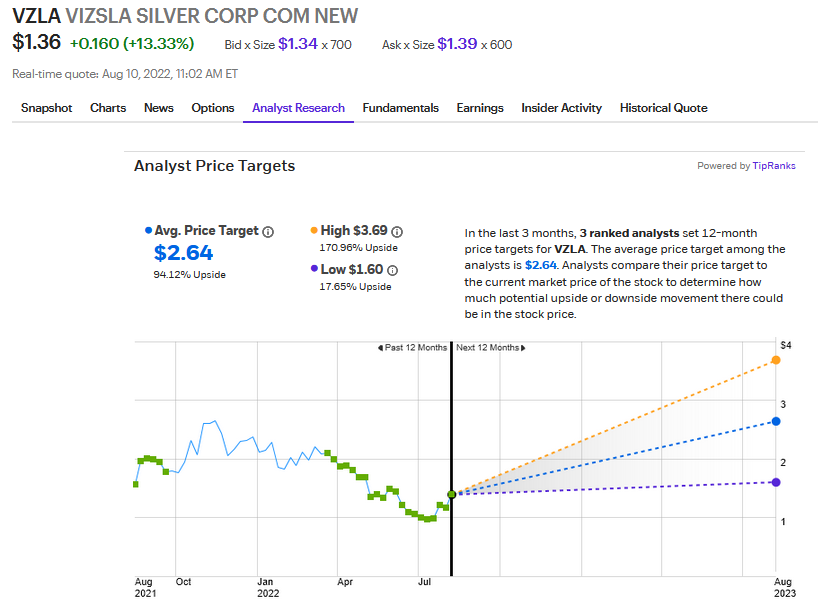

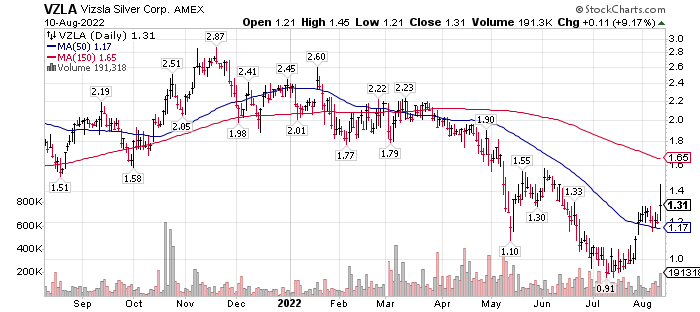

Vizsla Silver (VZLA)* $1.31 is one of our favorite exploration companies. They are focused on Silver and Zinc in a district scale holding just east of Mazatlan Mexico. Drill holes with 1,000 gram silver findings are frequent. These are big numbers. I noticed that TipRanks started tracking Vizsla. They have a $2.64 average price goal with a high target price of 4.00 See below.

Vizsla was recently below $1.00 but has recovered nicely in the past few weeks. We still believe they is a double or more in the share price as potential. We consider Vizsla a “core” position and will accumulate on weakness and sell some on strength while working to build a bigger position longer term. We expect to own this company and work this company for at least three to five year. We consider it a “good one.” Good Finances. Good Management. Good Location for rapid development. Best of all, a Great silver resource.

Accumulate on weakness. A double or triple in price is the goal from the current price.

CONTRIBUTOR – Harshita Swaminathan Reuters JUL 20, 2022, 3:14AM EDT

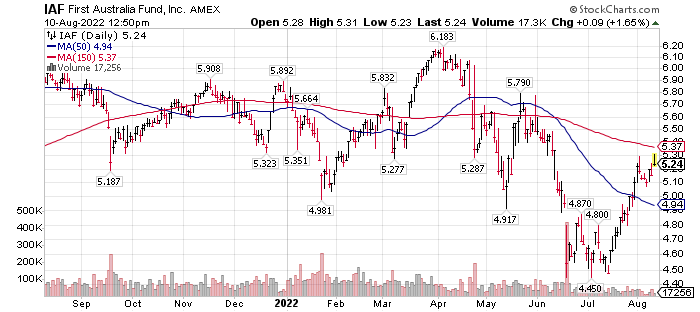

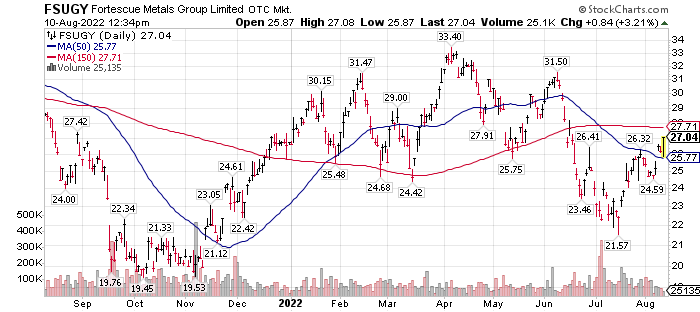

Metal Miners are one of LOTM’s Themes for the next few years. Australia is a friendly jurisdiction for miners. The next two ideas (previously mentioned in (LOTM) are strong on mining and from Australia. An Australian equities market characteristic is to pay 50% of earnings, on average in Dividends. Therefore, I have been searching Australia for better than average dividends plus some price appreciation potential. LOTM has mentioned IAF before and well as the second company below, Fortescue (FSUGY)

IAF (First Australia Fund) is about 25% Banks and 25% Miners paying an annualized dividend of about 12%.

Not the price ($4.70 area) when we first introduced IAF to you but still a good deal if buying for the dividend. We suggest a buy and add on weakness approach. X-dividend day is coming up in less than two weeks and that may contributed to the recent price hike. If your buying on a “share entry price,” then let the dividend go and consider buying a few weeks after the X-dividend date of the 19th. FYI: A related account to LOTM is selling IAF three to four days prior to the X-dividend date and buying three-to-four weeks after the X-dividend date. This is an on-going working strategy of ours. The drops post x-date and rallies per-dividend are greater than a buy and hold for the dividend. If a high dividend payer has call options, we frequently sell calls on income positions as the price cycles to the higher end of its range and yield drops to the lower end of its range. IAF does not have call options available.

FSUGY (Fortescue) in related accounts sought for the 16.5% dividend but owned for the dividend and transitions long-term to a Green Hydrogen and Solar Energy company from iron ore miner. FSUGY has a low P/E, (5), is the fourth largest Iron ore shipper in the world with an US$40 Billion Market Cap. Co-owner of one of the largest solar farms in the world. Two minute promo on Fortescue Future Industries a division of Fortescue.

The stock has rallied from our first mentioning the shares. We consider the share price, technically “neutral” Vs over-sold or over-bought, if one were to just focus on the share price. We like the dividend. We recognize that the dividend is high and likely to be reduced. Fortescue has said the dividend will be 50% to 80% of earnings. That in itself says the dividend is variable and will rise and fall. , we like management, and we like the direction the company is heading – Green Energy with an focus on Hydrogen. We bought a few shares under $25 in related accounts last Monday, but with a dividend of 16%, we still find it an attractive purchase at today’s price. We expect to add to the position on price weakness if funds are available.

This analyst say beware the dividend it is too high.

• Are Fortescue shares a buy for income or are they a dividend trap? Aug .9th, 2022, Motley Fool Australia

Buyer beware! But we think nimble investors will find happiness in Fortescue!

•‘Now is the time to move’ on green hydrogen Fortescue metals chairman

May 22, 2022. 14:35 minute video

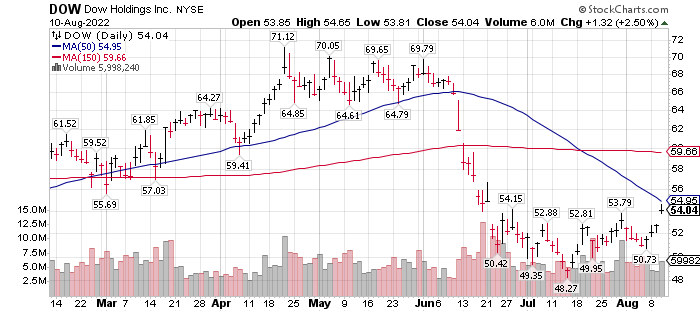

This brings us to our last stock of the day, Dow Holdings (DOW) $54.04

DOW is in a base building chart pattern trading fundamentally at about 8 times forward earnings and about a 5.1% dividend. We like DOW as a value stock with a forward catalyst. We brought DOW to you as a company that could benefit from the Nat Gas shortages and certainly high prices at competitor BASF (BASFY) $11.51 with major facilities in Germany. There should be pricing advantages for DOW Vs BASF. In addition, The German government is warning industry in Germany, that they might have expected industrial Nat Gas diverted for residential use this winter. That is a major headache for BASF.

In our research on Green Hydrogen as a better option as an Alternative Energy than Solar and Wind, we discovered that DOW is very active in the Hydrogen arena. If Hydrogen does emerge (we think it will) then this is a positive new growth area for DOW. It is a small contributor at this time.

The shares of DOW popped today on news from another alt-energy area – Nuclear. Dow is installing a mini-nuclear reactor in one of it facilities as a power source. In addition, DOW took a small equity position in the company providing the equipment and service, X-energy (private company).

Dow, X-energy to drive carbon emissions reductions

through deployment of advanced small modular nuclear power

Aug 9th, 2022. PR Newswire

We are believers that the transition from Fossil Fuels with go through hydrogen and nuclear as base load energy supplier. Certainly, Wind and solar will be contributors but Hydrogen and Nuclear are kinda no-brainers because of their energy density vs wind and solar.

Both hydrogen and nuclear are far in the future for DOW however Dow is at a excellent value and could be a good project as a slow accumulation position. It depend on your style of investing and what you are comparing it to. 5% dividend and 20% appreciation is certainly in the formula. Something to consider and a lower volatility name than we normally provide you.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

2,270 total views, 2 views today