Gold miners are drifting lower as interest rates on 20 & 30-year treasuries, move higher. We like these four Gold miners and think they are cheap protection should the market fall as well as just too cheap a valuation. We think that more difficult market times are ahead of us (this year) with rent and mortgage deferments drop away, Impact from the small – medium enterprise damage from government policy related to COVID-19, and failure of the vaccines to create herd immunity as fast as we would like, comes into focus. Gold (and silver) miners are a hedge against a general market sell off. If the market goes into a hard correction, we believe long interest rates will back off creating both a safe haven for equity investors and an attractive monetary backdrop for the miners.

Gold and silver miners are creating cash like they own the press. Margins are GREAT with the current price of physical silver and gold. The industry is balance sheet lean and many miners are initiating dividends and share buy backs.

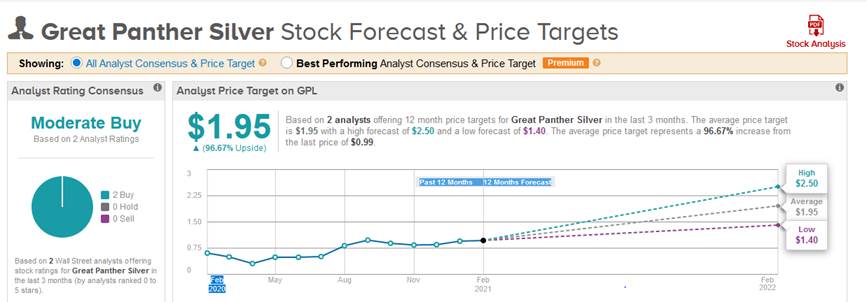

I: Great Panther Silver: In spite of its name, Great Panther is at present, 80% gold production. Average Analyst upside Target is 96% upside from its current price. Forward P/E ration from Finviz is 6.5.

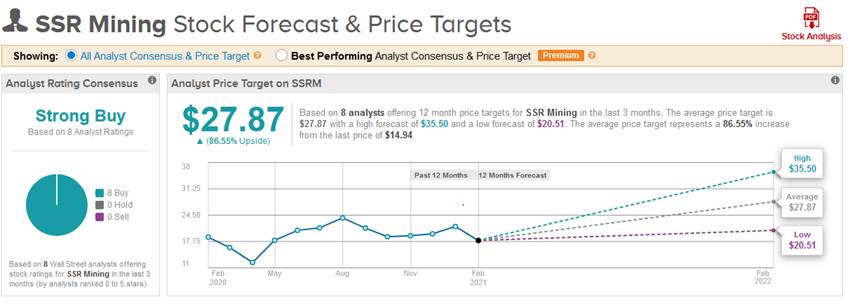

II: SSR Mining: SSRM has some great numbers going for it. The biggest negative is that its largest mine is in Turkey, a potential negative jurisdiction. No issues at this time, however. Average Analyst upside Target is 86% upside from its current price. Forward P/E ratio from Finviz is 7.34.

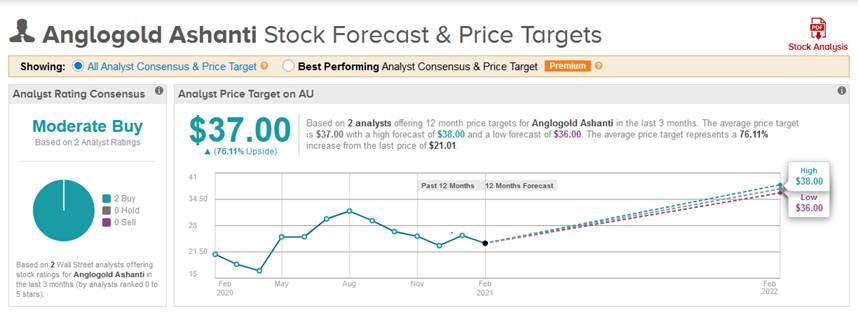

III: AngloGold Ashanti: AU produces 7% of world’s gold production, non of it in South Africa as its name would suggest.

Average Analyst upside Target is 76% upside from its current price. Forward P/E ratio from Finviz is 6.79.

IV: Kirkland Lake: Located in Canada, a friendly jurisdiction, KL has an Average Analyst upside Target is 61% upside from its current price. The Trailing P/E ratio from Finviz is 12.5.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()