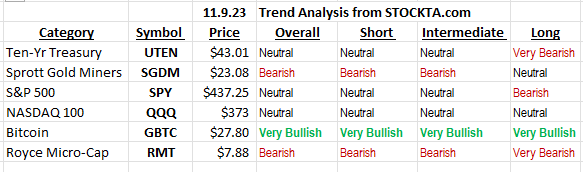

Hottest sector – Without question – Crypto

LOTM Favored Cryptocurrencies at this time.

- Bitcoin (BTC) – Ethereum (ETH) – Solana (SOL) – Chainlink (LINK)

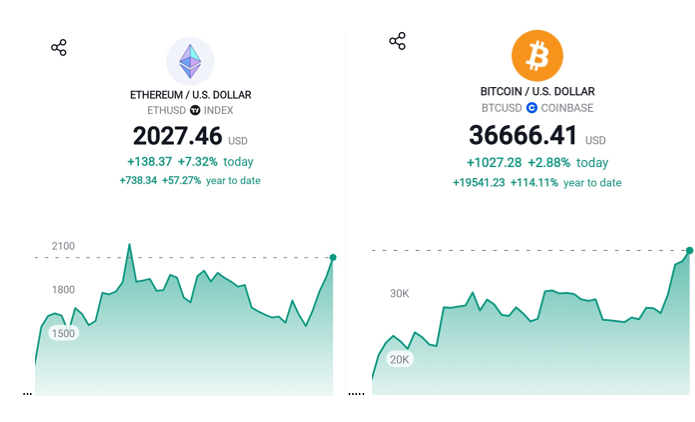

Bitcoin – The digital “Store of Value” that protects the loss of purchasing power built into Fait currencies. BTC is a Layer 1 asset.

Ethereum – The base layer upon which the majority of applications are built. Owning Ethereum is similar to saying you own the internet. Google, Apple, Meta and Microsoft are companies that created immense wealth with applications that run on the internet. You and I could not buy the internet, but we can buy Ethereum. There are multiple applications that are being built of Ethereum. ETH is a Layer 1 asset.

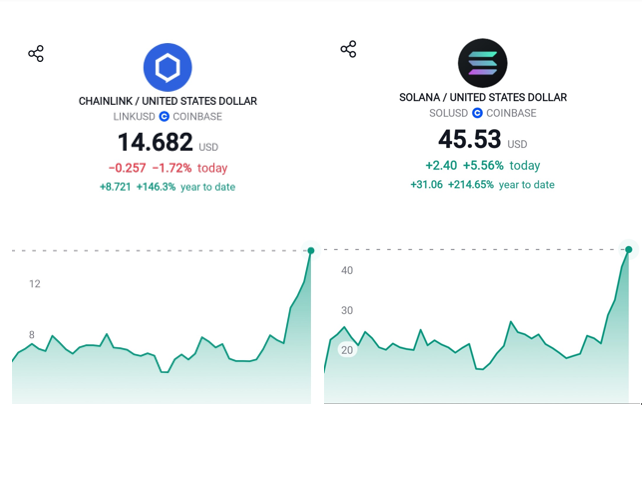

Solana – Solana is a crypto payment application that can process one million transactions per second. Visa has adapted Solana to process its consumer transactions as has Citigroup. SOL is a Layer 1 asset.

Chainlink – Chainlink is an application that allows different alt-coin applications to interact with each other. This is a critical service that is being described like Goole is to the Internet. Banking’s SWIFT system has adapted Chainlink into their procedures. Chainlink is a Layer 2 crypto built on the Ethereum base layer.

Exchanges to consider when purchasing Bitcoin and Alt-coins . Personally, we use Swan Bitcoin and Coinbase. Kraken has a very strong reputation as a highly regarded crypto exchange as well.

2022 TAX LOSS BUYING – Year-end from October through November is a great time to be buying the worst performing industries of the last one or two years. Last season we added seven names from tax loss purchase ideas in LOTM Ten Under $10 for the Double list. These names are:

- Grayscale Bitcoin Trust (GBTC*) Now $29.90 – bought November 11, 2022 at $8.26.

- GrayScale Ethereum Trust (ETHE*) now $17.02 – bought 12.2322 at $5.30.

- African Oil AOIFF*) now $1.88 – added November 12, 2022 at $2.16.

- Kratos (KTOS*) now $17.31- added December 1, 2022 at $9.75

- Vizsla Silver now $1.00 – added November 21, 2022 ay $1.05

- Victoria Gold, now $3.91 – added November 21, 2022 at $5.70

- Soluna 9% preferred (SLNHP) now $1.26 – added November 21. 2022 at $2.60

Losing Positions: Four stock purchases are down slightly. $4000.63 invested – Present value of the four names is $3,005.81.

Winning Positions: Three stocks that are up with a buy-in cost total of $3,053.96 with a present value of $8,782.

Totals of the seven purchases apx one year ago is $7,054.59 with a present value of $11,787.81 for apx gain of 67%.

Purpose of sharing this: Education. We have a “plan”. Buy oversold “value” in the biggest losers for the year or combined two year period during tax loss selling season. Hold for one to two years. We are not being smarter than anyone. We are simply buying value when value is not appreciated.

This is a probability game.

We are simply seeking to be consistent in a statistical way,

to put the probabilities of regression to the mean to work for us.

We selected the above names because we felt that they were real assets and had a horrible performance year in 2022. The seven names in total are up – certainly helped by crypto’s price performance this year and shared above. This is not an unusual occurrence. Rather it is a high probability approach. We are simple farmers planting out seed (buying) when it is planting season and then harvesting (selling) in one to two years when share prices have regressed to their mean or moved above their mean. In stock market terms, we are “Buying at a Discount to Value” and selling a a “Regression to the Mean.” Statistical probability at work.

Along the same line of reasoning for this year, there are deeply oversold industries. Gold and Silver are still one of the most undervalued industries in the stock market. We have done some selling for tax purposes but reinvested those proceeds and new money back into different Gold and silver companies.

We have add a new industry sector that we believe has 50% to 100% appreciation potential within one to two years. We are only sharing this new industry and company names with Paying members of LOTM Blog.

Consider buying a one month subscription to LOTM and we’ll send this industry and additional companies we believe are deeply over-sold and can rally as soon as the calendar moves into January 2024. This happens simply because Window Dressing by institutions has ended, and Tax Loss selling has ended. We encourage you to give the trade a one to two year growing season for the biggest percentage moves.

GOAL if buying now: buy on a dollar-cost-averaging approach with a one to two year time-line to harvesting gains. Our price appreciation goal target is 25% to 50% annualized return within a two-year timeline. These number goals fit any professional investors’ goal. The best of the best, Stan Druckenmiller, averaged 30 percent returns annually. 25% to 50% annually fits nicely in that target range.

Consider a one month subscription and then cancel. We are ok with that as it is compensation for our work and helps with stock market education. Subscribe today, at LOTM.SUBSTACK.com and get out list of statistically probable, regression to the mean, company names.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We sometimes allow 100% loss/risk on some purchases.

Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible.

We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written November 10, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

436 total views, 2 views today