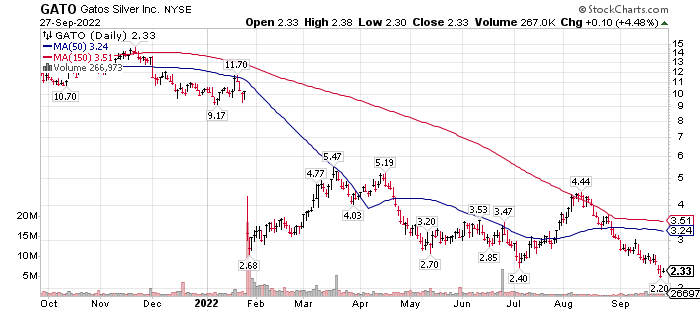

One-year price chart:

Gatos Silver (GATO)* $2.33 is a producing and continued development of the Cerro Los Gatos Mine and the Los Gatos District. These projects are located in one of the world’s premier silver mining regions, the Mexico Silver Belt.

- In January of 2022, Gatos issued a reduction of 30% to 50% in its reserves. This was a determination based on an inaccurate calculation by its independent consultants.

- The share price is down from $10.00 (rounded down from the announcement) to $2.33 – down more than 70%. Remember the resource reduction was estimated at 30% to 50% of reserves. Not of production.

- The Q1 ’22, cliff note version shows record silver production from the 70%-owned Cerro Los Gatos (“CLG”) mine during the first quarter of 2022. CLG achieved record silver production in Q1 2022 at 2.39 million ounces, a 58% increase compared to the first quarter 2021 (“Q1 2021”)

- The Q2 ’22, cliff notes version of financial health was CLG continues to deliver strong operational results. During the second quarter of 2022, silver production increased by 9% and lead and zinc production increased by 5% and 8%, respectively, compared to the second quarter of 2021. The increased production was primarily due to significantly higher mined ore grades, in addition to improved recoveries. Silver production increased 29% in H1 2022, compared to H1 2021. Lead and zinc production increased 16% and 26% respectively during the same period.

- The offset to reserve reduction is Gatos has only explored 20% of its claim. Plenty of opportunity to increase life-of-mine and reserves.

- Controlling ownership of Gatos is excellent. The Electrum Group of self-made Billionaire Thomas Kaplan is the controlling entity of Gatos. Highly respected in the Mining industry, Kaplan has the money, connections and respect to solve any challenges Gatos might encounter.

- LOTM Probability Summation: The stock is down more than 70% on a potential reduction in reserve reduction of 30% to 50%. Over-kill in the company valuation reduction. Operations were strong in both Q1 and Q2 ’22. This says ongoing operations are doing very well – literally no effect from the reserve reduction. Worst case is life-of-mine is shorter than previously projected. Best case is the reserve reduction is over-stated in the short-term and no effect on the company in a two to three year timeline.

It is anticipated that an official summary of the company reserves will be released in late October 2022. We are guessing that the reserve reduction was over-stated to begin with and that the market price reaction the reserve reduction also was over-stated. We could be wrong but still not concerned about the longer-term outlook for Gatos. This is a class act company.

Silver is greatly out of favor. LOTM is highly optimistic about the price of silver rising in the next one to three years. This is based on the current trend of supply not keeping up with demand. Current fears about a recession are weighting on the stock and silver price. We believe the fear is over-stated. Gatos is financially healthy with 13 to 1 current ratio and low debt burden over-all. Management and ownership is world class. On an investment and a speculation, basis we feel Gatos is a low company risk but high volatility stock opportunity to rally two to four-fold in a 24 month to 36 month period. This is based on the Fed easing from its current rapid increase in interest rates and an re-evaluation of the need for silver in an go all electric world. Silver is still the best conductor of electricity in the world. Demand for silver will come from the electronics industry, space industry, the solar panel industry and the electric vehicle industry. Throw in demand of silver for it monetary value and we could get luck with more than a four-fold move higher.

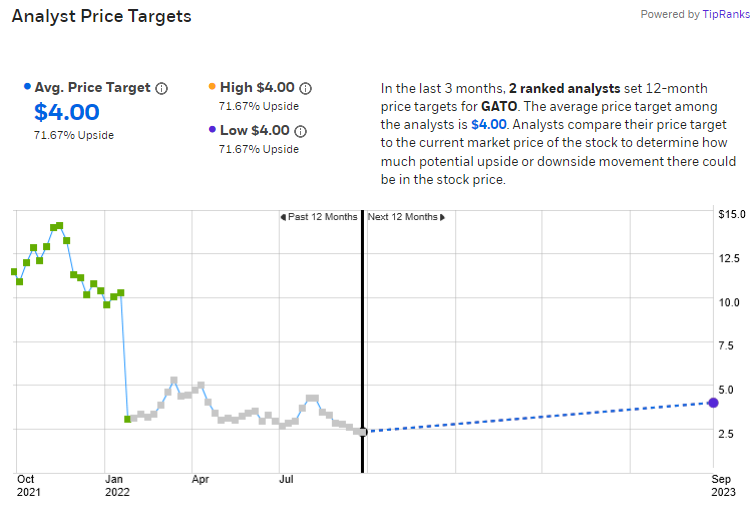

Once the reserves adjustment is finalized and released, we believe you will see analyst upgrades. If for no other reason, than uncertainties on the reserves are resolved. The Market hates uncertainty.

Seeking Alpha articles on Gatos Silver linked here.

Electrum Group website a very low key group as displayed by its web site.

Gatos Silver is a position in the LOTM: Ten Under $10 for the Double.

Written September 27, 2022, by Tom Linzmeier, for Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

890 total views, 2 views today