Commodities and especially precious metals are closely linked to the action in the US Dollar – in an inverse relationship. US$ up – Gold and Silver down. US$ down – Gold and Silver Up. The chart above illustrates this relationship. Presently the US$ is in a rally mode and we are seeing a pull back in physical gold and silver. It is our opinion that the rally in the US$ is in a rising correction to the longer-term downtrend that started in early November 2022. Once the corrective rally in the US$ ends, we expect gold, silver and other commodities will reverse and rally strongly. Time will tell us if the US$ will break downwards or break upwards. It is the trigger to directional changes. The DXY (US$) Index) is in the lower part of the chart (above) with its 50-day and 150-day moving average. The DXY crossing these two moving averages trigger shifts in the price of gold.

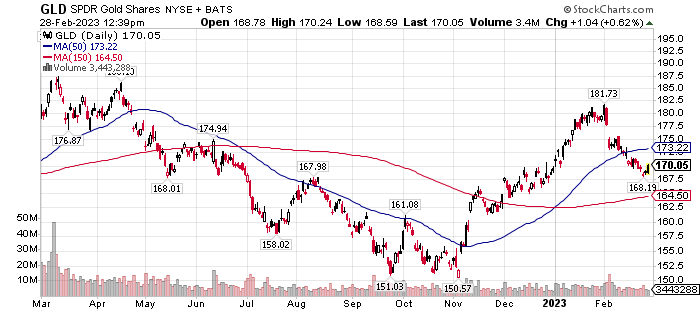

Gold (GLD) Price alone. I am seeing a bullish cup and handle chart formation in the chart below.

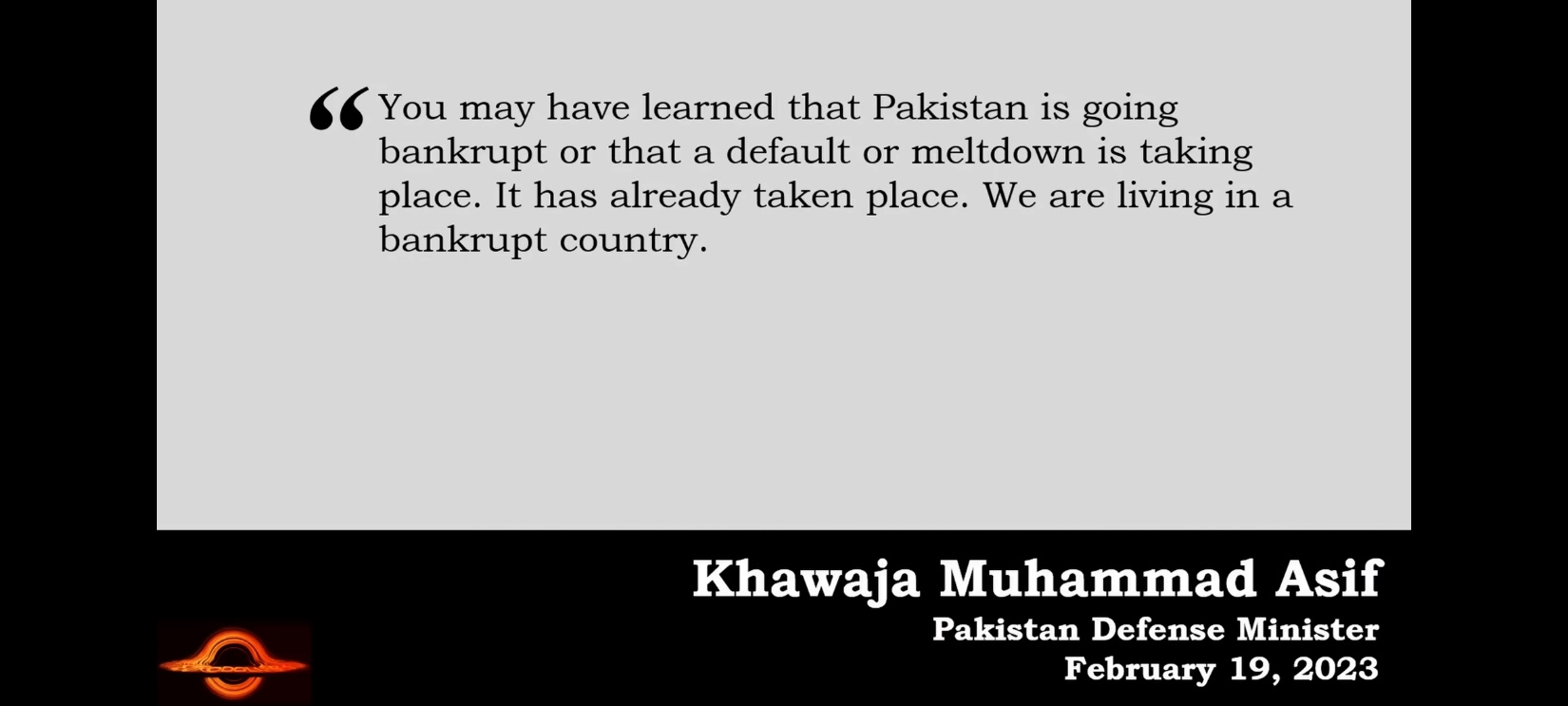

Pakistan following Sri Lanka. Food for Thought. Why money is flowing towards hard assets?

The US Dollar falling could be interrupted by Country defaults such as Pakistan and Sri Lanka. Country default action would drive money towards the US Dollar as the least risky fait currency in the world. Country defaults would be a positive for gold, silver and hard assets. Bitcoin would benefit as well as a store of value.

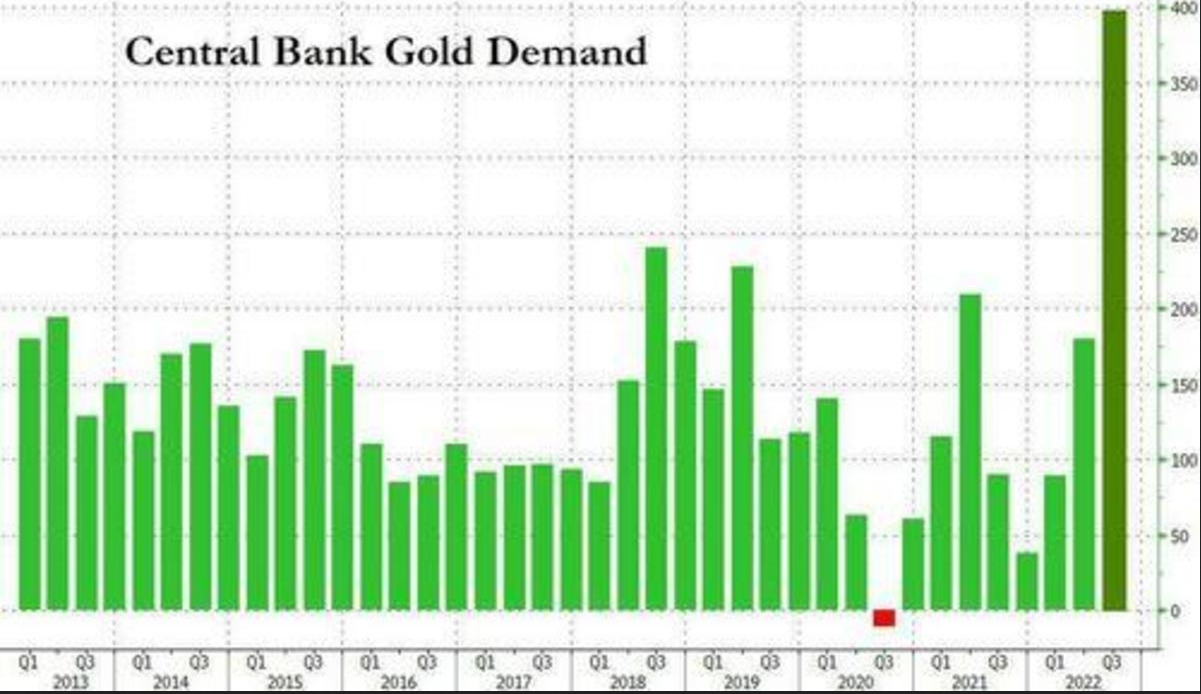

Central Banks globally are accumulating gold.

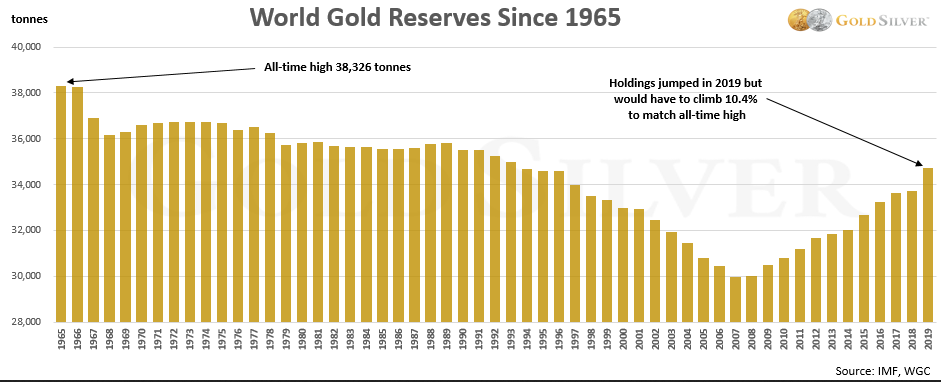

Long-term view of Central Banks buying Gold.

Oil can be expected to rally should or when the US$ declines.

We would like to say that the inverse relationship between Gold and the US$ changes with time. At this time, there is a very close inverse relationship between the US$ and Gold/Commodities.

Disclaimer: Accounts related to LOTM are over-weight in precious metal miners and energy companies.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

Written February 5th, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

1,174 total views, 4 views today