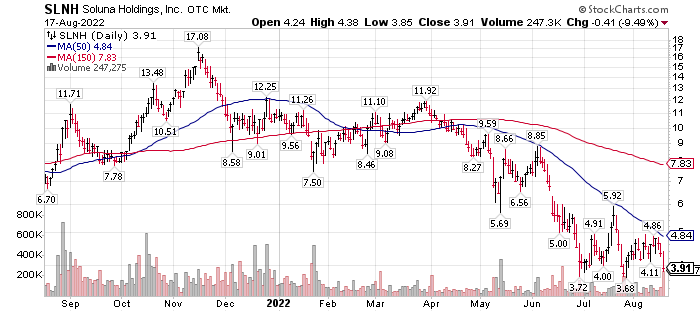

Soluna (SLNH) $3.91

Soluna issued a 10Q that contained the words “substantial doubt about the company’s ability to continue as a going concern.”

Since management cannot provide any assurances that the Company will be successful in accomplishing any of its plans, I cannot either. I certainly hope they can, but I realize hope is not a plan. Day by day, one day at a time. I not selling on this news alone, but each of us has our own situation to take into consideration.

I am surprised and frankly shocked. The company sold and closed on its Instrument division in May bringing in $9 million dollars. Yet at the end of June, the company is saying they cannot generate enough revenue to be a going concern. Management needs to offer up a come to Jesus meeting the with shareholders. At this point, all I can say we are dependent on outsiders to keep us going. As recently as Aug 4th Management did not give any indication they were out of working capital as of June 30.

It is a tough situation to sell and move on because of low liquidity in the trading shares. Personally, I going to hold the majority of the position. This is tax loss selling season for institutions in September. December is tax loss selling season for the rest of us. I will likely sell 5% to 10% of the position at some point to take a gain (cost is $0.52 per share) and hope to re-buy SLNH into any tax loss selling pressure that might develop.

Even though management lost a lot of credibility in not being more transparent, I will operate on the assumption they can resolve this situation.

- On Aug 12, 2022 Soluna announced: the initial funding of up to $12.5M from funds managed by Spring Lane Capital, a private equity firm focused on hybrid project capital for sustainability solutions in the energy, food, water, waste and transportation industries.

- In the Aug 4th presention they state they are in talks with interested companies.

We are not sure how the project capital mentioned above plays into Soluna’s negative working capital as it is project capital.

We can live with volatility but get nervous when the words “continue as a going concern” as used.

Excerpt from 10Q

Soluna Holdings From August 15, 2022 10Q – linked here

Going Concern and Liquidity

The Company’s financial statements as of June 30, 2022, have been prepared using generally accepted accounting principles in the United States of America (“U.S. GAAP”) applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. As shown in the accompanying financial statements, the Company did not generate sufficient revenue to generate net income and has negative working capital as of June 30, 2022. In addition, the Company has seen a decline in the price of Bitcoin due its volatility, which could have material and negative impact to our operations. These factors, among others indicate that there is substantial doubt about the Company’s ability to continue as a going concern within one year after issuance of these financial statements as of June 30, 2022, or August 15, 2022.

The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. In the near term, management is evaluating and implementing different strategies to obtain financing to fund the Company’s expenses and growth to achieve a level of revenue adequate to support the Company’s current cost structure. Financing strategies may include, but are not limited to, stock issuance, project level equity, debt borrowings, partnerships and/or collaborations.

In addition, as discussed above and further in Notes 14, and 15, the Company sold the MTI Instruments business in April 2022 to focus on developing and monetizing green, zero-carbon computing and cryptocurrency mining facilities. The Company received approximately $9.0 million in cash, net of transaction costs, from the Sale and expects to receive another $0.2 million following Purchaser’s approval of the final working capital.

Following June 30, 2022, to further implement management’s strategy, the Company entered into various transactions as further described in Note 17 to recapitalize and negotiate revised terms with senior secured lenders, which released collateral (thus enabling execution of the project financing strategy) and to provide a means for holders of the secured obligations to reduce their debt through the equity markets, including entering into the Addendum (as defined in Note 17) to allow the Company to convert $3.3 million in notes payable to common stock and redeem up to $6.6 million of notes payable, the issuance and sale of $5.0 million in a new series of preferred stock. In addition, also as further described in Note 17, in May 2022, SCI entered into a structural understanding with Soluna SLC Fund I Projects Holdco LLC, a Delaware limited liability company (“Spring Lane”), pursuant to which Spring Lane agreed to provide up to $35.0 million in project financing subject to various milestones and conditions precedent and following the recapitalization and restructuring discussed above, in August 2022, the Company entered into an agreement with Spring Lane for an initial funding of up to $12.5 million of the up to $35.0 million commitment for the Company’s development site in Texas. Management will continue to evaluate different strategies to obtain financing to fund operations, but believes that these transactions, and the availability of up to $7.1 million in additional equipment financing with a third party lender, together with the Company’s cash on hand of approximately $4.6 million as of June 30, 2022 and proceeds from potential capital raising activities and/or increasing the available under our credit facilities, will allow the Company to meet its outstanding commitments relating to capital expenditures as of June 30, 2022 of $1.5 million and other operational needs. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. These financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The COVID-19 global pandemic has been unprecedented and unpredictable, and the impact is likely to continue to result in significant national and global economic disruption, which may adversely affect our business. Although the Company has experienced some minor changes to our miner shipments due to disruptions in the global supply chain, the Company does not expect any material impact on our long-term strategic plans, our operations, or our liquidity due to the impacts of COVID-19. Further, various macroeconomic factors could adversely affect our business and the results of our operations and financial condition, including changes in inflation, interest rates and overall economic conditions. For instance, inflation could negatively impact the Company by increasing our labor costs, through higher wages and higher interest rates. If inflation or other factors were to significantly increase our business costs, our ability to develop our current projects may be negatively affected. Interest rates, the liquidity of the credit markets and the volatility of the capital markets could also affect the operation of our business and our ability to raise capital in order to fund our operations. However, the Company is actively monitoring this situation and the possible effects on our financial condition, liquidity, operations, suppliers, and the industry.

2.Basis of Presentation

In the opinion of management, the Company’s condensed consolidated financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the periods presented in accordance with U.S. GAAP. The results of operations for the interim periods presented are not necessarily indicative of results for the full year.

Certain information and footnote disclosures normally included in the annual consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto included in our Annual Report.

The information presented in the accompanying condensed consolidated balance sheet as of December 31, 2021 has been derived from the Company’s audited consolidated financial statements. All other information has been derived from the Company’s unaudited condensed consolidated financial statements for the three and six months ended June 30, 2022 and June 30, 2021.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and our wholly-owned subsidiary, SCI, as of June 30, 2022 and for the three and six months ended June 30, 2022 and 2021, also includes the accounts of our then wholly-owned subsidiary, MTI Instruments. All intercompany balances and transactions are eliminated in consolidation.

Written by Tom Linzmeier, August 17, 2022, editor www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,202 total views, 4 views today