Linked here is an August 4, 2022, interview with the top two people at Soluna, John Belizaire and Michael Toporek. The video is 17 minutes in length. The video discusses future financing and the reason for the delay of full implementation of Dorothy in Texas.

It is important to understand the companies we are invested in. Stock prices rise and fall very quickly. Volatility is often based on emotional reactions to Macro, Geo-political or domestic government / economic reasons. At the company level, management and employees continue growing the company day after day after day. The “company” is more constant in growing the value of the company than the emotions that move the price of stock around. It doesn’t take a big leap, to recognize that if the company has a rising diagonal of value creation with interaction of the emotional volatility of the stock price, to see it is a good thing to buy a healthy company when the price volatility knocks the price down, even while the value build at the company increases. Basic investing, but we need to be consciously aware of this opportunity. Only in such a way can we truly buy value at low prices and understand when price Vs valuation relationship is maxing out. It is the basis of Value investing and Speculation in the term – Buy Low / Sell High.

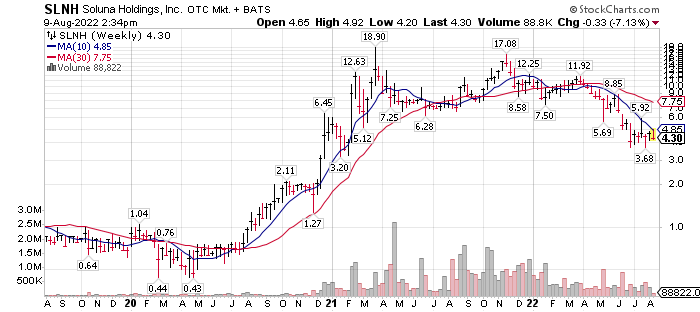

Soluna is more valuable as a “company” today, than in March of 2020 at $0.43 per share or at $17.08 in November of 2021.

Management anticipates deal financings to be announced between now and year-end (closer to year-end) that will bring the real value of what Soluna is doing, back into investors vision.

Below is a second Interview, discussing the build-out of computing operations in Texas – Soluna’s 100 mega-watt project in process.

August 4th, 2022, – 22:24 minutes. This interview goes into depth on the delay of full implementation of Dorothy in Texas as well as legislation from our Washington players.

Fulfilling the goal of financing the multi-year backlog of projects Soluna has in hand, has started. The engagement of the broker, Truist, July 5th, started the selection process of finding large financial partners. This process will extend into the fall of 2022, at which time Soluna projects announcements from this financing process. Between now and the end of the year, I believe shares purchased now will trade higher by December 31, 2022. Can the price go lower? Certainly. Who knows what our leadership in the USA will do, much less what leadership in other major countries will do. There are many factors that influence “stock” pricing. That is why it is the “companies” we own are most valuable assets we focus on. Timing is the most difficult aspect of the market. Soluna and others in the “wasted (curtailed) energy” field have greenfield opportunities for many years into the future.

- Introduction to Project Dorothy (Texas) dated July 22, 2022, by John Belizaire – length 5 minutes. This is an excellent and very short explanation of what Soluna does and provides to the computing industry, extending to local training and jobs in the area of the computing centers.

Written Aug 9th, 2022, by Tom Linzmeier, editor, www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,210 total views, 2 views today