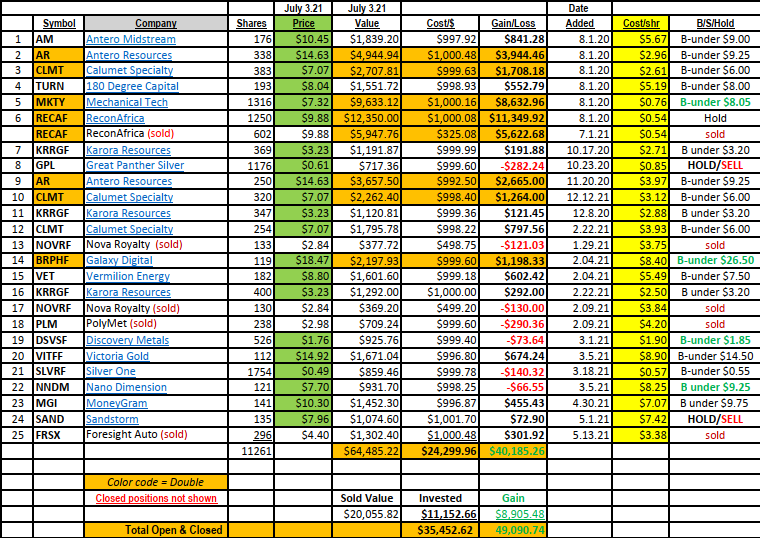

It has been eleven months since we started with our first LOTM stock picks. We have seen the doubles slowdown from the first six months, but we are quite pleased with the returns. Our enthusiasm for the end of 2021 is quite strong however we do believe ‘the market” will see a correction between now and a strong year end rally. Continue reading

![]()