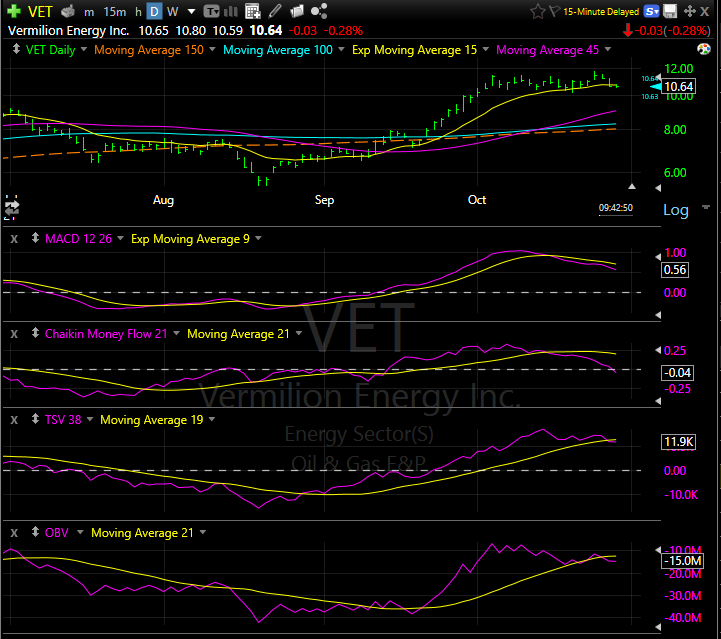

There are traders who have little interest in what they trade. They look at technical attributes within a chart and they are ready to go. Very early in my stockbroker career, that was the path I took. My “awaking” happen when the most perfect of chart patterns suddenly broke straight downwards one mornings with no warning because of a long-lasting geopolitical event that was not “in” the chart patterns. Continue reading

![]()