Down from $120 five years ago, we believe Apache Corp (APA) is too cheap as is the Oil and Gas industry. LOTM is focused on gas more than oil but we could not ignore Apache.

Big volume entered the shares in March of 2020, and we are projecting that is the multi-year low. We are getting a bit of a retest on the price at this time. You might want to wait for a break-out above the June July highs is wanting to establish that checkmark. We happy to step in now and use a stop loss or dollar cost averaging risk management tool. The buy list from analysts is very long, and can be seen here.

Technical analysis indicators are all negative. So, we have to say we are guessing a bottom. We are positioning companies in the Nat Gas industry because the industry is so cheap historically. No doubt there is uncertainty about the elections and what the energy policy will be during the next administration. We have taken the position that it will be decades for the world to get off fossil-based energy and there will be time of rapidly rising energy prices and yes times like now, when they get too cheap.

TIPRANKS: Based on 17 analysts offering 12 month price targets for Apache in the last 3 months. The average price target is $16.20 with a high forecast of $22.00 and a low forecast of $11.00. The average price target represents a 67.53% increase from the last price of $9.67. This leave the potential for a double in twelve months.

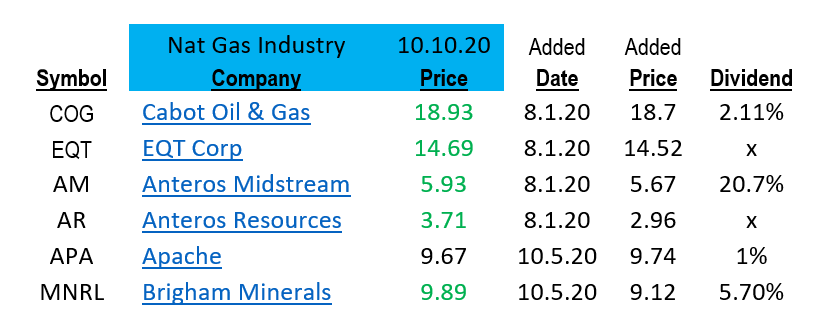

Here are some of our other positions or ideas we like at this time in Energy.

The company names are linked to StockTA.com and provides the StockTA technical opinion on the respective stocks. We are Fundamentals first and technical second most of the times but not always. We readily admit we are early on this call. We believe no matter who wins the election Nat Gas stocks will rally. More so on a Trump win, than a Biden win. Never-the-less, the “Market” hates uncertainty. Knowing the problem and challenge is better than uncertainty. The market has always been this way. Bad news is not bad news if it is already priced into the stock when the news is announced. Buy or sell the rumor and do the opposite on the news. Have a great day!

The company names are linked to StockTA.com and provides the StockTA technical opinion on the respective stocks. We are Fundamentals first and technical second most of the times but not always. We readily admit we are early on this call. We believe no matter who wins the election Nat Gas stocks will rally. More so on a Trump win, than a Biden win. Never-the-less, the “Market” hates uncertainty. Knowing the problem and challenge is better than uncertainty. The market has always been this way. Bad news is not bad news if it is already priced into the stock when the news is announced. Buy or sell the rumor and do the opposite on the news. Have a great day!

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()