An Out-of-Favor Sector of the Market – Went BOOM!

This chart above is not unusual. Who is DAC? DAC (Danaos) is a container shipping company. After tripling in price, the P/E is still only 1.4 on a ttm and 1.2 on a forward basis. Value? Yes. Too cheap. Not exciting stuff – except, perhaps “the market” thinks the global economy is coming back. Don’t know. Just following the market. What I do know, is it is unusual for a shift in asset class, fund flows to end in just three weeks. Eight or nine months – OK. A two-year move? More normal.

Unloved one day – In demand the next. There are many charts like the one above.

This is not so much a recommendation notice, as it is a notice that there has been a dramatic change in focus as to where the market action (funds flow) is now.

There has been a noticeable inflow of funds to a what has been an ignored and unloved sector of the market. Something happened Aug 1, 2020. More example show up in the charts below. We happen to own these two and told our readers about them before the moves

Kontrol Energy is a Canadian architectural, construction firm that renovates buildings using Cloud based IoT, Blockchain and Data Analysis with best in class energy conservation tactics. Oh, yes, they also introduced a room sized virus and bacteria detection system, ready to go-to-market at the end of November.

Mechanical Tech is a small Scientific Instruments company, debt free, profitable with a new growth initiative in Blockchain and crypto mining.

Three different types of companies – different industries – yet each a triple in value since August 1. Something is changing in Market Money Flows. Commonality between these three companies – They are low priced stocks trading a very low valuations, with a catalyst.

Perhaps it is a signal the global economy is in recovery mode. Perhaps an asset rotation? Can’t say for sure – just that it is real and not likely to stop after three months. U.S. GDP has taken a big leap forward in Q3. It will be announced in about five days.

It is hard to quantify.

The best I can say is that there is an asset rotation happening:

- A shift to Value stocks from Large cap growth.

- A shift away from Gold and Silver miners to Base Metal miners – don’t worry, Gold and Silver will correct and run again soon.

- Small cap companies are doing better than Large cap companies.

- Value better than Growth –

- Traditional companies better the FANG stocks

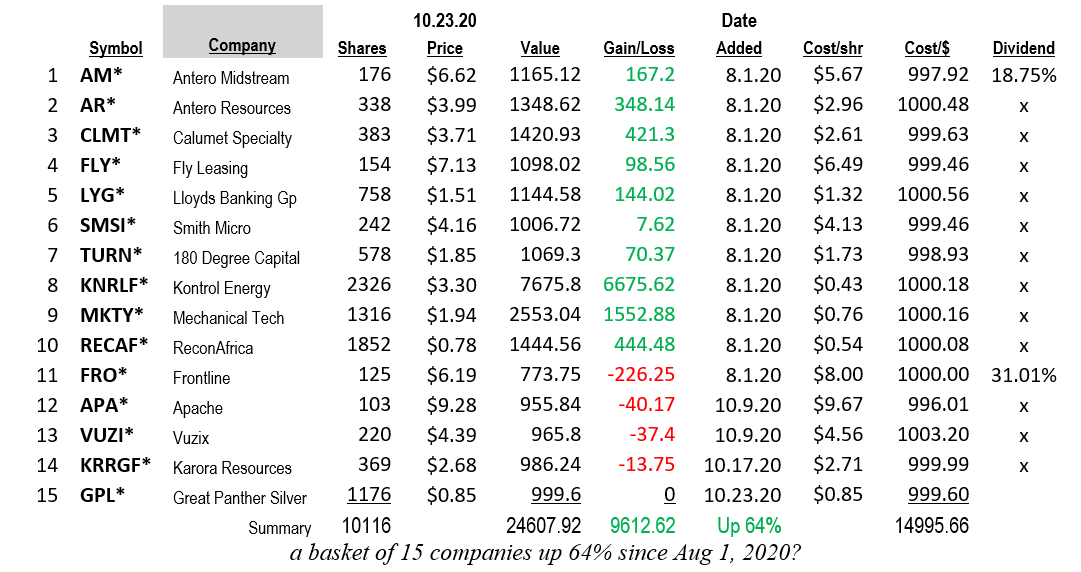

By chance – LOTM started a Ten Under $10 – in search of Doubles list on Aug 1, 2020

Here is what it looks like today.

In our view we will see more non-tech, low P/E, commodity, traditional Vs high tech companies be on the receiving end of market fund flows.

In our view we will see more non-tech, low P/E, commodity, traditional Vs high tech companies be on the receiving end of market fund flows.

More stocks we like:

- Energy stocks: APA – AR – AM – MNRL – FANG – RECAF

- Aircraft Leasing is a new favored group: AL – AER – FLY

- Miners of all types – too many to list you have many past emails with names.

- Crypto and Blockchain: MKTY – KNRLF – RIOT – GBTC

Check out Tom’s Blog and sign up for free updates to your email address!

-

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()