We are making a number of changes to the LOTM Ten Under $10 list today. We see opportunities and yet want to limit the number of positions held on the list in order to keep a focus. That does not necessarily mean we are negative on any of the positions on the list but rather we see some combination of timely & higher potential in other companies than the company we are exiting.

Stocks we are adding to the LOTM: Ten under $10

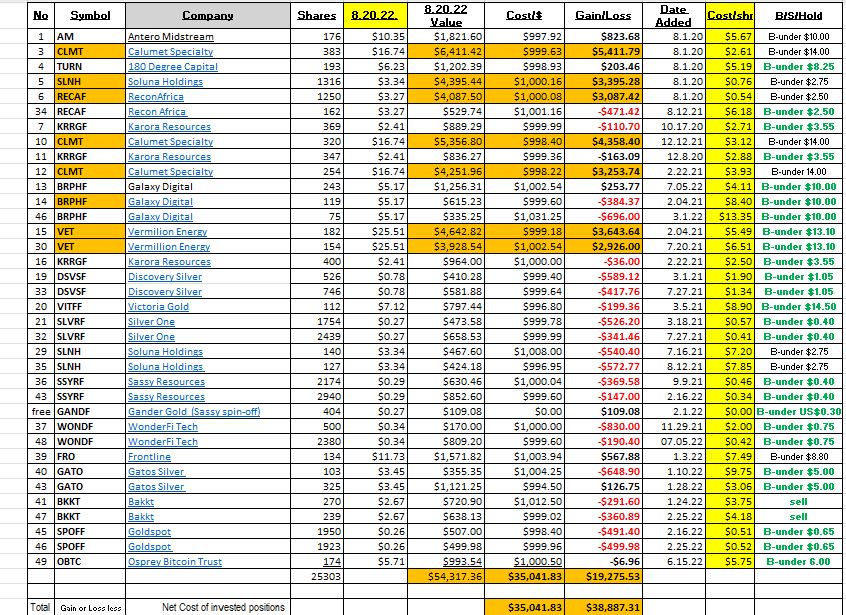

As is our discipline in this public example, we use the same dollar amount – $1,000 – for each position.

NOTE: a better way for scalability of an active portfolio is to limit the number of positions (companies held rather than number of units in each position) and keep a % of the account as your measure for position size. EXAMPLE: 20 positions at 5% in each position. Then work into over-weight positions and under-weight position as you make determinations on the degree of commitment you want to each company. Staying limited to a set number of units of commitment, forces a certain discipline on your process.

- StoneCo (STNE)* $9.20 – I have written a lot on STNE so if you need to update, please see recent postings on our blog.

- Journey Energy (JRNGF) $5.07 – a small oil and gas producer from Canada trading at 2.2 times earnings – very healthy and not that well known in the investment community. Link to August 2022, presentation https://www.journeyenergy.ca/presentation-events/

- Vizsla Silver (VZLA)* $1.15. Many high grade core samples in a very large 100% controlled area of Mexico. Length of district controlled, is 14 kilometers. Good news coming on the expansion of the “known reserves.” Even though one can project this from core samples, it is the announcement is the official known resource report still month away but feels like the price is right and time to act.

- Buying one unit of African Oil (AOIFF) $1.93 trading at about 4 times earnings. Web site African Oil is part of a very credible organization, The Lundin Group, so it not an obscure management group.

- Buying an additional unit in Galaxy Digital (BRPHF) $5.00. This takes us to four units, the highest number of units held in any position to date. This covers our exit from OBTC below, in case you are thinking I have gone soft of Crypto.

- Selling BKKT. They are really strong financially and are very connected but I seeing some companies growing rapidly in what BKKT does and think there are better choices available. The strongest grower in this business is Paxos, led by Chad Cascarilla (good interview of current investment thoughts) but Paxos is still private. Just think BKKT management is a bit too slow moving and ironically the stock is now not volatile enough. However, they have a strong in, into the banking industry and that could be a very big market for BKKT in 24 to 48 months forward.

- Selling OBTC on a rally above $6.00. I love crypto and am focused on BTC & ETH. OBTC is slower to react than I want but it will double as BTC doubles.

- Selling the higher cost position in Recon Africa (RECAF)* – $3.09. That is 162 shares at $6.18 – keeping the remaining 1250 shares bought at $0.54 as a lottery ticket for the years forward. Want to put myself in position to get lucky.

- Selling one of the three units we hold in Calumet (CLMT)* $17.64. CLMT is a great runner for us as a 5X position. Lots of future upside but the future is unknown so we will sell the fewest share of the highest cost basis shares. Goldman Sachs came out with a recent buy recommendation ($23 target) and the stock did not move much on the news. Good news, bad stock reaction. We’ll use that as an excuse that the story at this moment is well known and institutions are using good news to exit. 254 shares bought at $3.93 is the lot sold. Can the stock double from here? Yes, but we are pulling some off the table to replant for the next crop of winners.

Dated Friday close Aug 20, 2022.

Total investment in Closed positions from TEN Under $10 from inception before the changes mentioned above.

| $25,966.70 |

Total realized Profit (net of losses) from Closed positions since inception.

| $19,381.69 |

74% profit since inception on closed positions. Inception was 8.1.2020.

As of last Friday, open position cost was $35,041.83 with a net unrealized gain of $19,275.53 for a 55% unrealized gain from inception. This correction has been hard on the account with Galaxy Digital and Soluna’s correction and our over-weighting in the positions. We think we are ok in both companies for now. Galaxy initiated a share buyback program in May and Soluna has some insider buying in both its common and preferred. Galaxy’s share buy back is more a signal of liquidity not being a problem than anything. Soluna’s share buy back isn’t as big a signal but very nice to see anyway.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,128 total views, 2 views today

Pingback: Different Risk Management Approach for High Returns in the Market. -