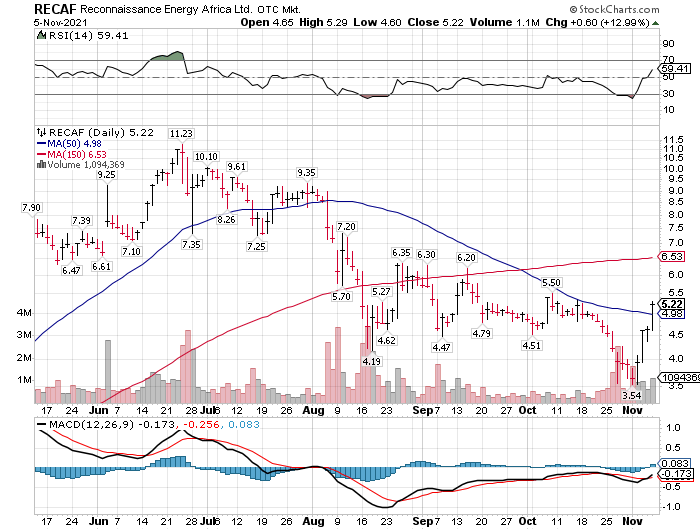

LOTM first brought StoneCo (STNE) to readers on October 24, 2120, as a high performing company that ran into to temporary problem that collapsed the stock price. Since then, the share price has retested the lows and gone lower than the recent October low. However, the internal momentum indicators say to us that the emotional bottom was the first October drop and the second November low is the beginning of the real bottom. Watch for a price crossing the 50-day moving average for price confirmation. Continue reading

![]()