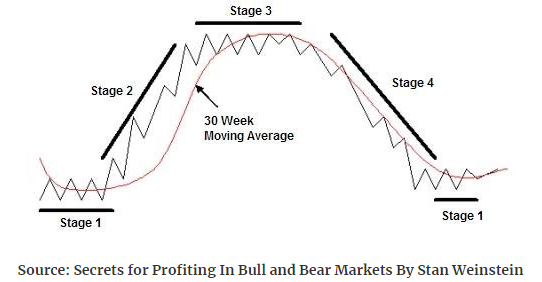

Bitcoin and Alt-coins are leaving a stage one base-building chart pattern and entering their stage two rising price stage. Link here to Investopedia for a discussion of Stage Analysis. Blockchain application companies are lagging slightly but also attracting money in-flows. See Mark Yusko’s comment on the generational shift of inheritance into Crypto instead of Gold or paper currencies, for “The biggest transfer of wealth in human history. IMHO, you want exposure to crypto and blockchain companies.

Example of Stage Analysis:

Since this shift into stage two of Stage Analysis is an industry trend, we thought it helpful to mention the ETF’s and Trusts that are available for USA residents to buy for trading or investing. Since the volatility factor is very high in crypto, one might have a two fold approach of owning a percent long term but also employ a price management plan to trade a portion of the position.

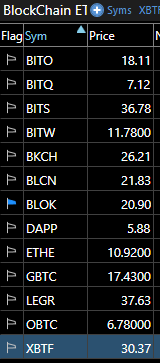

LOTM Watch List of Blockchain and Crypto ETFs and Trusts at TC 2000:

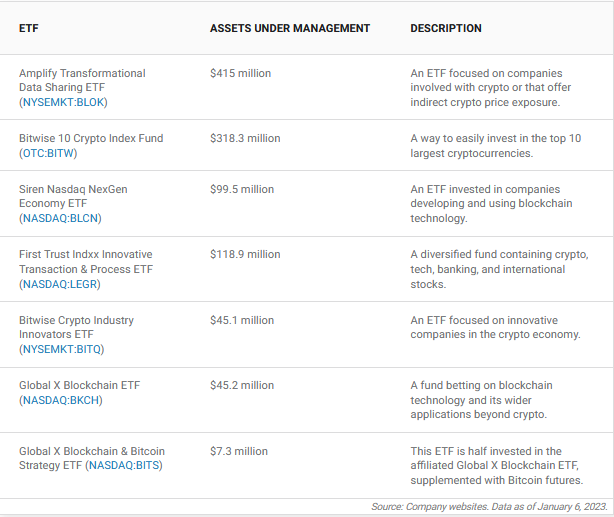

Resource at Kiplinger: 9 Crypto ETF – Kiplinger, about March 25, 2023

In this article:

- Grayscale Bitcoin Trust (GBTC) $17.43

- ProShares Bitcoin Strategy (BITO) $18.11

- Bitwise 10 Crypto Index Fund (BITW) $11.78

- Amplify Transformational Data Sharing ETF (BLOK) $20.90

First Trust Indxx Innovative Transaction & Process ETF (LEGR) $37.63

Siren Nasdaq NexGen Economy ETF (BLCN) $21.83 –

Global X Blockchain ETF (BKCH) $26.21

Bitwise Crypto Industry Innovators ETF (BITQ) $7.12

VanEck Bitcoin Strategy ETF (XBTF) $30.37 futures trading – leveraged and high volatility. Best suited to active traders

Names are linked to ETF Description & Fact page

Stock Price is linked to price chart at Finviz or StockCharts

Resource at Motley Fool:

Source: Jan 6, 2023 Motley Fool:

Consider the size of the fund – a small sized fund will provide more volatility and more difficulty entering and exiting trades.

Check the Daily volume in the funds. Traders like large trading volumes that provides the opportunity to “trade like water.” Easy flowing and large volume so you are invisible.

Are the funds spot holders of crypto or Futures holders of Crypto? Futures has more volatility and price decay than spot holders of Crypto.

Which ETF’s give you access to companies that use applications based on Crypto and Blockchain? This is the invisible, but staggering in size, opportunity to approach this industry.

We hope this is of help for those of you who are interest in a broad based approach to Blockchain and Crypto.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April 16, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

632 total views, 2 views today