When an industry is “hot” money is put to work quickly through the buying of the ETFs of that industry. Money flows in, the ETF buys the stocks within that ETF and the stocks go up. Momentum buyers buy more of the ETF and the ETFs buy more of the stocks. It is a wonderful thing! That’s pretty much how seven stocks have driven the market higher over the past decade.

The seven stocks that have driven the market are Apple, Meta, Tesla, Nvidia, Microsoft, Alphabet and Amazon. Money flows into the NASDAQ 100 (QQQ) and the S&P 500 (SPY) and because these indices are market weighted indices, an outsized amount of money goes into these seven stocks and less into the remaining stocks in the indices.

This works great in an up cycle. How does it work in a down cycle?

Let’s look at some of the ETFs in the Genomic industry.

Here are five:

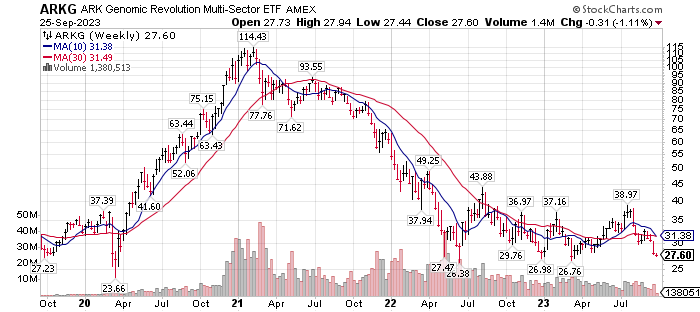

- ARKG $27.60 – Ark Genomic Revolution

- PFE $57.42 – Invesco Dynamic Biotech Portfolio

- IDNA $44.63 iShares Genomics Immunology and Healthcare ETF

- GNOM $10.07 Global X Genomic & Biotech ETF

- LABU $3.64 Direxion Daily S&P Biotech Bull 3X Shares ETF

Each of these ETFs topped out in price in 2021 and have worked their way lower since the dates posted below:

- ARK traded at a high price of $111 on February 10, 2021

- PBE traded at a high price of $83 on February 9 and 10, 2021

- IDNA traded at a high price of $55 on September 20, 2021.

- GNOM traded at a high price of $28 on February 26, 2021

- LABU traded at a high price of $176 February 9th 2021.

Individual stocks within these ETF have also performed poorly. Selling of the ETF puts downward pressure on the individual companies.

LESSON & OPPORTUNITY:

- Companies within an ETF will rise and fall or at least be heavily influenced by the direction of the ETF.

- Look at the ten biggest positions within a hot ETF. By buying the top three to five positions When the trend of the ETF turns positive, you might out-perform that ETF. You are not dragged down by the underperforming and smaller positions within the ETF.

- NOW for the real story. This is tax selling season for institutions – September and October. For individuals it is late November and December. By virtue of the end of the year coming, this tax selling pressure ends. Just crossing into January 2024, the price selling pressure on the companies being sold stops. Odds are good that after two years of falling prices the industry is over-sold. Look for the prices of Genomic stocks to POP in January, perhaps in Late December.

I used a quantitative study on many of the individual Genomic stocks as well as the Genomic ETFs mentioned above.

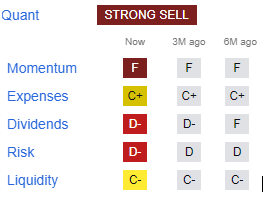

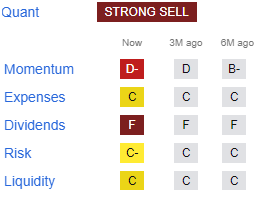

Each of the ETF has a strong sell recommendation as of today. Selling pressure is still on these ETF – likely tax selling momentum. Not much happening as to negative impact on company operations.

See for yourself above, the high price of the last two years in the ETFs, comped to today price.

If you monitor the Genomic ETF’s and wait for them to turn positive, 1) you can buy for a good move because they are over-sold and/or 2) look for the biggest positions in each ETF for the highest conviction names, to out-perform the ETF.

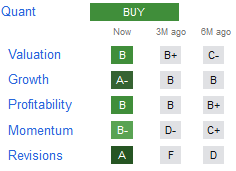

Here are the current Quantitative signals for the ETFs.

ARKG: IDNA:

PBE: GNOM

LABU:

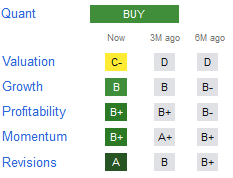

Top ranked individual companies by Quant studies within the Genomics Industry that have a Buy rating:

Example for two companies individual as a comp to the ETF quant ratings

SDGR: CSTL

These are the 10 strongest ranked companies in the Genomic industry, at this time, of the 38 names LOTM has in our watch list.

I will let you do the research on charts to see the high price of the last two years and the lows of the last two years. The probabilities that we are at peak selling intensity after two years and tax selling motivated are very high. When the ETFs go on a buy signal, the names above, have a high probability of out-performing the Genomic ETFs. You can check the Charts, news & analysts opinions at FINVIZ.com

End of the year tax loss selling is a great time to be buying the strong companies of a weak industry. I can assure you, with complete confidence, the Genomics industry is not going away.

Our belief is that the Fed is adding liquidity to the market that will show up in late Q4 of this year.

If I am wrong, you are buying industry leaders at great prices. This is true in the Genomics industry as well as the Gold and Silver industry.

Make the market a game and have fun with it. This is one type of strategy to buy good companies cheap.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

622 total views, 4 views today