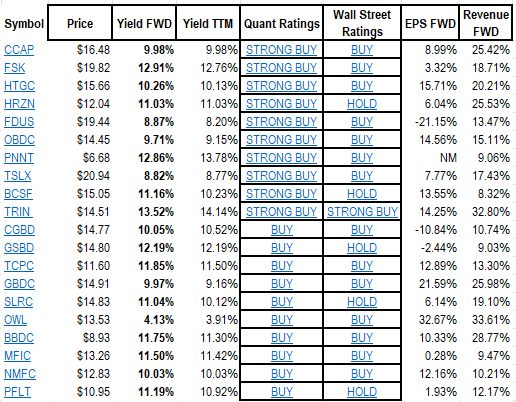

II: 20 High Rated Business Development Companies (BDC)

III: Top 10 Quant Rated Dividend Payers of SA Universe

IV: Featured Focus! 25 Monthly Dividend Paying Equities – Dividend range from 26% to 7.5%

Grouped by five different sorting characteristics.

Below we share multiple ideas in Dividend income. There is no advantage in picking one or two names. You can minimize sector risk and company risk by owning many small positions when hunting dividend income. It is better risk management to have 20 names at $500 dollars each than two names with $5,000 in each one. Just a thought.

We added a grouping of names that pay dividends monthly in this report. Have fun shopping.

As a broad statement – High dividend payers are out of favor for fear of a coming recession and slowing economy hence under-valued while Big Tech is overvalued anticipating falling interest rates because of the coming recession and slowing economy. Funny logic, isn’t it? Perhaps this is a time to accept the bird in hand rather than looking for two birds still in the bush.

The average fifty-year average return on small caps is about 10%, about 8% for each, value stocks and growth stocks. Dividends above 8% isn’t a bad way to go.

I: Price trends of various asset classes:

This is the macro view of price trends and therefore a good overview of where money is flowing.

Trend comments:

Ten-year Bonds appear to be in a bear market rally at this time. Long-term trend is still down.

Gold Miners are improving but still neutral technically but fundamentally under-valued.

Oil – down trend

Bitcoin is losing upside momentum. Seems to be a consolidation of the recent up-move rather than a topping.

Small Caps – firming but action is in large cap tech. Undervalued but lacking catalyst.

S&P – majority neutral to down with five large cap tech stocks pulling the index higher.

QQQ – Index up but minority of companies doing the outperformance with majority neutral to down.

II: 20 High Rated Business Development Companies (BDC):

BDC’s are among the highest dividend paying vehicles in the market. It is because the dividends are not as consistent as an established company with a smoother revenue and profit margin profile. BDCs are more subject to the economic cycles as many are early stage companies or turn around companies. This would impact the debt quality of the client companies. The high yields currently available are pricing in an anticipation of a economic slow down / recession. We don’t know at this time, how soft or deep a forward recession might be.

Remainder of the blog is reserved for Paying members of LOTM

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog Linked here.

Sign up for a year for the best price or one month at a time and receive this article and other past blogs.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Written November 21, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

380 total views, 4 views today