Two things are happening that we would like to address today.

- The first is the loss of purchasing power of the US dollar. The United States, by “real” math, cannot repay our national debt. Our government is depreciating the purchasing power of the US$ to attempt to repay the debt with cheaper dollars. This shows up as letting inflation run hot . By this we mean, the “actual” inflation rate, not government numbers, will be higher than interest rates by design. Inflation will not go away because the government does not want it to go away. Watch what they do, not what they say.

- Second item we want to address is – other countries see this and want to move away from holding or transacting business in US dollars. Hence the movement to buy gold at central banks and oil no longer being bought and sold only in US dollars. There are other factors involved here. One is locking other countries out of the international SWIFT banking system. We have use this as a weapon too many times and countries are tired of it. The second is confiscating gold, investments and assets held on deposit in the USA or allied countries as punishment.

The consequence of this is, other countries are moving to be independent of the USA. We are moving rapidly towards a two tier trading block system. The emerging countries like Brazil, India, Iran, Saudi Aribia, Russia and China are in this group. The list that wants to join this group continues to grow. The second block is the United States, Japan and Western Europe. Countries that are neutral are being pushed to choose a side. This will, or rather has started a kinetic war in the Ukraine and likely will in SE Asia.

Assumption:

- Fossil fuel as a base-load source of energy and the transition to carbon free energy sources will take decades. Current government policy aims at a seven to 12 year transition (2035) period. Government policy is not connected to what physically can be done. Fossil fuels includes Oil, Gas, Coal, Methanol and Peat.

- Wars cannot be fought on Wind and solar energy sources. We are moving from Globalization to Nationalization. War have returned are a part of the Geo-political process. This means an increasing demand for Oil and Gas.

- In times of peace, wind, solar and battery storage are inferior sources of base-load energy system than fossil fuels.

- The only viable replacement of fossil fuels for base-load energy supply is Nuclear. A transition to Nuclear energy as a base-load energy will require a fifteen to forty year process. Maybe longer. Use the distributed income from fossil fuels to build your personal energy transition into Nuclear Energy as Fossil Energy declines.

Plan of action:

- Accumulate multi-stock portfolio of

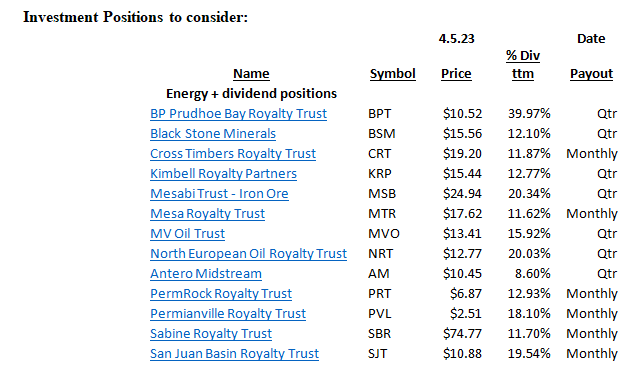

- Accumulate a portfolio of Fossil fuel assets that provide a dividend paying policy and or history of paying dividends. Royalty Trust do this very well.

- Own Precious Metal (PM) and PM Miners. Central Banks are and have been accumulating gold for a decade. That is fact. Maybe we should also.

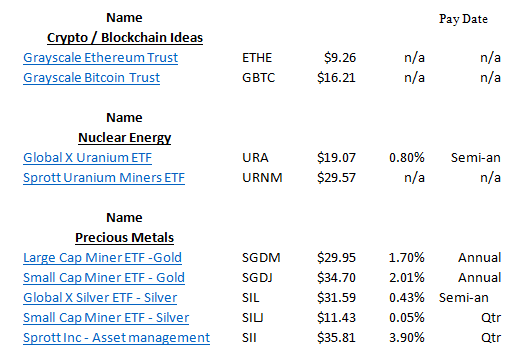

- Own Crypto and Blockchain investments. Bitcoin is global. It is a better system. The USA is trying to crush it and has many excuses to justify this. It is BS. Bitcoin is global. The Middle East is embracing Bitcoin, Crypto and Blockchain. Abu Dhabi and Dubai are an hour and eighteen minutes apart by car. They have established regulations for crypto and are a global hub for Crypto and Blockchain development. Australia is rushing forward with blockchain and crypto. Vietnam is being recognized are a global crypto and blockchain leader.

- Own companies exposed to the growth of the Nuclear Energy industry. It is still not on the radar and will take years to become reality, but we have no choice as a baseload energy choice.

- Use the fossil fuel dividend stream to reinvest in the

- Accumulate additional dividend paying fossil fuel assets. Typically, this is a dollar-cost-averaging policy for existing positions and new fossil fuel ideas.

- Build on your Precious Metal (PM) and industrial metal positions. We as nations, have underinvested here since 2010. It takes a decade or two to bring these assets back on line.

- Initiate asset positions that benefit from the development of the Nuclear Energy industry. This might include a) miners of Uranium, b) physical uranium held in trust, c) manufactures and operators of nuclear equipment and electricity transmission equipment. Grid systems cannot handle the transmission load required by government mandate.

- Build on exposure to Bitcoin, Ethereum and leading crypto based assets and companies involved in Blockchain applications.

Some things to know about Oil & Gas trusts.

Oil & Gas Trusts own the mineral rights to the they own. After expenses, the majority of positive cash flow is paid out as a distribution. Each Trust will likely have different terms on length of the trust ongoing activity of the trust and terms of the distributions from the trust. It is important to know what you own. Therefore, more work needs to be done on your part to find a fit that applies to you and your situation. The payout could be as soon as the following month the oil & gas was sold. The business model is similar to You owning the mineral rights, you have professional management managing the property and the dividend is tied directly to the profit margin earned from the previous months sales. If the price of oil or gas increases, the distribution increases. It the price of oil & gas declines your distribution declines.

This can be a protection from a declining US Dollar. Typically, if the dollar declines the price of commodities rises in dollar terms. Since this is an asset in the ground, the value of what you own and receive increases with inflation.

How Oil & Gas Royalties Work (Link to multiple source for full complete understanding)

The purchase of oil and gas rights is very similar to a real estate investment. An oil company leases a plot of land from a “surface owner” (a farmer, rancher, or another such property owner). The investor then purchases, on a per-acre basis, rights to the oil and gas resources below the surface of that land. The rights are then leased to the oil company, which conducts the business of extracting and selling natural resources. The oil company retains its share of the revenue but also distributes monthly royalty payments to the true owners of those mineral rights – The investors.

Like those who invest in property, mineral rights holders may encounter an opportunity to sell their rights for a profit. Upon doing so, the investor—which, again, can be your self-directed retirement account—will retain 100% of the profits generated from the sale. As with other investments in a self-directed IRA, any capital gains would be completely tax deferred.

Other Considerations

Understanding the full scope of possibilities with an interesting yet unfamiliar investment vehicle can help you make informed decisions. (Link to multiple source for full complete understanding)

- Motley Fool. Energy investing in Oil & Gas Trusts 101. Oil and gas royalty trusts are unique creatures — they aren’t companies, so you need to look at them very, very differently.

- Tax Considerations. Depending on the type of investment you’re considering, you should check whether there are tax incentives available for investments made with non-taxable funds. If so, and you have enough funds available in your taxable investment account, then you may wish to make the investment outside of your self-directed IRA in order to maximize your benefits. However, many of these tax breaks have expired as domestic development has boomed, so most potential investments may still be suitable for your self-directed IRA. Also consult with an expert to understand how UBTI (Unrelated Business Taxable Income) might impact your investment. This concept (which can be an issue for self-directed IRA owners when they seek to use debt financing to make an investment – such as getting a mortgage for a real estate purchase) can result in an immediate tax bill for certain types of investments. Linked source.

LOTM Sample Allocation of $16,000 Investment in the Ideas listed above:

$16,000 total investment

- $10,000 allocated to Oil and Gas Trusts with $1,000 allocated to each of ten exchange traded trusts. 62.5% of holdings. Ideas listed above for consideration. Do your own due diligence please.

- $1,000 allocated to GBTC (Graystone Bitcoin Trust). 6.25% of holdings. 36% discount to NAV.

- $1,000 allocated to ETHE (Graystone Ethereum Trust). 6.25% of holdings. 49% discount to NAV.

- $1,000 allocated to each of Four Precious Metal ETF’s – SGDM – SGDJ – SIL & SILJ. 6.25% in each of the mutual funds with a total of 25% of the initial balance in the P.M. ETFs.

- Use the monthly and quarterly distributions to 1) build on the existing positions or 2) hold cash until the next quarters end. In both options, rebalance the portfolio quarterly to bring the % valuations back to the original percentage you set.

- It is your account so allocate as fits your desire and financial situation. The percents above are for illustration purposes. Change the numbers and positions to customize for your personal situation.

None of our above comments should be construed as Investment Advice or Tax Advice. Information provided is to educate and inform. Consult your tax advisor and investment advisor to understand how this might affect your situation.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April , 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

782 total views, 2 views today