Featured Companies:

- Gatos Silver (GATO) $4.72

- Frontline (FRO)* $9.76

- Karora Resources (KRRGF)*

- Gatos Silver (GATO) $4.72

![]()

Featured Companies:

![]()

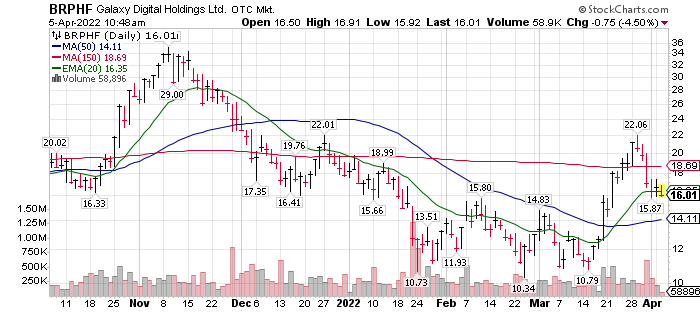

Bitcoin Predicted to Reach $500,000 by Galaxy Digital’s Mike Novogratz Continue reading

![]()

Something to think about:

![]()

Summary:

![]()

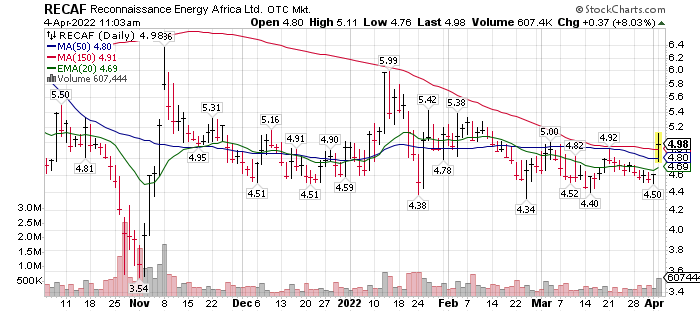

Looks Like a Cup & Handle Chart formation – Typically a bullish chart pattern

Galaxy “the company”, is doing amazing – and being a start-up in 2017. Consider these numbers: Continue reading

![]()

Fred Krueger is serial software entrepreneur with early career, Prop Trading experience on Wall Street.

Krueger did a personal study on the outcomes of short-term trading Crypto Vs HODLing Cryptocurrency, Bitcoin specifically. His conclusion is similar to my personal experience but in an actual study. A dramatic statement in the article linked below: Continue reading

![]()

Summary:

![]()