Aug 9, 2020: Tom Linzmeier editor LivingOffTheMarket.com

In our daily studies on the market we are seeing a very big surge of money into the Banks. Not our favorite sector for investing, but they are sold out. Money flows have started buying into the industry group. We believe in the Gold & Silver theme and Banks are the opposite end of that theme – much less desirable. It could be we are at a pivot point away from Gold & Silver and into Banks, but I doubt it. I believe we will see Banks and Gold and Silver rally. More on that in another writing.

- First: The Headline and why Banks Insurance, Energy and Cyclicals

- Second: Banks are at the intersection, Where Value meets a Technical Rally Lift Off.

Stock-market expert sees a ‘monstrous’ rally taking hold next week, if one recent trend holds

Last Updated: Aug. 8, 2020

The best start to an August for the U.S. stock market in years might get even better, as soon as next week, if the forecast from Thomas Lee, founder of Fundstrat Global Advisors, is accurate.

Lee makes the argument that the stock market’s underloved sectors are on the verge of a breakout that could come as his research team sees COVID-19 cases peaking, setting the stage for what he describes as an almost textbook rebound for parts of the stock market that had been pummeled so utterly near the start of 2020.

Fundstrat says coronavirus cases, which have topped 19 million globally and are 4.9 million in the U.S., as of Friday, are declining on a seven-day rolling basis to a decrease of 15,492 (see link for full story)

This is what we do at LOTM – look for over-sold industry sectors and monitor them watching and waiting like a cat stalking a bird for a sector rotation into the industry. That is what we saw in 2015 /2016 with gold and silver. We are still on that buy signal. We recently saw it with the Natural Gas Industry and for the first time in a while we are seeing it in the Banking and Insurance industry.

Visual image of money flow shifting strongly into regional banks as shown in this ETF view.

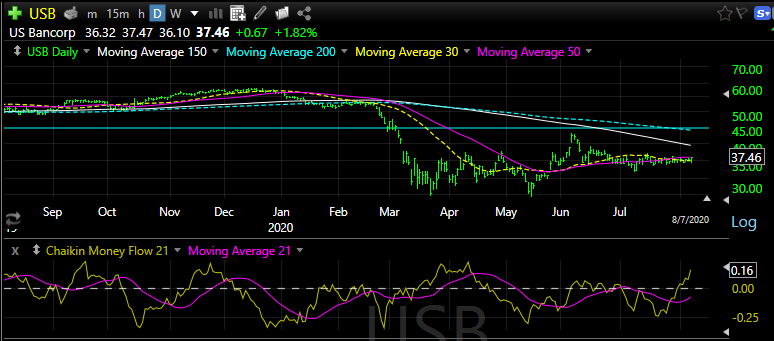

Individual Bank: US Bank

Same pattern is in both charts. Note the sharp increase in positive fund flows shown by the Chaikin Money flow. Prices are lagging the positive change in money flows.

The regional banks have recovered from the March sell off, but more of a “they stabilized and based” while other sectors of the market ran the show. Now it seems there is a rotation beginning to come into the Banks and Insurance stocks. Last week we saw some of this in the Natural Gas industry. We believe this is the beginning of the Post-Corona Virus rally into areas left behind in the first move April to July.

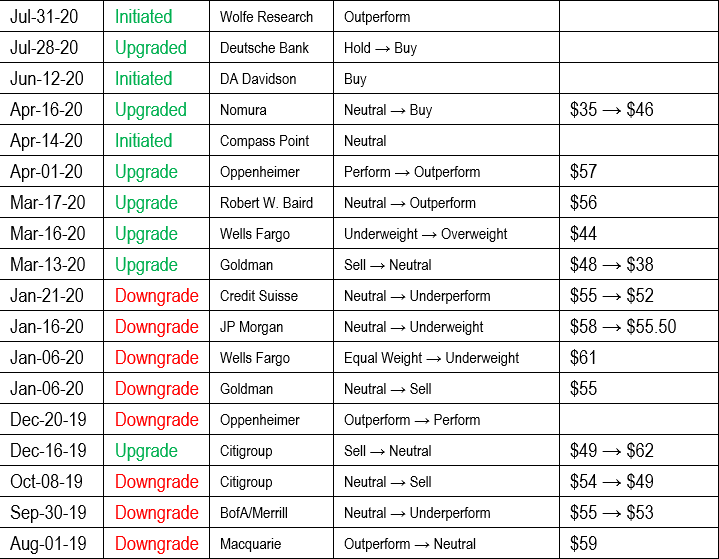

Many brokers in June and July have issued buy rating on the banks and Insurance companies. Example: USB (US Bank) at Finviz site. Drop down to the analyst section and you will see these actions.

Note the January down grades were about five to seven weeks ahead of the price declines. We think the brokers upgrades April to July combined with the stronger technical signal are supportive of a group rally.

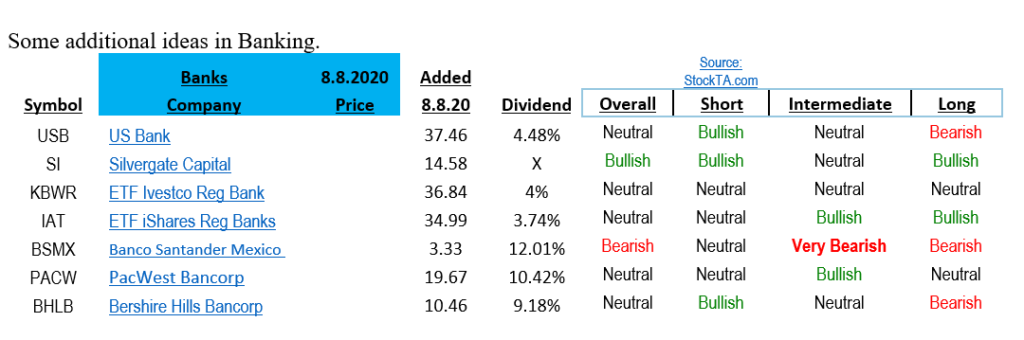

Note: BSMX has recent buy recommendations from Citi and Goldman.

Methodology….

- Find and underperforming industry that is at a good valuation.

- Monitor for a change in inflows of investment money and for the share price to start moving from Stage 1 chart pattern to Stage 2 chart pattern (basing to initial rally)

- Look for the strongest companies in the industry as well as strong industry companies that pay high dividends.

The logic is that in difficult times the strong will get stronger. Coming out of a difficult period (fundamental and technical), the strong will outperform the weak. It is also a good time to be shopping for dividend stocks that offer appreciation potential, so we do not want to ignore that part of the market.

In summary:

- We are getting buy signals for the banking and insurance industry.

- Traders, we are not sure how long the buy signal will last so have your exit strategy defined.

- Investors, consider ideas with dividends. Everyone is shopping dividend. Favorable comments on the industry will draw buyers to the dividend payors.

Where Value meets Buy signals!

We teach you Risk Management for Your Personal Situation.

LOTM is a free newsletter. Feel free to forward or recommend to others.

![]()