Miners typically are in Three stages of development.

- Exploration

- Development

- Production

All three stages above, are subject to the volatility of investor’s fear, greed or apathy. Developmental stage is typically an apathetic price stage. The thrill of Exploration Discovery has gone, and the results from production have not started. The development stage time period can be as short as two to three years to five or six years. In jurisdictions which are unfavorable to mining, it can take much longer. Example: PolyMet (PLM) $3.27, within the state of Minnesota, is going on twenty-years trapped in the developmental stage. Permitting was completed years ago, the State and Federal by 2018. PLM has been declared of national strategic importance (Biden Admin) and still the company is tied up with lawsuits in the courts.

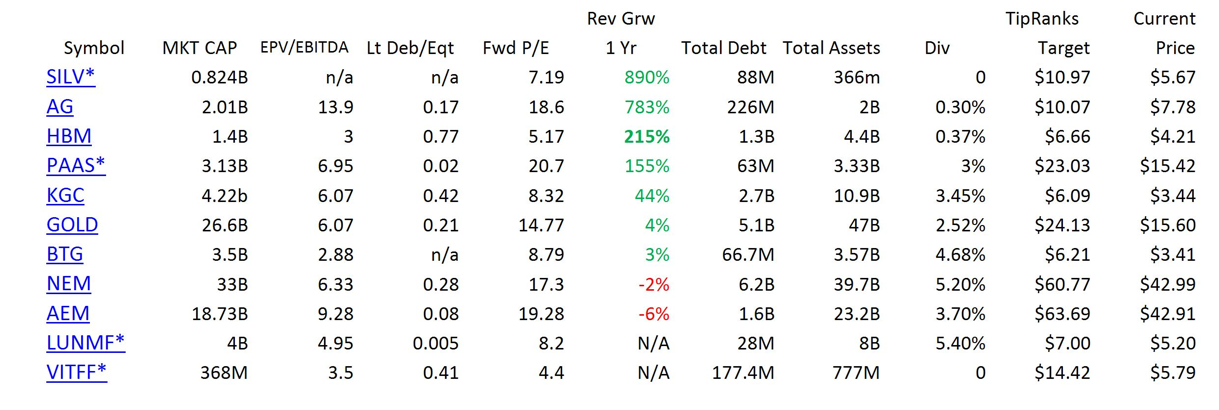

Avoidance of the “Developmental Stage” of a company, is probably wise. Below we have listed multiple companies in production that we like and find of interest.

To help you with the table we would like to share the importance of the EPV/EBITDA ratio.

- EPV is Enterprise Valuation. This is similar to metrics critical in buying a private company.

EVP is the market capitalization of a company, plus company debt, and then minus the cash.

- EBITDA is Earnings Before Interest, Taxes, Depreciation & Amortization.

In very basic terms, it is the value of the company, divided by cash flow.

This ratio levels the playing field when looking at a company Vs its competitors in determining an answer to the question; is it cheap or expensive relative to its peers?

Certainly, there is always more to the story. We will cover in some differences in company narratives below the table.

Individual comments:

- SILV (SilverCrest) – SILV has no EPV/EBITDA because they just started production in June/July of this year. Revenue growth will climbing from a zero base. The land package is big. The grade of silver is considered third highest grade of silver on a global scale. Earnings are expected to be strong in the first year as shown by a 7.1 forward P/E ratio.

- AG (First Majestic) is a top silver producer on a global scale. They also produce a high percentage of gold. The stock is never “cheap” because it has a cult like following. The runs when physical silver is climbing in price and also drops quickly when silver declines in price. AG is a volatile trading stock. It is a high caliber company with excellent management led by founder Keith Neumeyer.

- HBM (Hudbay Minerals) HBM is a quality Canadian copper miner. One never finds a pure copper mine, so Hudbay also processes addition minerals such as gold and silver. The EPV/EBITDA is low and very attractive. We believe there will be strong M&A activity in this industry as bigger companies scramble for replacement resources. HBM is an attractive target. In addition, it is #3 on our list for projected revenue growth. Humm, cheap valuation, fast growing with a clean balance sheet.

- PAAS (Pan American Silver) – The crown prince of silver miners. Considered #2 silver miner in the world by volume of silver produced and #1 in the world in silver reserves held. PAAS has one billion ounces of silver on its books that is not priced into its stock. One billion times the price of silver per ounce at $18.57 an ounce. I can do that math. A market cap of value of $3.1 billion. Wonder where this price could go when silver gets hot?

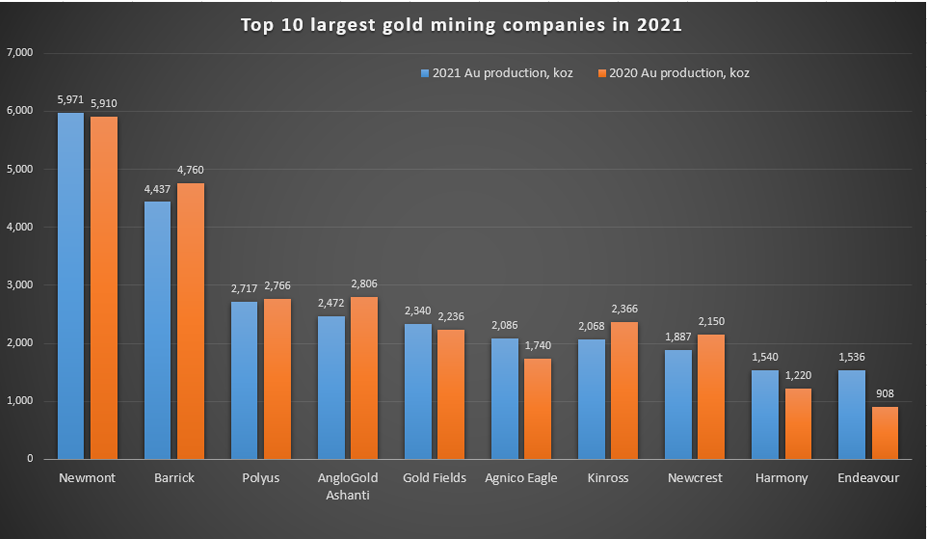

Link to the Top Ten Gold mining Companies in the World.

- GOLD (Barrick Gold) World’s #2 gold producer. Go to purchase by Institutions when gold comes in to favor. Industry valuation is average for the top ten companies this time. Hard to knock this excellent company.

- BTG (B2Gold Corp.) This is a company I am not very familiar with. The valuation is excellent as the best EPV/EBITDA on the chart with a 2.88 reading. The divided is appealing at 4.6%. They have properties in non-conventional places. That is .either a good or bad statement, They are very international with operations in The Philippines, Namibia, Mali, Columbia, Finland and Uzbekistan. Headquarters is in Vancouver, BC.

- NEM (Newmont) the #1 producing gold miner in the world. Nice dividend at 5.2%. If we have the decade of gold/silver/copper & commodity outperformance we believe will happen, this dividend can grow nicely. Newmont is not mentioned as a copper producer, but copper is a big part of their business. NEM is a good choice for exposure to the mineral commodity cycle. It is a gold/silver and copper play within the “all electric” theme the world has going. On top of that, a 5% dividend that is growing and a healthy balance sheet. We also think fait currency will lose it desirability and be replaced by a basket of currencies and commodities.

- AEM (Agnico Eagle) AEM is a 2022 combination of Agnico and Kirkland. Two great miners joining to become the sixth largest miner in the world. AEM in my opinion is the best gold mining company in the world. It’s valuation reflects this opinion, however. Not the highest dividend on the list, not the fastest growing on the list and not the cheapest valuation on the list. It is however a high quality company.

- LUNMF (Lundin Mining)* This is not a name most will recognize but it is an impressive company within a family run, natural resource management company going on its third generation. The company is not small at four billion US$ in annual revenue. The valuation is attractive by the numbers and even more attractive when non-producing assets are considered. This is primarily a copper miner that also has gold and silver as secondary products. At the end of 2021, they completed an acquisition of JoseMaria a very high quality copper/gold/silver property in the northwest corner of Argentina. This is a challenging located project, but a world class project in scope. Lundin Mining is one of eleven public companies in the Lundin Family portfolio. Lundin Mining is an excellent value, pays the highest dividend on the above list, has a great balance sheet but not a friendly takeover target. Management is proven and developed over three generations of family.

- Victoria Gold (VITFF)* probably the best takeover target on this list. Coeur Mining owns about 18% of the company. VITFF was strongly profitable in its first year of production 2021 was their first full year of production. They have a aggressive debt reduction plan in motion. Costs were up and production flat in Q2 2022. This brought the price down as the industry was and still is weak from the April to present sell off. Over all, this seems to be a great asset trading inexpensively. Of the stocks listed above, analysts have the greatest distance between current price and target price for Victoria.

Our interest in these gold miners is one of accumulating as the industry is at extreme lows Vs the physical metals at a era where demand legislated cannot be met by supplies. Not so much in gold directly but certainly silver copper nickel. Gold’s demand with come from central banks around the world buying gold as a treasury holding to support their currencies in a dollar deglobalization world.

We suggest owning a basket of these companies. Ten is not too many to own. Reduce the percentage owned in each one and treat the basket as your own ETF of producing mining companies. The more conservative you consider yourself, the more you might want to focus on the dividend payers. For this list we focused on gold, silver or copper producers. Truthfully, we like them all. Have fun looking for the takeover idea or the dividend idea or the rapid growth idea that fits your investment style. Nothing wrong with a blend of a few together.

Personally, I love the mining exploration companies. That is a different game, however. It is more volatile, more speculative, less predictable and more “lottery ticket” like. Exploration companies do not move until late in the cycle but when they do move, five X or more is pretty normal. That is speculating, not a normal investing style. I love it, but it can be a long, long, time between gratification experiences. So different strokes for different folks.

We will do a quick technical analysis of these companies in a follow-up email. Some are starting to break-out of a basing stock chart patterns while others are lagging behind in their chart pattern development.

Peace, happiness and prosperity to all.

Edited Sept 9, 2022 6:11 PM CST, originally written by Tom Linzmeier, Sept 8, 2022, for Tom’s Blog at www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

1,182 total views, 2 views today

Pingback: Ten Producing Miners for Growth and/or Dividends. -