Inflation?

Ouch! My morning coffee is about to increase:

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e., inflation). Stagflation can be defined as a period of inflation combined with a decline in the gross domestic product (GDP).

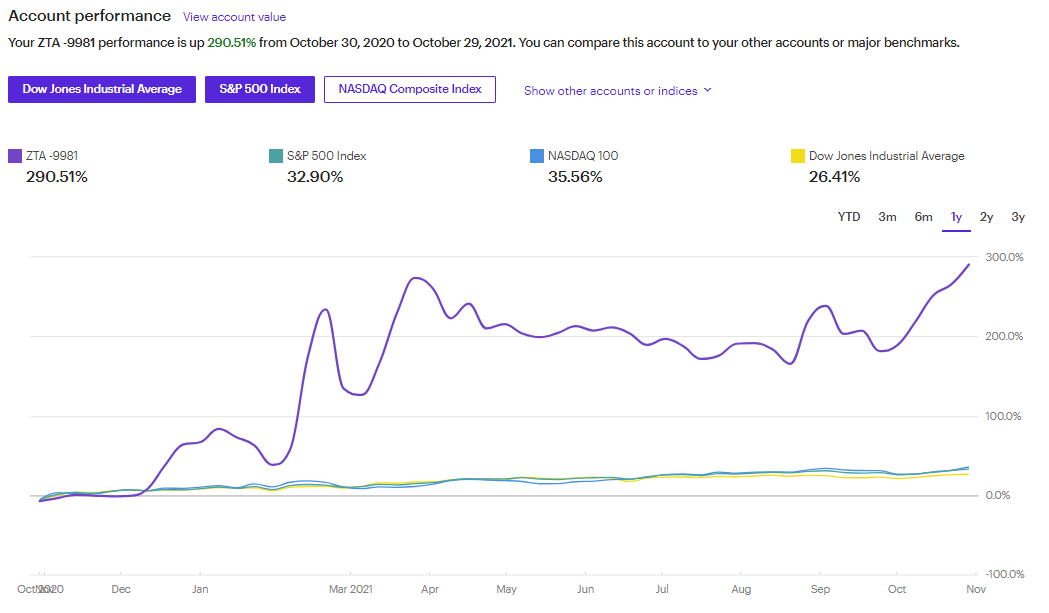

Stagflation is the theme or assumption LOTM has been working on for some time. It has been working, as shown in our performance of a partnership (ZTA) we manage at eTrade. This account is non-diversified or balanced. It is in two asset classes, Blockchain related (stocks) and Commodities (primarily metal miners). Right time/right place is our excuse for the good performance. We cannot say we can continue or duplicate, but we’ll try.

So far so good with our Stagflation game plan.

How to beat Stagflation.

- Hard Asset Investing / Commodities/Precious metals, metals in production demand (silver, copper, nickel), Energy – oil & gas especially.

- Companies growing faster than inflation – typically small companies do this better than big. Blockchain is the fastest growing industry in the history of human kind. 113% CAGR. The previous leader was the internet – 67% CARG

Three excellent interviews on stagflation or deflation. Stagflation is becoming the common theme, still early in the cycle. Deflation is an uncommon theme but cannot be dismissed. Deflation is going to be hard to hold off due to demographics. Aging Boomers leaving the workforce and spending less and all; that stuff. It’s kinda a mess out there. Maybe you’ve noticed.

Lyn Alden – a really bright star in the Macroeconomic world. 58 minutes

Chamath Palihapitiya, Billionaire Venture Capitalist. Linked here. Ten minutes

There is a group that still says Deflation is the primary outcome of the where we are. Leading this commentary is Cathie Wood from AKT Invest.

Cathy Wood, ARK Invest founder.

All three of the above people are top of the Class performers! Lots of room for differing opinions – Stay Flexible – but stay Focused also.

The price of energy (oil) raises the cost of everything in its path. Food, Transportation, Manufacturing all increase because of oil prices. This is not in our system yet.

The price of oil and gas globally is managed. Saudi Araba for oil supply. Russia in being the provider of Nat Gas to the EU. Both are big influencers of price through controlling supply. That is a warning for the price of oil. It can change quickly just by increasing or decreasing supply. In the USA Nat gas is more a domestic product.

By Tom Linzmeier, editor, LivingOffTheMarket.com October 27, 2021

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()