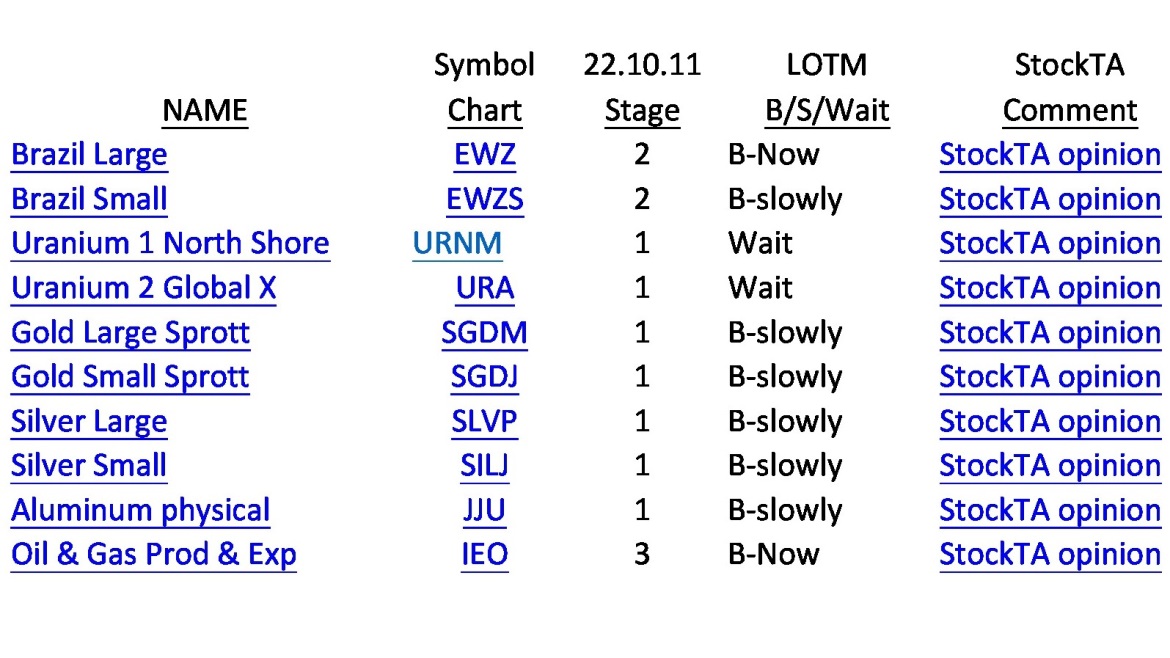

The two best charts from this list are IEO and EWZ.

In spite of the choppy market, these two names appear to be ready to break-out.

EWZ – Brazil has reduced their inflation rate significantly. Interest rates are still high at 13.75%. When Brazil starts dropping interest rates, this market is off to the races. There is a presidential election at the end of October. Markets are pretty smart. They know what good for them and have an uncanny way to anticipate. Remember when Trump ran in 2016 and everyone was fearing a market crash if Trump won. Trump won and the stock market exploded and did not look back. Brazil is ready to explode.

IEO – Oil & Gas: I am hearing lots of chatter about much higher oil prices ahead. Mostly due to supply constraints. Personally, I want to own more energy, especially dividend payers. Oil and Gas is still the Big Dog in energy.

The “Market” in general is over-sold, likely to rally short-term, but the still very over-valued historically. This directed heavily towards the large cap tech stocks and FANG stocks. Buy selectively, the market is likely heading lower in 2023 unless the Fed pivots.

From Finviz:

![]()

Written October 19, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

1,786 total views, 2 views today