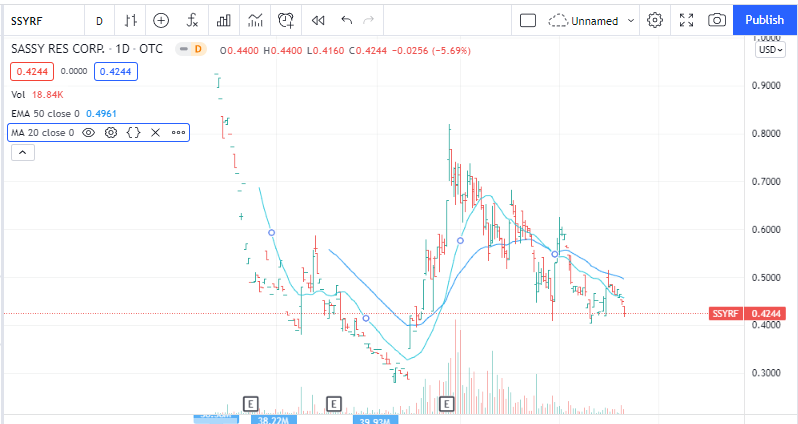

Sassy Resources spinning out its Gander Gold Subsidiary

List of some, Gold Rush Claim companies in Newfoundland

Ten Under $10 For the Double Update. Continue reading

![]()

Sassy Resources spinning out its Gander Gold Subsidiary

List of some, Gold Rush Claim companies in Newfoundland

Ten Under $10 For the Double Update. Continue reading

![]()

Silver and Electric Metals:

In this Video, Jake talks, with Keith Neumeyer, founder Chairman of First Majestic Silver about the massive increase in demand for Silver, Nickel Copper from the “Going Electric” movement.

Silver is NOT What You Think | Watch This BEFORE You Buy Gold & Silver – Keith Neumeyer

Sept 10, 2021, A “I Love Prosperity” video by Jake Ducey – 43 minutes Continue reading

![]()

Karora Resources (KRRGF)* $2.53

Trailing P/E is 5.4

Revenue is expected to Double by 2024

Earnings and Cash flows expected to expand faster than revenue growth.

All in sustain Costs is $996 – expected to decline

LOTM price prediction is $10 by 2024

Nickel deposits alongside KRRGF’s gold deposits provides an add-on product with little extra expense.

Karora is a LOTM related accounts, core holding and largest single position in precious metals.

Interview with Chairman/CEO Paul Huet – July 9, 2021 Continue reading

![]()

Just discovered CELO last night. Sorry now addicted to Crypto….

Altcoin: CELO, $5.80 a crypto protocol.

Market Cap $5,670 million

Circulation 1,000 million

Big project / Big money backing them

$5.80 altcoin – still developmental stage.

Explanation Video: https://www.youtube.com/watch?v=mkpTmbkRv4A Continue reading

![]()

BITW – a package of ten Crypto currencies – is up 23 percent in three days

On Tuesday Aug 31, 2021, I bought 150 shares of Bitwise 10 CRYPTO INDEX (BITW)* $61.00 at a blended price of $49.58.

It is up 23% in three trading days on a portfolio of ten crypto currencies. Continue reading

![]()

There has been a change, though subtle, with money flowing into gold, silver and short-term treasuries. This is typically a defensive maneuver by Institutional Investors to lighten up on risk-on positions and move some funds to risk-off positions.

My coming to this conclusion isn’t universally accepted but LOTM has long had a Risk-off attitude with a 30% to 40% position in precious metals. It is where the value is in this market if you look at cash flows. Nat Gas is also a high cash flow risk off position in October / November 2020. It is still a high cash flow generating sector though not nearly as inexpensive as it was a year ago. We have risk-on positions in Blockchain and Crypto. Continue reading

![]()

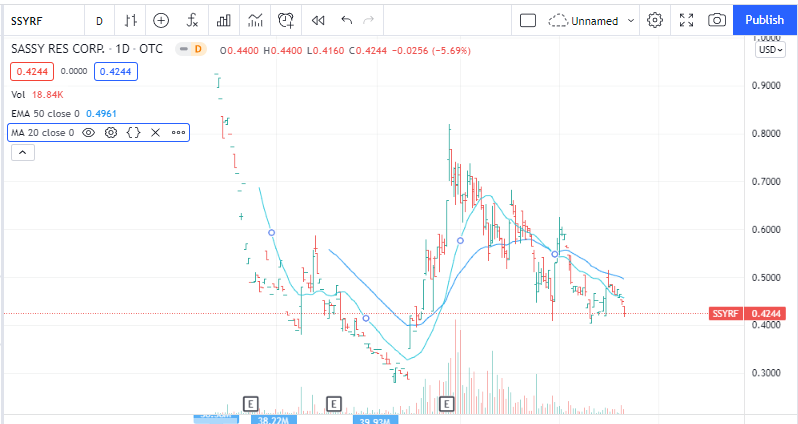

As we head into the weekend, we offer up our thanks to Plum Capital and Kingdom Capital for their great write-ups on MKTY (Mechanical Tech)* $9.85 for spreading the word!

Recent article from Plum Capital and recent article from Kingdom Capital. Continue reading

![]()

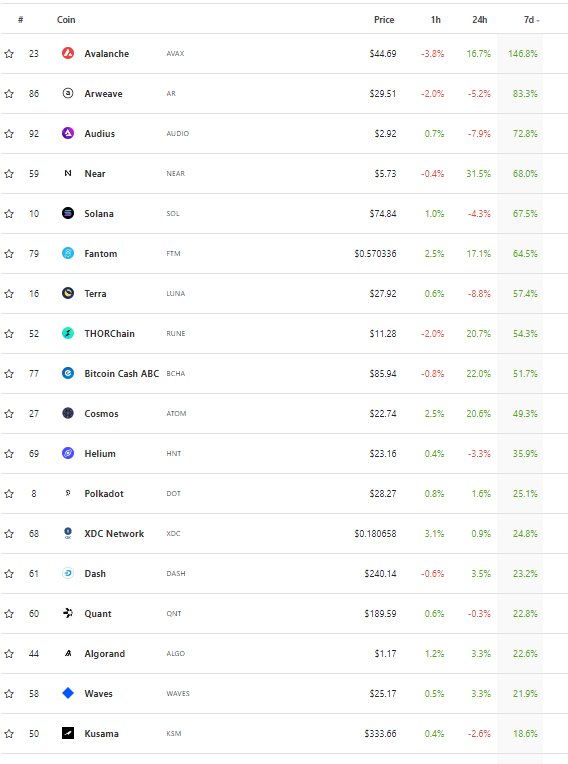

Exponential growth is here now. Want proof?

Sourced: https://www.coingecko.com/en Continue reading

![]()