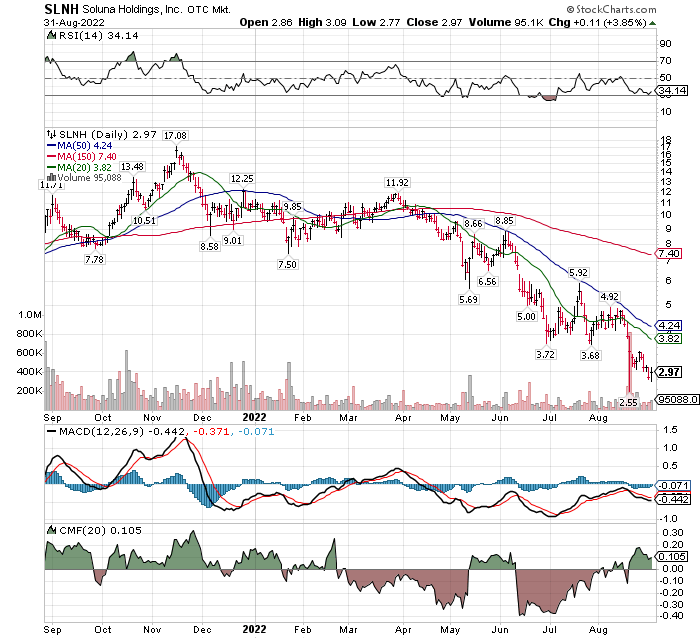

CMF showing some interesting accumulation going on.

CMF showing some interesting accumulation going on.

Link to August 20, 2022, Investors Presentation

- The Wholesale cost of electricity to Soluna rose from the TVA (Tennessee Valley Authority). Soluna was not able pass on the price hike to its JV partner at its computing center. The contract (at Marie) expires at the end of September. TVA suggested they expect rates to decline in September. This needs time to play out with a change date of September 30, 2022, for something.

- The Texas Grid (ERCOT) has not approved Dorothy (Texas Wind Farm Project) at this time. This appears to be a process rather than a problem. Having said that, there is no date knowable for approval. Based on conversation at an August 20, 2022, Investor presentation, it is anticipated that Dorothy (total 100 Megawatt project) will be phased in gradually in Q 4 ’22 and Q1, ’23. Maybe longer or more slowly.

- Funding future Projects: Terms of past and future Project Financing – the most likely form of raising capital – is return of capital first, a Hurdle rate return to investor, and 50/50 split on remaining profits. Each contract partner will negotiate their own terms.

- Does Soluna have enough operational capital to get to year-end ’22? It depends on a variable cost per tera hash. At a cost of 20 to 30 tera hash yes, at a cost of 40 tera hash, no. This is stated at the 24:35 minute mark in the Video linked below.

Presently Soluna is projecting a total of 70 megawatts by the end of 2022. This is down from 200 megawatts projected for adding in 2022 as the target a year ago and down from 100 megawatts down from end of 2021 for a gain in 2022. The company is now projecting 70 megawatts total for year-end ’22. That now sounds like it is too conservative for year-end ’22 but let’s see. The ERCOT requirements has slowed things down substantially. There does not seem to be any problems to resolve with ERCOT, but rather assurances and policies provided to the bureaucratic process.

In some accounts related to LOTM, I have sold some Common shares of Soluna and purchased some of the Soluna preferred shares. The preferred is a higher rank within Soluna if there are financial issues. It is also a 27% dividend payment on a $8.50 cost. 27 percent cash payout doubles is about 2.75 years. With resolution of issues that has brought the shares price lower, there is room for a double in the preferred’s price along with the high dividend. There is risk and uncertainty but a big potential reward as well.

Expect some tax loss selling in the coming days and months. Some institutions have a Sept 30 year-end date. This selling could happen before there is any news announcements that provide positive interest in the shares of Soluna. It is hard to say there will be a reason for buyers to enter the shares in the next 30 to 60 days without positive news. This is a heads up more than a reason to be a selling action based on anxiety about a price drop.

The stock price is actually giving us a second chance to buy – however, the story is riskier now than when the shares were under $1.00 back in 2020. In the items mentioned above, Soluna needs a third party actions to make their story work. I think they will find that third party, but neither management nor I can give assurances of the outcome. If Management, who are also the biggest shareholders, can orchestrate a desirable outcome with minimal share dilution in the next six months, The stock still has 10 X potential from the current price.

Written August 31, 2022, by Tom Linzmeier, editor of Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,058 total views, 2 views today