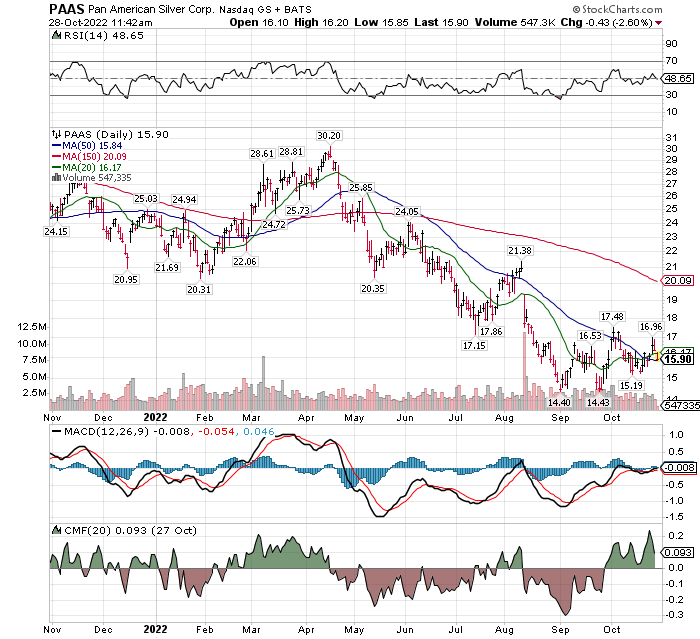

- Chart for Visual perspective with technical observations.

- Value buy with 2 to 4 x upside potential.

- Two significant properties not priced in the stock.

- Two recent Seeking Alpha articles explaining the situation.

- Third Party Comment on Why Silver Now: Michael Oliver of Momentum Structural Analysis (MSA).

Technical Check list:

- RSI: Positive with rising trend

- Price at the 50-day – base building but constructive

- 20-day Moving average (MA) above the 50-day MA.

- MACD: Positive trend

- CMF: positive

Stock is still in a Stage One base-building, but all internal indicators suggest PAAS is under accumulation.

Value buy with 3 to 4 x upside potential:

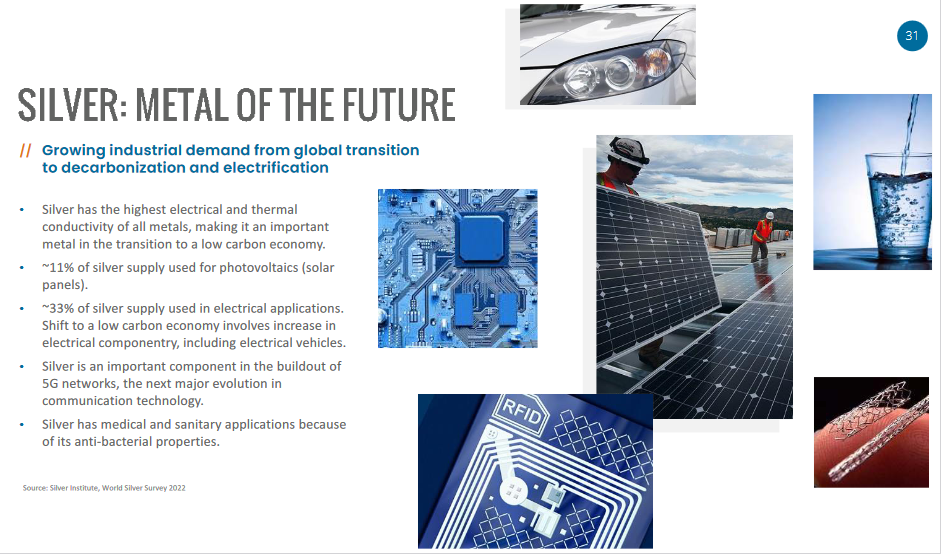

Pan American, as a mining company, is mostly a trading stock as are all mining companies. Since their end products are commodities, the companies rise and fall as the commodity they work in rises and falls. Public and professionals know, this so the mining industry is highly reactive to technical indicators. The share prices travel between very under-valued to very over-valued. Move between these two poles are frequently 2-X to 5-X and sometimes more. Pan America Silver current valuation metrics are attractive.

Price to Sales: 1.98

Debt to LT Equity: 0.02

Price to Book: 1.38

Dividend: 2.46%

Cash: $241 million

Unused Revolver of credit: $500 million

Debt: $63.2 million

PAAS has two properties, non-producing at this time that are each equal to PAAS’s current production.

The Escobal mine in Guatemala. This mine has bee closed for a number of years. The local community had a strike shut down in disputes between local residents and the prior owner. Pan American has a history of being able to work with communities around its mines. This was a top producing mine prior to being closed. Opening this mine alone would increase production at PAAS from 20 million ounces to 40 million ounces. The second property not priced into the shares, the massive Navidad resource in Argentina could eventually bring on 20+ million more silver ounces when built, for a potential TRIPLE in annual production 3-5 years (from the article immediately below).

Pan American has the largest silver reserves of any mine in the world. PAAS has a strong balance sheet with low debt. While the shares could be volatile, it is a great asset to hold in a decade of inflation and rising commodity prices.

Link to it web site here.

Link to September 2022 company presentation.

TWO SEEKING ALPHA ARTICLES:

I: Pan American Silver: 1.8 Billion Silver Ounces For Roughly $1 Each

Oct. 27, 2022 8:06 AM ET Pan American Silver Corp. (PAAS),

Summary

- Pan American holds one of the top leverage positions to silver prices in the mining sector, with a major mine now offline, and another yet to be developed.

- Healthy asset diversification, little debt, plenty of cash, and a high dividend yield are noteworthy to de-risk the investment vs. alternatives.

- The key to a brighter future will be a reversal in silver prices, possibly into a strong multiyear upcycle. Link to full story

II: Pan American Silver: Trading At Its Cheapest Levels Since March 2020

Sep. 19, 2022 5:30 AM ET Pan American Silver Corp. (PAAS),

Summary

- Pan American Silver released its Q2 results last month, reporting quarterly production of ~4.54 million ounces of silver and ~128,300 ounces of gold.

- The quarterly decline in gold production combined with lower silver prices and negative settlement adjustments resulted in an 11% decline in revenue in the period.

- Unfortunately, the company also reported a write-down at Dolores, and continues to be impacted by inflationary pressures, prompting an increase in its gold cost guidance.

- However, with the stock now trading at 0.90x P/NAV and ~7.0x FY2023 cash flow after making new lows post-earnings, much of this negativity looks to be priced into the stock. Link to full story

LOTM: The price of physical Silver has been out performing the price of physical Gold in recent months. This is not a common event and speaks to Silver strength at this time. There are two events in addition to bringing the two the two properties above on-line. The first is PAAS is projecting a strong increase in cash flow and revenue in 2023 from existing operations. Good results projected by management in the next year. The second is an expectation that the price of physical silver will rally in the next six to eighteen months. See Michael Oliver’s comment below.

Excerpt from Michael Oliver’s Momentum Structural Analysis (MSA) comment non Silver:

O c t o b e r 4 , 2 0 2 2 Silver: Some reasonable underlying assumptions for “all in” – No, investors are best never to go “all in” on any given investment or trade. We know that. However, from my own perspective (Michael Oliver speaking here), I see a situation in progress for silver that encourages me to go “all in.” Or at least focus on silver as my prime place to be now and perhaps for the next year or two. A place where I expect far larger percent gains than might be seen in gold, and a place that will in effect be the reverse of holding a short position in the now bursting paper asset bubble (the stock market, debt, real estate, etc.). I’ve seen prior bull markets in gold and silver emerge and produce massive gains, often involving many years, and my technical sense—large scale and intermediate trend factors now—tells me to prepare for full trend resumption now. And to look large. What we’ve seen the past two years in MSA’s view has merely been a confusing pause/correction for gold within the larger context of an ongoing bull trend. Definitely a period that made many investors suffer much doubt and pain, especially so in the miners and silver. And particularly late-joining longs who were perhaps only motivated to be long in the 2020 summer surge (not those who initiated their position in early 2016 when the new bull trend in gold emerged based on MSA’s annual momentum trend assessment). As gold trends, so will silver and the miners. In fact, they’ll likely lead in performance terms once again. Indeed, over the past month we’ve seen just that sort of eruptive upside action out of silver. Resurrection from the depths, sudden and even violent. Ignoring gold’s day to day. And not a surprise. But aside from our view that the trend remains bullish for gold and that the past two years have merely been a pause (much like how 2008 saw a lengthy pause in the gold bull trend including a sharp downside spike in October that year), there are some other technical factors evident in the past five decades. Features way out in front of the bull move. MSA will continue to routinely update the net trend technicals (price and momentum of price) for gold, silver, and the miners. See the numbers specified in the weekend report in that regard especially. Yes, as the advance continues there will be yet more positive factors coming into play, technically speaking. Unfortunately, there is never just “one” magic trigger. But we’re seeing enough at this point to assume the downside quick panic rout in gold produced late last month has come and gone. A bear trap that wraps up the process of the past two years. This report is provided with a broader background intent.

Momentum Structural Analysis, LLC. michaeloliver@olivermsa.com subscription and for MSA’s history and an introduction to its methods visit: www.olivermsa.com

Written October 28, 2022, by Tom Linzmeier for LOTM: Tom’s Blog

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

854 total views, 2 views today