Small – no tiny mining companies have been thrown down to prices that you can say – all they have to do is survive and you will make money. In accounts related to LOTM, we own these companies and love them. Yes, sure they could go lower, but are they going out of business? A high probability statement – they are not. Nothing is certain except – what, death and taxes? I believe in reincarnation and tax havens.

Here are five tiny miners LOTM considers Dirt Cheap.

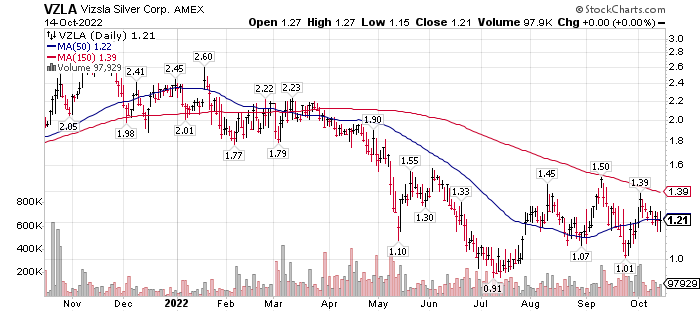

- Vizsla Silver (VZLA)* $1.21 Market cap $189.1 Million / Enterprise Value $180.6 million

Perhaps the hottest discovery company in the world for high grade silver at depth and width. 1,000 oz discoveries at width are common. 1,000 is a kilo. In the September 9th announcement they found almost 3 kilos in a ton of rock. Bonanza grade! Vizsla is an exploration company with production at least three years forward. That’s ok. Silver in the ground is not that different than silver in a safe. Resource report coming before year end is expected by LOTM to be Excellent. Now being consider a possible number one silver resource globally. A LOTM: Ten under $10 for the Double holding.

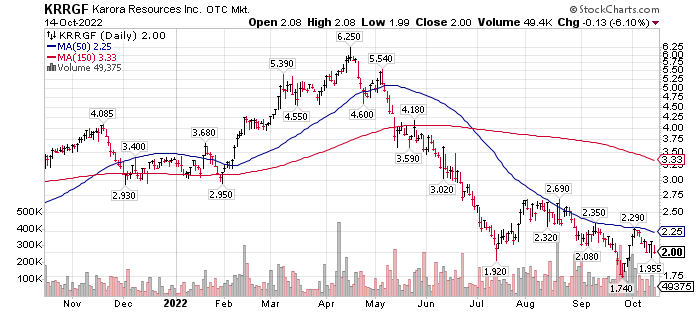

- Karora Resources (KRRGF)* $2.00 Market Cap $363.7 Million / Enterprise Value of $347.1

Record setting production, coarse grade strikes, large scale property. A double in production in about three years 2021 into 2024. Price is down from $6.25 to $2.00 with no negative news. A LOTM: Ten under $10 for the Double holding.

- EarthLab (SPOFF)* $0.18 Market Cap $24.3 Million / Enterprise Value $11.3 million plus $35 million in natural resource assets.

| Aug-26-22 | GoldSpot Discoveries (EarthLab) Reports Record Results for the Second Quarter of 2022 |

Website under construction. If you have not viewed this video on EarthLab (formerly GoldSpot) we recommend it. SPOFF is a tiny company but the mining industry leader in Artificial Intelligence and Machine Learning. Their business model is to invoice enough in cash to cover company expenses and take sweat-equity payment in stock, warrants, options or royalties. SPOFF is an asset gather. It is the cheapest way you and I can accumulate natural resources properties. This company knows what is on a property before the owner’s know, because they are the ones doing the looking. They are now expanding into Natural Resource Financing. Think about the advantage SPOFF has over banks, investors and traditional brokers. They have two significant owners in Eric Sprott and Palisades GoldCorp, a Merchant Bank. EarthLab is a LOTM: Ten Under $10 for the Double holding. Our Long-term price goal is $1.20.

- Sassy Gold Corp (SSYRF) $0.13 Market Cap $7.1 Million / Enterprise Value $16.6 million + 49.5% ownership of Gander Gold.

Sassy is an exploration company in the Golden Triangle of British Columbia with 49.5% ownership of Gander Gold (GANDF) $0.16 one of the largest claimholder in Newfoundland, CA, the New Gold Rush Territory. Todays enterprise value of Gander Gold is $13.65 million. Sassy 49.5% holding is valued at $6.75 Million. Nearly the Market Cap of Sassy itself.

Sassy is a LOTM: Ten Under $10 for the Double holding. Our long-term price target is $1.50

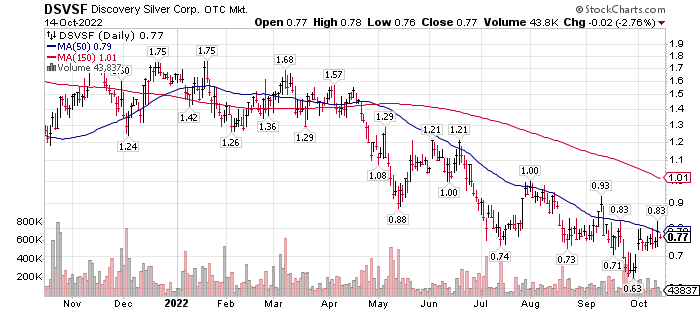

- Discovery Silver (DSVSF) $0.77 Market Cap $274.3 million / Enterprise value of $252.3 million

Projected to be a top five silver producer when it goes into production in 2026, Discovery is in the period between Exploration and Production. This is called the Development stage where the property is being prepped for production. Discovery is a LOTM: Ten Under $10 for the Double position. Our-long term price target is $3.00

Along side the company name and price we have you the Market Cap and the Enterprise Value (EV). The enterprise value is Market Cap – Plus Debt – minus Cash. EV gives a better picture of what the company is worth with debt and cash considered. It is a nice positive to see EV larger than Market cap.

All five positions are LOTM: Ten Under $10 for the Double holdings. Accounts related to LOTM hold positions in all five companies. Yes, we are below cost in all five. We continue to dollar-cost-average into the positions. In time, when the stocks rally, we will sell some of our higher cost shares. I am not concerned in the least about these companies going out of business. The greatest risk, I suppose, is a global depression that takes the value of Gold, Copper, Silver and Zinc to much lower levels and the projects and mines are shut down. Need I remind those that were not invested in the 1930’s depression, that Homestake Mine was the best or one of the best performing stock in the 1930’s. To that extent, I am not too worried about the mining industry.

Two worthwhile videos if you have time are:

- Palisades Gold Radio’s interview with David Brady, “Metals are close to a Bottom.” One hour. Brady’s easy speaking manner runs through the current financial crises that is happening right now and what he feels this projects for the markets to include gold and silver.

- Mr. Doom Gloom & Boom, Marc Faber.

This is a 20 minute interview at Wealthion, “A Lot of People will Lose All their Money.” Faber is positioning to not make money but if he only loses 15% to 20 % of his money he feels he will have done well. Not a joyful interview though Faber is an entertaining speaker.

- A big point is, trust no government. If you hold assets in other countries, for Geographical Diversification, be sure to have custody of those assets in the country where the assets are held.

- Faber likes Emerging Markets. Different countries for different reasons. Indonesia, Vietnam, Argentina & Brazil are high on his list. He mentions Hong Kong stocks as dirt cheap. He is long-term negative on US Tech stocks.

Written October 14, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advise appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

910 total views, 2 views today

Pingback: LOTM: Ten Under $10 for the Double Update October 16, 2022. -

Pingback: Sassy Gold – Undervalued Company in an Undervalued Industry -