November 23, 2019 – Thomas Linzmeier, Access Vietnam Group, LLC

Calumet (CLMT)* $3.20

I have no idea why the shares are where they are at. It is too cheap, yet I can’t say it will not revisit its recent low around $3.00 or lower. Why is the stock down from excellent earnings a week ago? Bear Raid? Year-end tax loss selling? I don’t know. Tax loss selling is usually over by mid-December.

By the numbers the company is doing great. Latest earnings report November 12, 2019.

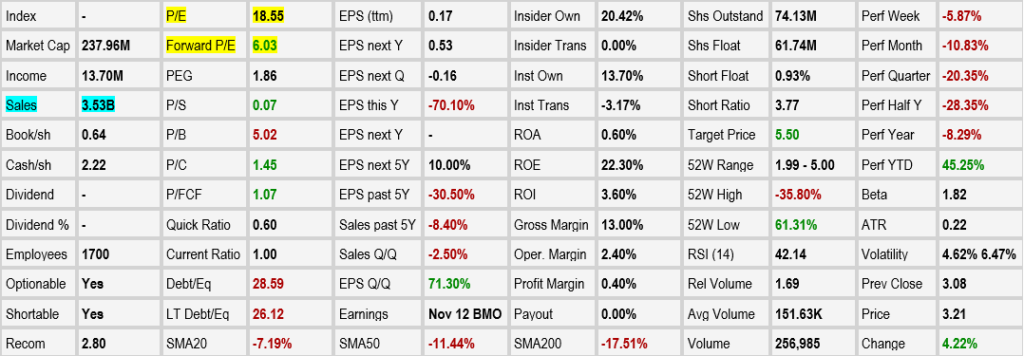

Here are the important stats on Calumet (CLMT)* $3.20

Note the P/E of 18.55 and the Forward P/E of 6. These are outstanding numbers. The current trailing price to earnings (P/E) ratio of the S&P 500 is 22.78.

This is not a small company. They do $3.53 billion in sales with positive cash flow running $150 million a year.

The reason people will buy this is because of the dividend. Maybe the only reason. Would you buy a healthy company that is paying a $1.50 dividend on a $3.20 investment (for the actual math – 46.8% annual return). You can buy now anticipating this dividend but when they declare the dividend you will not be able to buy at this price.

Calumet Stats:

Am I worried about the company?

I am worried that someone will buy the company at $5.00 or $6.00 before it has the opportunity to get to $16.00 that is what I am worried about. If the share price goes to $30, a $1.50 dividend is a 5% payout. That would be twice the ten-year treasury rate. It is possible.

Management will get a $16 million dollar bonus when 1) they reinstate the dividend and 2) the stock price hits $16.00. That is Management Incentive.

They are one asset sale away (Great Falls, Montana Refinery) from a debt reduction goal that has been mentioned as the goal before they reinstate the dividend. Expect a dividend between $1.00 and $2.00 a share.

Fundamentally; the shares are cheap – Buy – no stop loss. Fundamentals are that good.

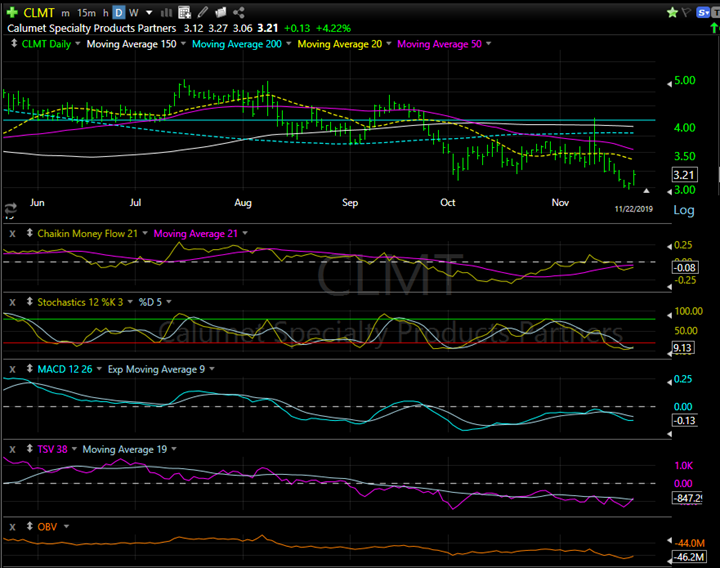

Technically; one would wait for a rising trend – Buy some, add on rising trend. Nine day crossing above the 50-day is a good signal.

Sentiment: frustrating and makes you want to puke – BUY!

BELOW CHART: Almost all technical indicators are bottomed out and appear ready to rise. My read on them anyway. Take a look and judge for yourself. What I see is all indicators are above their readings when the stock hit its early October low. Now the share price is lower, but indicators are higher.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket

ZTA Capital Group, Inc.

Attn: Thomas Linzmeier

339 Summit Ave, Suite 4,

Saint Paul, MN 55102

![]()