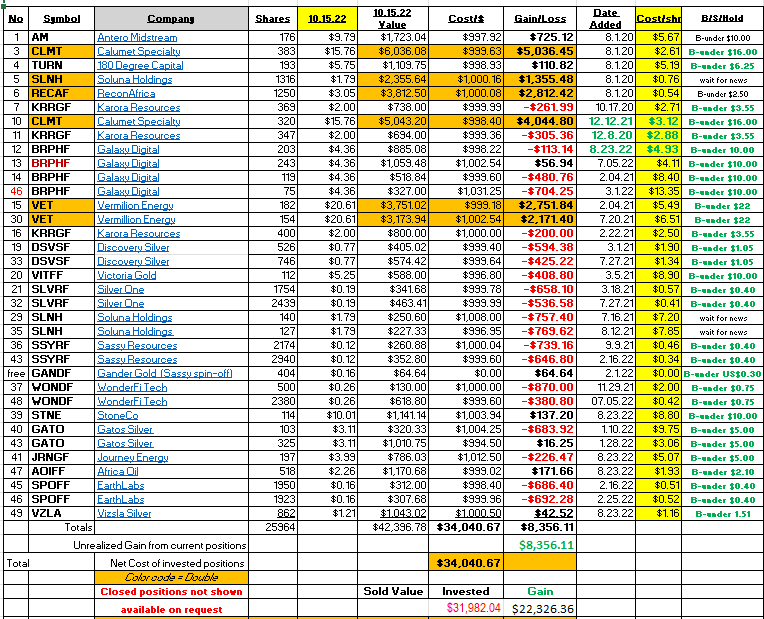

Performance from August 1, 2020, to present:

- Unrealized Gains: $8,356.11 on $34,040.67 – Gain of 24.55%

- Realized Gains: $23,226.36 on $31,982.04 – Gain of 72.62%

- Risk management tactic: Equal money in each position with 100% of that investment at risk. 20 different positions held at this time.

Low priced stocks under $10 are often illiquid and thinly traded – especially when things go negative for the market or company. Stop-loss tactics do not work in this situation. One needs to assume that 100% of the money is at risk and act accordingly. This is why equal dollar amounts in ten or more positions works FOR you. Your risk of loss is limited to 100% but your potential upside in not limited by 100% except by YOU. It is a probability game. Let your winners run so you capture some 200% to 500% gainers. This will more than pay for the 100% losses.

This is a speculator’s mind set. It is long-term focused. Selective timing with dollar-cost-averaging and with future selective tax-loss selling of highest cost positions, is an excellent added tactic to what might appear to be a buy and hold strategy. This is anything but, a buy and hold strategy, but a buy and hold strategy does work under this approach. “Managing the position” goes a long way in shortening the time to goal Vs a buy and hold approach. We are here for you if you want coaching or consulting. We do not give investment advice.

I am so excited about the positions held above! I am confident that commodity bottlenecks will continue to be a global problem. Commodity prices will rise and what now are our some of our biggest losers, in my opinion, are going to become some of our biggest winners. At least consider dollar-cost-averaging into some of the positions.

- LOTM: Five Tiny Miners that are Dirt Cheap – all five are in the list above.

The only company I, personally have concerns about in the holdings above, is Soluna. My head and my gut says they are going to be ok, BUT I also have to recognize that they are in a very difficult financial situation. Many variables are not under their control. Therefore, they not in control of what happens to them, at this time. The story can change dramatically and quickly – either way. That is why we have chosen to wait to buy in the actionable column.

Reminder: November 1, 2022, LOTM will go behind a pay wall. We hope you join us on this adventure. It has been a crazy 25.5 months since we started. If you came late, which most have, it is not feeling so good right now. I have done this longer than some of you have been alive. This programed approach above, works. The timing can be frustrating.

There is a reason we are going behind a pay wall at this time. The odds are good, that we are at a bottoming period. It could get worse, but I think not. Sentiment is terrible. The bond market is broken. The problem is at the central bank level. Short positions and cash levels are very high. That makes me an excited optimist. Join me for the ride. It is going to be fun.

Contact us if you want to pay direct or by mail at Money@ LivingOffTheMarket.com (close the gap after the @ sign.

Have a great day!

Written October 16, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

948 total views, 4 views today