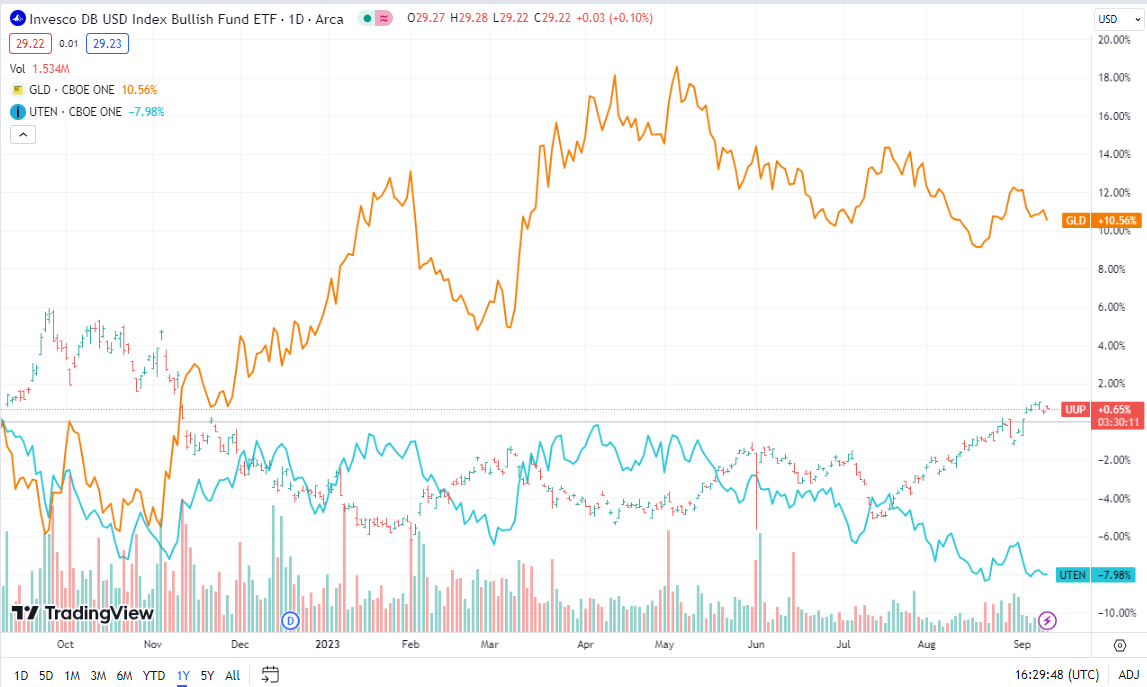

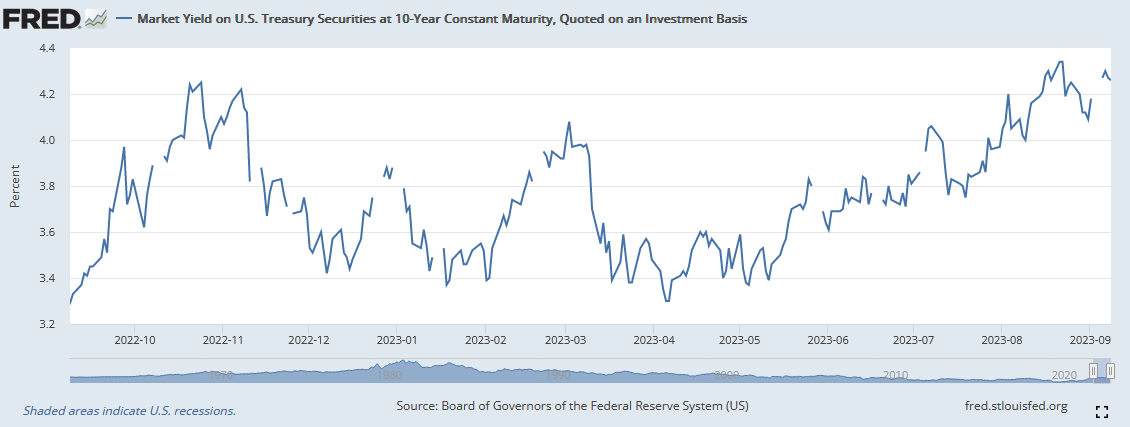

Note that when the UUP (US Dollar) moves one way GLD (Physical Gold) tends to move the other way. UTEN is the ETF for the US Ten-year treasury. As interest rates rise the Treasury price declines. It is a teeter totter relationship between market driven interest rates and the bond market. We are pointing out that as interest rates rise, the US Dollar tends to rise and Gold declines. This is a “probable” relationship but not always relationship. It is consistent enough to pay attention and react. When interest rates and the US Dollar decline, Gold will rally sharply.

Below we have the relationship between the price of physical gold and the VanEck Gold miners small cap ETF. GDXJ. The small cap miners are more volatile and therefore a bigger price range than the Large Cap, Van Eck ETF, GDX. For this example, we use Van Eck ETFs because they are not an active manager, but rather select positions by their Market Cap. If we were to take any position in a mining ETF other than a trading position, we would select an actively traded ETF where they analyze and manage the individual companies within the ETF.

In the chart below, we illustrate that the miners valuation oscillates between a premium and a discount to the price of physical gold. Our biggest opportunities to make profit comes from owning and traversing from discount to premium pricing in miners to physical gold. Accumulating precious metals at times of a discount to physical gold, is a fundamental value opportunity. The actual “Go” signal for institutions to put money to work in this area happens when interest rates decline and or the US Dollar falls.

This is a five-year weekly chart of GLD and GDXJ.

We are very near a point in time where Gold miners in general, go from trading at a discount to physical gold (GLD) to a premium valuation.

This move will be triggered by falling interest rates on the ten-year treasury and a declining US Dollar. There are trading algorithms written that trade the relationships discussed above. One can conclude that computers will make this trade work when the events come to happen. The probabilities of this happening are overwhelming.

- The most conservative action is to buy physical gold. Decide if you are a longer-term value accumulator or a short-term trader in gold and precious metals.

- The second level and more aggressive, would be to buy the large cap gold miners and royalty companies.

- The third level that is more aggressive is to buy the Junior producing miners

- Level four would be to buy the exploration and development (non-producing) miners.

- The most aggressive, highest risk and where the ten to twenty X returns come from are the Exploration miners who have not yet hit that big gold or silver strike. One must employ a portfolio approach if in the exploration and development phase miners. To do otherwise is very high risk bordering on gambling.

Remember this is a probability game. Having a plan, a strategy to manage risk, will work at all five levels. The more passive and detached you are, the more conservative your strategy might be. The more you like to consume information, grow your knowledge of the individuals and companies involved, the further up the aggression scale you can go. There is always risk and there are multiple ways to manage that risk.

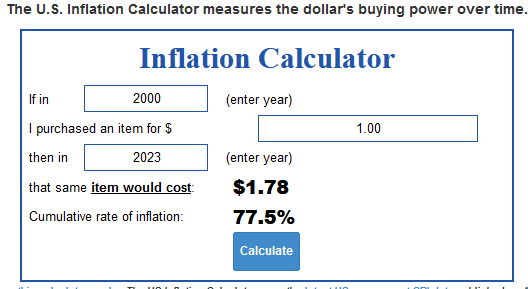

If you want a hedge Vs the US Dollar’s decline in purchasing power, then owning physical metals and bitcoin are the best tools. The dollar has declined since the Federal Reserve / Central Banking System was started in 1913. You can see how much the decline in te purchasing power of the US Dollar has been over different periods at this link. For example: at the “official” rate of inflation since 2000, we have lost 77% of the purchasing power of the US Dollar.

Gold in 2000 was about $279 dollars an ounce while the current price of gold today is $1930. Gold was a better holder of value than was the US Dollar by far. The median price of a USA home in 2000 was $119,000 based on the 2000 Census. Today that number is $416,100. See current ratio of Income to Home prices linked here.

If you want “performance” and have the desire to be engaged, then owning miners at a select time, can be a very profitable way to make money. Metal miners are not good long-term investments. A buy and hold strategy is not a good path to travers with miners. At select times, miners are literally the yellow brick road to riches. Timing is important and not overstaying the move is a key element in the process.

Our conclusion that for a buy and hold approach, physical metals are better hedge against the US Dollar. On a timing basis, we believe we are about to enter a period of time where gold and precious metals out-perform the physical metals. A shortage of supply in a high demand for metals world, is our theme. Miners are a leveraged play on physical metals. Simple supply and demand economics.

Best of success for us all, Tom

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April , 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

#gold #preciousmetals #goldstocks #silverminers #stocks #inflation

554 total views, 4 views today