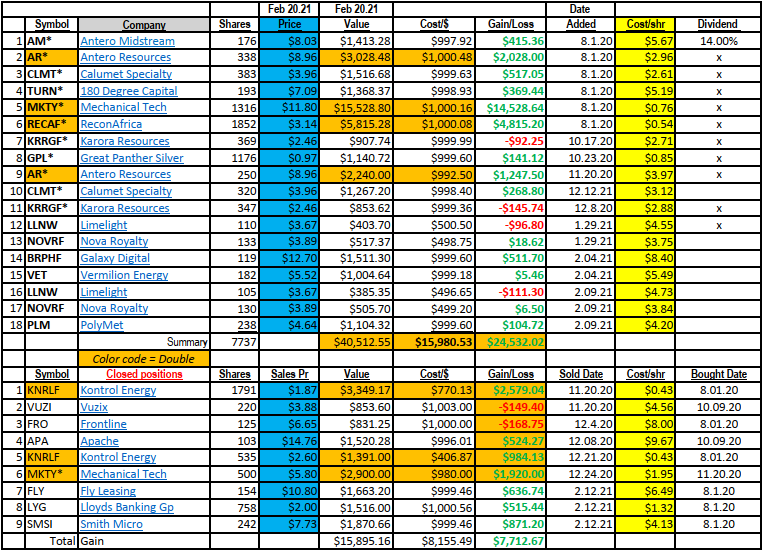

Our stock picking track record is posted above so we will not comment on the record.

Our stock picking track record is posted above so we will not comment on the record.

Our overall investment theme is:

- Smaller growth companies,

- Deep Value companies,

- Commodity related companies with a leaning towards Metal Miners & Nat Gas companies

- Blockchain and Companies working on business infrastructure supporting the growth of Blockchain and Crypto Mining.

Additions:

We will make at least one addition next week. Karora Resources (KRRGF)

- Why are we buying a third investment unit Karora Resources (KRRGF)?

- The shares are trading a ttm P/E ratio of about 8. Cheap, cheap cheap.

- They are sitting on massive reserves.

- Quality of underground gold found is higher quality than average.

- They will begin an organic growth phase in 2021 after three recent acquisitions.

- They will make four Investor Conference presentations in five weeks starting in early March. This could be a catalyst for the share price.

- Gold Miners are one of the cheapest industries in the market and I cannot think of a better place to be, should the market crash.

We love Calumet (CLMT) and what they are doing. We will buy more CLMT if we can buy below $3.95.

- CLMT pulled their offer to sell their Great Falls, Montana Refinery from the market because it was underappreciated by potential buyers.

- Management is changing two-thirds of the refining, to Biodiesel, using other people’s money.

- They said they are no longer considering an offer for the Finished products division. Same reason as the refinery.

- Between the two divisions, they project they can generate $280 million to $320 million in free cash flow before EBITDA. That free cash flow, is the same as their market cap. Who trades that cheap! Buy, buy, buy – haha. Yes they have $1.4 billion in debut but the current cash flow is more than adequate to handle the load.

Because Galaxy Digital (BRPHF) is above $10, so we will not add more to this portfolio, but we are buying aggressively in Portfolios related to LOTM.

- Galaxy Digital in most ETF’s related to Blockchain and Crypto Innovation.

- Blockchain and Crypto currency is at the birth stage of, oh say, maybe a twenty-year growth period.

- What does Galaxy do?

- Galaxy Digital’s mission is to be the bridge between the crypto and the institutional worlds. The Galaxy Digital team has extensive experience spanning investing, portfolio management, capital markets, venture capital, asset management, and blockchain technology. Galaxy Digital operates in the following businesses: Trading, Asset Management, Principal Investments, Investment Banking and Crypto Mining. Galaxy Digital’s CEO and Founder is Michael Novogratz. The Company is headquartered in New York City, with offices in Chicago, San Francisco, London, Tokyo, Hong Kong, the Cayman Islands (registered office) and New Jersey. Additional information about the Company’s businesses and products is available on www.galaxydigital.io.

Sold Positions on Feb 12, 2021:

We closed out three positions from the Ten Under $10 for the double.

- SmithMicro (SMSI)

- FLY Leasing (FLY)

- Lloyds Banking Group (LYG)

We will likely sell Limelight (LLNW) this week. We are off to a bad price start and don’t want to nurse it through a market correction.

The truth is we do not have negative opinions on these positions. The reason we sold is that we are nervous about a hard market sell off. The companies we sold are companies we like but decided that they may not rally back very fast in stock market tough times combined with economic hard times.

These companies are also out of our investment theme as posted above. Metal Mining, Blockchain, and commodities. We really are comfortable owning commodities, especially commodities with a shortage of supply commodities like the electric metals (silver copper & nickel) and Natural Gas. We feel gold and silver are the perfect place to be and miners especially cheap Vs the price of gold and silver. They also provide protection from loss of purchasing power with fait currencies. If blockchain and crypto sell off, we would consider it a gift. They are on the front end of a couple of decade long growth cycle.

Have a great week.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()