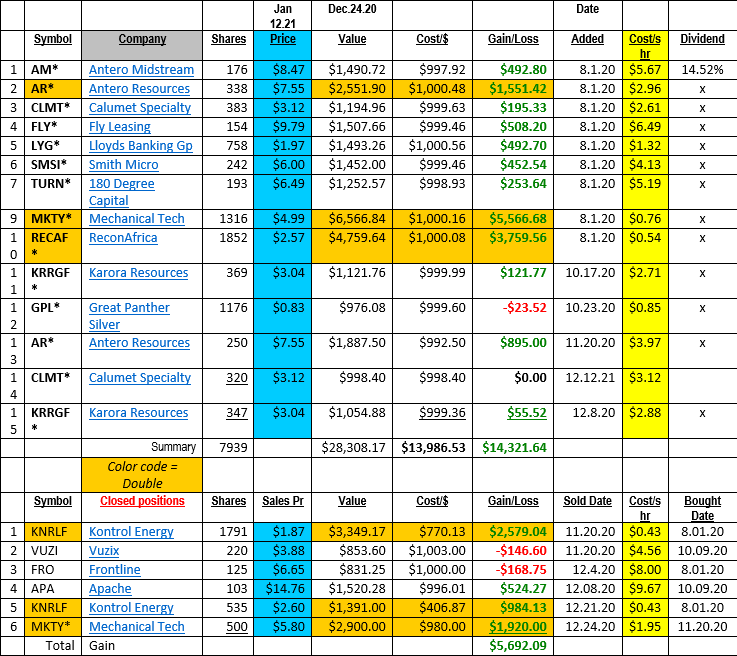

Addition to the Ten Under $10 list:

Yesterday we added a second unit of $1,000 to Calumet (CLMT). There is a clear catalyst for the shares of CLMT. That is the sale of one or more divisions of the company. This would allow the company pay as much of a third of its long-term debt of $1.4 billion. Should the company sell a second division that a third party has expressed interest in, it is possible that the company would liquidate the entire company. The sale of two major divisions would reduce the footprint of the company to a level that consideration must be given to sell what is left. We do not believe this is the path Calumet will go but future decisions revolve around being a growth company or being a cash distribution company. Both are choices between two positive paths. At this time, we do not know which path will be chosen. Our price goal for CLMT in 2021 is a triple from the current price.

Quick Notes:

MKTY – we suggest consideration be given to buying a second unit of MKTY at a price below $4.40. We have traded this once successfully. Adding back at a target price should there is a correction is an option we welcome. Late Q1 and early Q2 2021 is expected to produce multiple Press Releases on progress in business development.

AR – two quick financings have eliminated concerns about near term debt maturities. The stock moved up sharply. This is a top five producer of Natural Gas in the USA. We are happy to see a shift back to the operations of the company and away from financial concerns.

RECAF – owners of 95% to 100% of the drilling rights in a large basin in Namibia and Botswana (about 26,000 sq Kilometers) ReconAfrica has begun its first exploratory well. This is a once in a life-time opportunity to control a large land mass for one tiny company. The upside is very big. The downside is you could lose your investment. I believe they call this in the industry a Wildcatting opportuniy

KRRGF – we really like this junior gold mining opportunity. Cash flow are strong at $5 million USD per month. Reserves are large. Under known outside Mining circles. Growth plans will be announced in Q1 2021. Oops – guess that is very soon.

Our comments here are short and incomplete. Many of these names we have discussed in the past, so we are not going to retell the stories. Check oy web site for more in-depth on some companies. We also recommend listening to company conference calls as well as reviewing their press releases, Other blogger sites/comments and the company web site.

Training, Mentoring and Coaching

A reminder that we offer Training, Mentoring and Coaching for different levels of experience. Making money in the market goes far past simply buying the stock of a company and waiting. With four decades of experience Tom, is an asset to consider having on your team!

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()