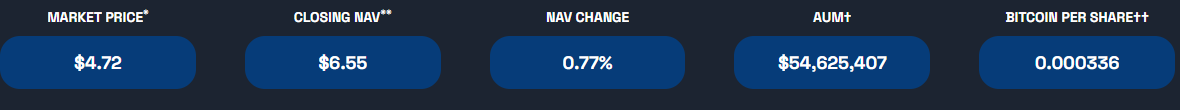

Osprey Bitcoin Trust (OBTC) Price $4.52 NAV $6.55 a discount of about 25%

We have noticed that the Chaikin Money Flow (CMF) is showing strong accumulation. This is often a precursor to an upward move in the price of the shares. There is nothing showing up yet in the relationship between price and its various moving averages.

This could be an arbitrage where someone is shorting BTC directly and buying the trust to squeeze the difference out of the two prices. I do not see this in the Greyscale Bitcoin Trust (GBTC). GBTC trades at about a 35% discount to NAV (net asset value). It could be that GBTC has a 2% management fee and OBTC has a 0.57% management fee. Perhaps the traders opt towards the ETF with the lowest expense ratio.

It could also be someone accumulating OBTC anticipating the crypto winter is ending and they want a position. That is in fact the reason I looked at OBTC and GBTC. I do think the crypto winter is ending.

Truth is to paraphrase asset manager Mark Yusko, Crypto is in a messy, choppy period that moves sideways before we start the next rally phase. I agree. We seem to have ended the decline following the liquidity washout in the May/June period. My own projection is that some time in the next six months – now to March/April, we will start the rally higher. If you have watched crypto for a few year you know the rally comes fast. Therefore, we want to begin re-accumulating our Crypto/Blockchain positions, starting now.

We are not including Soluna in this list as 1) they have financial issues to resolve and 2) we believe they will be treated more as a Data Center play more than a Crypto/Blockchain play.

Galaxy Digital (BRPHF)* $4.52 is on our re-accumulate list. We only sold about 10% of our position. What was sold, were the highest cost basis positions, to harvest tax loses.

Some of the ETF’s like OBTC and GBTC are on the wish list. See BITW below.

Individual coins we have on a strong interest list include:

- Bitcoin BTC

- Ethereum ETH

- Chainlink LINK

- Polkadot DOT

- Avalanche AVAX

- Polygon MATIC

- Solana SOL

- Cardano ADA

No surprises here. We are staying with network potential, size and liquidity

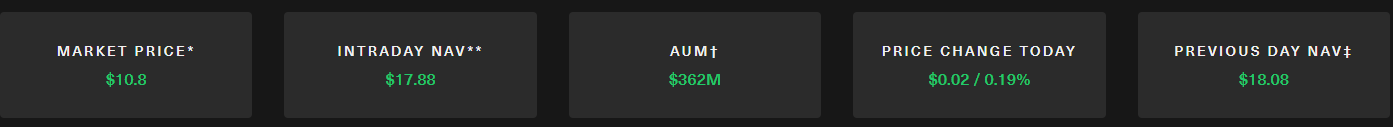

To buy into an ETF that invests in Crypto consider BITW Bitwise 10 Crypto Index – note the sharp rise in CMF similar or OBTC above. Someone is buying IMO.

Note the large discount to NAV!

The probabilities favor success when items are bought at a steep discount to their market values. Compare Market Price to Intraday NAV for OBTC and BITW in the data above. Someone is accumulating these two ETFs.

Written October 18, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

1,058 total views, 2 views today