Investing News Network – Melissa Pistilli Feb. 28, 2024 (Full Story Linked here)

Keith Neumeyer of First Majestic Silver (AG) has said he sees the white metal reaching US$100 per ounce.

Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year 2000, when investors were sailing high on the dot-com bubble and the mining sector was down. He thinks it’s only a matter of time before the market corrects, like it did in 2001 and 2002, and commodities see a big rebound in pricing. It was during 2000 that Neumeyer himself invested heavily in mining stocks and came out on top.

“I’ve been calling for triple-digit silver for a few years now, and I’m more enthused now,” Neumeyer said at an event in January 2020, noting that there are multiple factors behind his reasoning. “But I’m cautiously enthused because, you know, I thought it would have happened sooner than it currently is happening.”

LOTM Notes: This comp by Keith between today’s market environment and what happened between 2000 and 2010, is very similar and appears very repeatable.

Rumors that Escobal has a probability of reopening have been verbalized but this is the first time I have seen it in print. The property is 100% owned by Pan American Silver (PAAS) and would double the size of Pan American within months of approval.

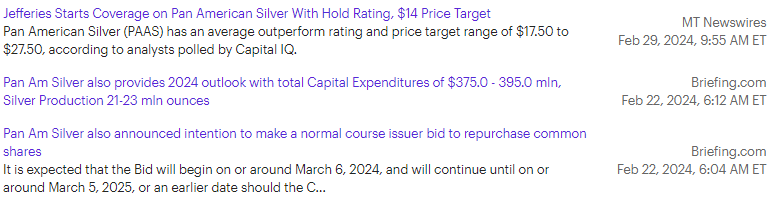

Pan American Silver News

News today, below, about Pan America is now in the “Probability” category.

“If” the property below is approved, it would double the production of Pan America in a matter of months. The property is fully developed, proven as one of the largest silver deposits in the world.

Controversial Canadian silver mine ‘likely’ to reopen in Guatemala despite opposition

A decade since it opened, Pan American’s Escobal silver mine awaits outcome of historic Indigenous consultation process – Hayley Woodin Feb 26, 2024 1:07 PM

Link to full story. Link to company (PAAS) website on Escobal.

LOTM Notes:

- I believe the new buy recommendation by Jeffries below, (Not linked) is due to the “probability” of the miner re-opening.

- Jeffries also placed a buy on a recent LOTM suggested stock in the Gold industry, B2 Gold (BTG) $2.30, with a $3.50 price target. Seems at least one broker is looking at the PM Industry with an optimistic view.

- Please note in headlines below, that PAAS also has a share buy-back program in motion for the next year.

- The dividend at the current price, is 3.28%.

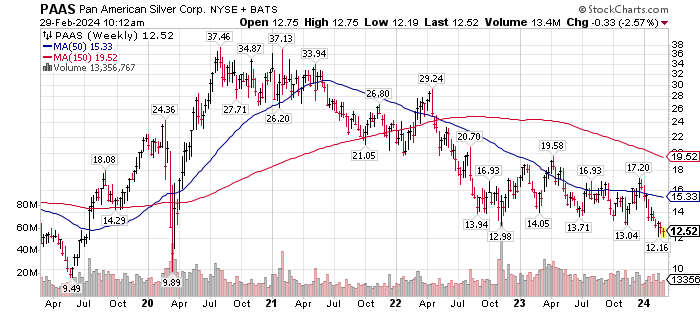

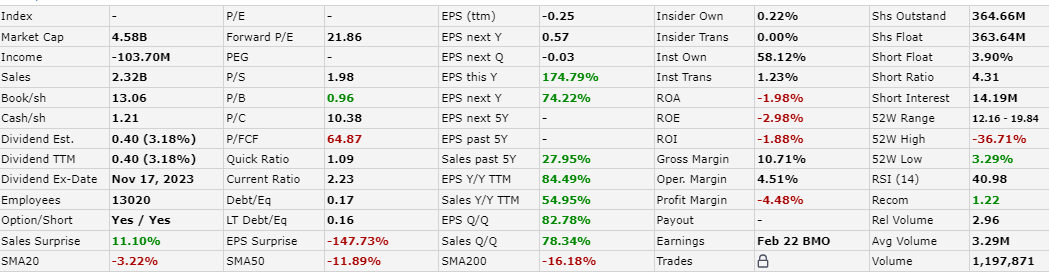

Pan American is cheap based on operations – Cheap but not perfect. Operational expenses, due to expense inflation, have put PAAS at a 2023 loss per share on a Trailing Twelve Month basis (TTM). Recovery of profit is projected for 2024 – See Finviz graphic below the StockCharts and also linked here.

This is a defining moment for Pan American to leap forward. If the project above does not get approved, it doesn’t appear to be a risk for the stock. The reopening is not priced into Pan American shares. Pan American is one of the premier Silver miners in the world. The company quality is excellent.

Note the green numbers above show green numbers. On TTM. The loss will be in the past – we are looking forward.

May the energy of prosperity be with us. Accounts related to LOTM own shares of Pan American Silver.

Tom

Written Feb 29, 2024, by Tom Linzmeier,

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog at LivingOffTheMarket

248 total views, 2 views today