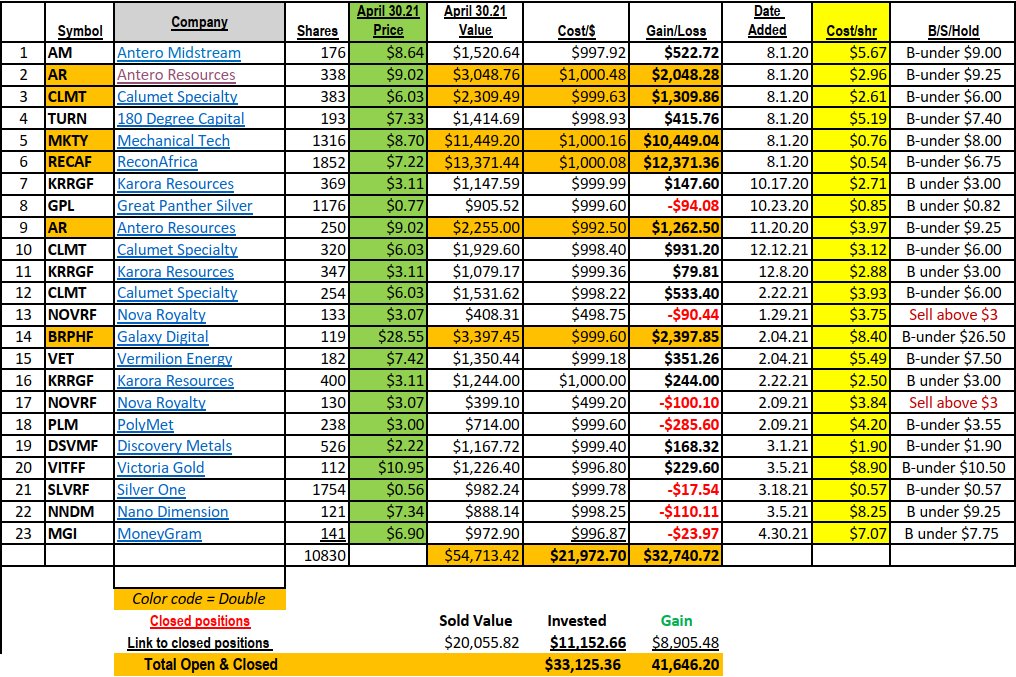

Our focus remains intact. Commodities and Blockchain / Crypto is our “hunting” ground for Ideas. We are beginning to look into some of Cathie Wood of ARK ETF Family of funds for fallen momentum stocks. The addition of Nano Dimensions, (NNDM) is from her list. Continue reading

![]()