Ok – ok, a bit of dramatic license in the title. Two of our followed Brazil individual stocks exploded. We believe the Brazil country ETFs will exploded. Vietnam appears ready to explode when technical indicators MACD and CMF are viewed (not shown).

Visual of Charts today:

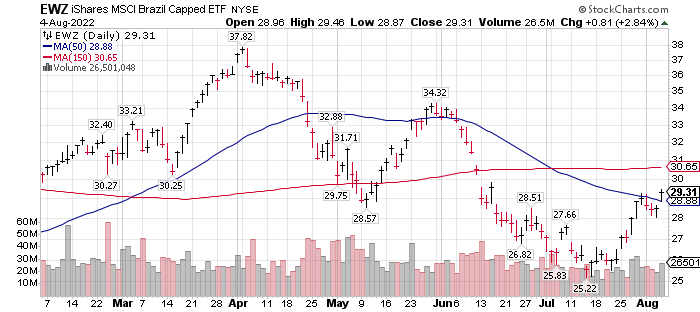

- Brazil iShares Large Cap ETF (EWZ) $29.31 up 2.84%

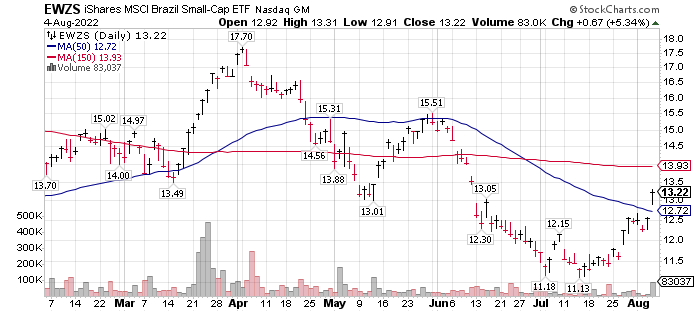

- Brazil iShares Small Cap ETF ( EWZS) $13.22 up 5.34%

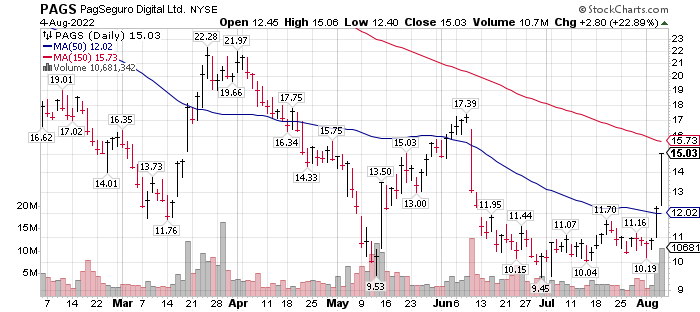

- PagSeguro (PAGS)* (PAGS)* $15.03 up 22.89%

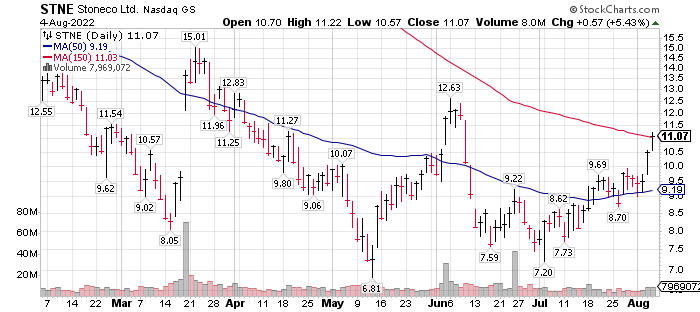

- StoneCo (STNE)* $11.07 up 5.4%

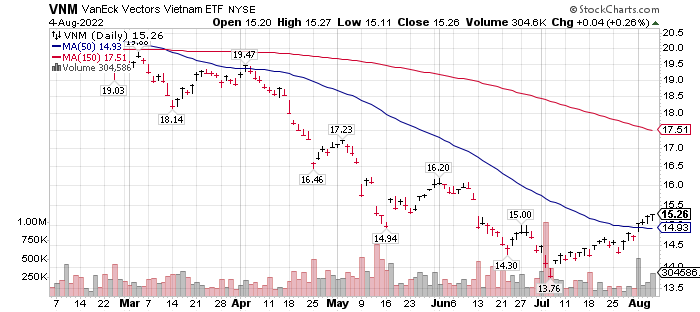

- VanEck Vietnam ETF (VNM) $15.26 up 0.26%

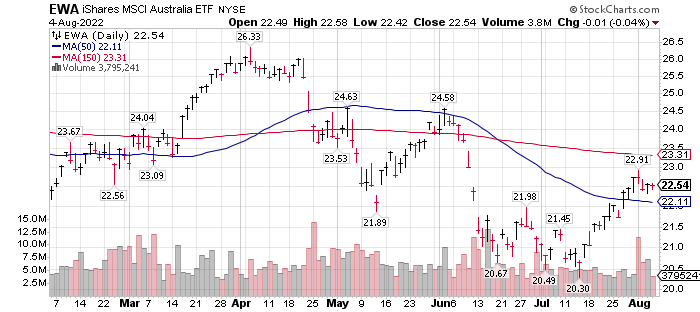

- Australia iShares EWA $22.54 down 0.04%

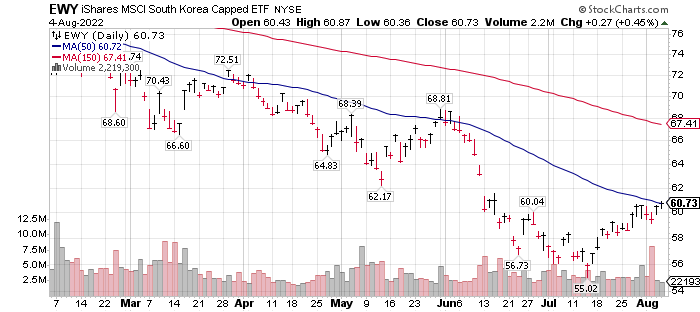

- So. Korea iShares ETF (EWY) $60.73 up 0.45%

Emerging Market Portfolios Post Longest Streak of Monthly Outflows on Record – IIF Aug 3, 2022.

Headlines as inverse indicator? – Seems to be on track. Not because the ETFs above are up today, but the headline came just as all the charts above are positive in price cross-overs above their 50-day moving averages (MA). That is more telling than being up one day! When looking at the charts below look for the price cross-above the 50-days MA.

Note the charts of the individual companies PAGS & STNE. They have moved first before the individual country funds followed with a slight delay by the Multi-country funds listed at the end.

Smaller company ETFs are leading the bigger Company ETFs this time. Usually, it is the other way around. Interesting.

Vietnam ETF below is showing constant increases in price. Usually that leads to a more explosive move as others pile on.

Actionable Ideas Today!

Our trading signals suggest Emerging Market ETFs and Funds are about to break above their 50-day moving averages. Our Favorites are Brazil and Vietnam as they are slightly ahead of the multi-country funds below. Australia looks interesting. Individual country funds will be more volatile and produce bigger gains if we are right and bigger losses if we are wrong than multi-country funds. They are more focused and more volatile. The list below is more conservative because they are multi-country funds.

10 Best Emerging Markets ETFs to Buy in 2022 Jan 2022 by Money Crashers

1) Vanguard FTSE Emerging Markets ETF (VWO) $41.39

2) iShares MSCI Emerging Markets ETF (EEM) $40.02

3) iShares Core MSCI Emerging Markets ETF (IEMG) $49.13

4) Schwab Emerging Markets Equity ETF (SCHE) $25.15

5) SPDR Portfolio Emerging Markets ETF (SPEM) $34.58

6) Invesco RAFI Strategic Emerging Markets ETF (ISEM) $22.44

7) Schwab Fundamental EM Large Company Index ETF (FNDE) $25.68

8) SPDR MSCI Emerging Markets Fossil Fuel Reserves Free ETF (EEMX) $60.89

9) WisdomTree EM ex-State-Owned Enterprises ETF (XSOE) $28.77

10) iShares JPMorgan USD Emerging Markets Bond ETF (EMB) $88.65

- Order was set by Money Crashers. I have no idea of their logic if there was logic.

- Company links are to Finviz stats, charts and news

- Strongest chart pattern of the ten above is #10 EMB.

Happy hunting.

Written Aug 4, 2022, by Tom Linzmeier editor , www.LivingOfftheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,042 total views, 4 views today