- Vizsla Royalty (VROYF*) & Vizsla Royalty Warrants (VRYWF) How I handled this situation

- SilverCrest (SILV*) – buy-out and forward option sale opportunity

- Coeur Mining (CDE*) accumulating a position

- Discovery Silver (DSVSF*) wow it popped 25% on the same day Coeur announced the SilverCrest buy out.

- LOTM Watch list of 42 silver miners. Many if not most are juniors exploration companies.

- Vizsla Royalty (VROYF*) & Vizsla Royalty Warrants (VRYWF) How I handled this situation

The Vizsla Royalty Warrants (VRYWF) will expire worthless on December 21, 2024. Currently they trade and have a value. I really like the opportunity presented by Vizsla Royalty (VROYF*). I am buying this position slowly in an account related to LOTM. My goal is to buy the shares of VROYF at a price of $1.35 and lower.

We have two options to choose from with the Vizsla Royalty Warrants (VRYWF). One is to exercise and for an additional $0.50 per share buy a share of VROYF. I tried this but it was a hassle. I stopped the process of exercising the warrant to receive shares of VROYF. Then I simply sold the warrant (VRYWF) at a limit order of $0.90 with a GTC limit order. Once sold, I bought VROYF at $1.35 or lower The difference was $0.45 – a bit less cost than exercising the warrant cost and adding the required $0.50. I did have a total commission cost of $14 at eTrade on the sale and buy. eTrade had a handling fee to exercise the warrants of $38.00. In addition, the time to work through the exercising process was unknown. By simply selling the warrant and buying the royalty shares I saved time energy and a few dollars. If you are not interested in the Vizsla Royalty shares, simply sell both the royalty shares and the warrants. Happy to share why I like the Vizsla Royalty (VROYF*) if there is interest in hearing my reasing.

- SilverCrest (SILV*) – buy-out and forward option sale opportunity

SILV has a buyout offer from Coeur (CDE*). The deal needs shareholder approval. I suspect it will be approved and the deal done. At the very least I consider it probable. The deal is projected to close on Late Q1 2025. I own both SILV and after see the deal and the drop in CDE shares began buying the shares of CDE. I like the combination of the two companies. As stated in the press release the buyout price is about $11.34. This price could change higher or lower. It is not set in stone. Another company could come along and offer a higher price. I don’t think any company will enter with a higher bid, but it is possible.

I noticed that January 2025, $12 call options on SILV have a value. Likely on the hope some company will come along and offer a higher price. I only have 200 shares of SILV but on Monday I will try to sell the $12 call options with the January expiration date. The strike price of $12.00 is above the stated deal price plus some value from the sale of the options. If the deal falls apart and the two companies walk away from each other the I would expect SILV to drop in price and perhaps CDE to rise a bit in price as it was higher at the time of the announcement.

Coeur Mining (CDE*) I am accumulating a position –I hope the deal goes through as it sounds like the combined companies will be stronger together as one. Just sharing a thought as I see it in the market place. Slowly adding some shares on the pullback in Coeur Mining.

- Discovery Silver (DSVSF*)

Wow, it popped 25% on the same day Coeur announced the SilverCrest buy out. Most of the small silver miners popped on Friday. Discovery was the biggest I saw. I did not see any news. Discovery is waiting for a permit to build an open pit mine. That is something the Mexican government has stated it does not want and will not permit. Should Discovery get permitted, and many think it will in 2025, the shares could move higher. For now, unless there is news next week concerning Discovery, I would guess it will not continue higher at this time. I do own the shares. I just went through the process of selling my highest cost shares for tax loss, waiting 30 days and repurchased the position again. I have no intent to buy more shares but would consider adding if the shares backed off towards the 40.50 area again.

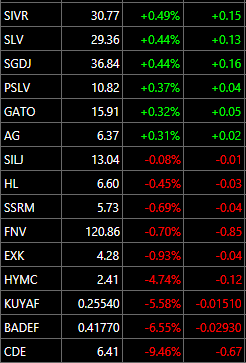

Below is the action in the silver miners I follow on a watch list.

This list is of my LOTM selections on TC2000.com charting service. Many of these companies will fade into the sunset and go out of business when the physical silver price declines. For now, I am personally, very bullish on the price of silver. The trend is higher. Be careful and spread your risk across a number of companies.

Silver miners LOTM owns in various accounts include:

- SILV, PAAS, CDE, VZLA, DSVSF, SLVRF, AG and EXK. We also own the new Vizsla Royalty (VROYF) stock that is not listed above. We think of all of these companies together as one play on the price of silver.

A few of the silver exploration explorers or development stage companies we do not own but like and would own if funds permitted, include:

- AYASF, DOLLF, SBSW, and ADMLF.

Hope this is of help. Tom

PS: These are troubled times from a domestic leadership, national debt and geo-political perspective. We have never been closer to nuclear war. We don’t know from what extreme our national election will trend. The probability of domestic violence is high no matter who or which party is elected.

The LOTM related ZTA account has about 12% of the account on margin (borrowed money). For whatever reason – if the market or the geo-political environment goes negative, we will sell enough equities to pay off this margin and more without notice.

Be prepared for both a melt-up due to the excess liquidity being pushed into the market or the launch of a nuclear war be it a reactionary launch or a pre-emptive nuclear strike.

Thank you for reading. We doing this to help you financially. We are concentrated by both a small number of positions owned and in not being diversified. We are speculators by that definition. We will continually share our performance so you can closely monitor not only what we are doing but how we are doing. Our reason for sharing performance is actually selfish. If we have to report our performance regularly, we are constantly focused on our performance. Thank you for being the whetstone that keeps our knife sharp.

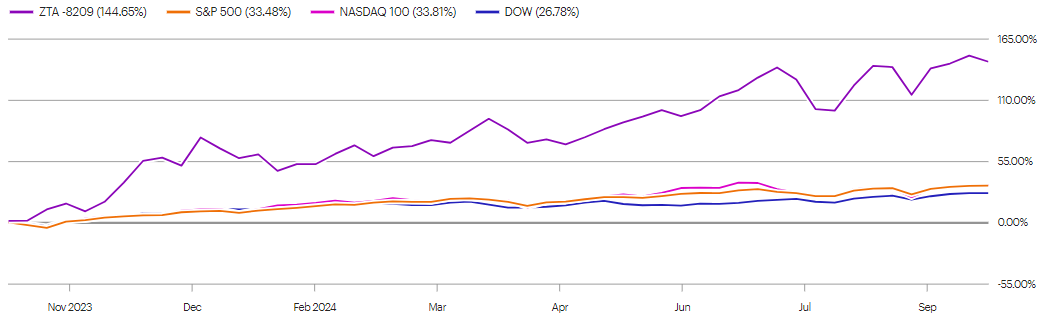

ZTA Limited Partnership (ZTA), is one of the accounts related to LOTM:

One year performance:

![]()