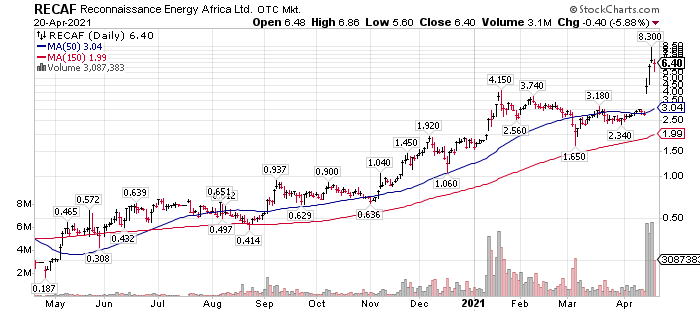

The “big” mover last week was Recon Africa (RECAF)*. They control 28,000 sq kilometers in Africa. Namibia and Botswana to be exact. Government relations and local people’s relationships appear good. Government wants the resource developed as country income and locals near projects, desire the jobs and income. In-country and international environmental groups are in opposition to drilling fossil fuels in an environmentally sensitive watershed.

Why did the Stock Jump? On their first exploratory drill site Recon de-risked the project by finding core samples with strong oil & gas presence.

What is the Potential? Recon Africa has 95% to 100% lease and development rights to somewhere between 28,000 and 30,000 square kilometers of property. That is about the same size as the entire Eagle Ford Basin in Texas.

“The Eagle Ford Shale (EFS) is quite possibly the largest single economic development in the history of the state of Texas and ranks as the largest oil & gas development in the world based on capital invested.” (linked above)

The current market cap for Recon Africa is about $789 million USD. We are estimating about 120 million shares outstanding. There has been recent fundraising activity and consolidation of related companies. This is still quite low valuation for the size of the property, now de-risked significantly from six months ago. Those who are in at lower prices have been well compensated for the risk they took on this wildcat project.

There is a lot of time and work needed to develop this basin and one well does not prove the entire basin. However, the risk factor has dropped significantly with this first well’s success. The drill rig is now in transit, to begin a second test drill site about 16 kilometers from the first site. A third exploratory drill site is planned following completion of the second test site.

ReconAfrica’s First of Three Wells Confirms a Working Petroleum System in the Kavango Basin, Namibia

April 15, 2021 PR by ReconAfrica

ReconAfrica Article in OilPrice.com:

The Best Is Yet to Come for The World’s Hottest Oil Play, By James Stafford – Apr 19, 2021.

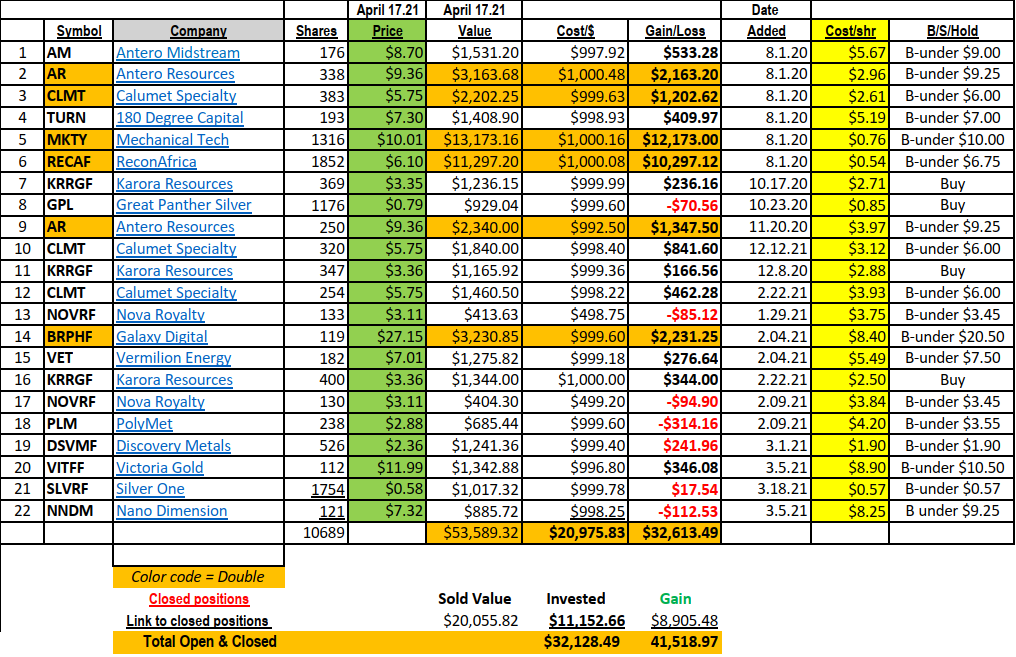

Ten Under $10 For the Double as of April 17, 2021.

We are big fans of Energy, Precious Metals and Blockchain related investments. At this time, we see these positions as both defensive to the overall market and having the greatest upside potential in the market.

We assume the market is in what is called Quad 3 – Slowing growth rising inflation phase of the market.

Four possible outcomes, each of which is assigned a “quadrant” in our Growth, Inflation, Policy (GIP) model and the typical government response as a result (neutral, hawkish, in-a-box or dovish):

- Growth accelerating, Inflation slowing (QUAD 1).

- Growth accelerating, Inflation accelerating (QUAD 2).

- Growth slowing, Inflation accelerating (QUAD 3).

- Growth slowing, Inflation slowing (QUAD 4)

After building this base of knowledge, we select what we like (and do not like) based on our historical back-testing of the different asset classes that perform best in each of the four quadrants.Linked to source

We recommend receiving the LOTM Daily Notes to stay current with our thoughts and suggestions.

During the next month, we will doing a lot of traveling. We are understaffed and time constrained. We will not always be able to provide the information we would like to. Account management will always take precedence over the newsletter. Just the way life is. Receiving the LOTM Daily Notes is the best way to stay connect to us. It is not always pretty or grammatically correct. At times, it is writing a steam of consciousness and send and cringe at what I sent later. Our goal is sharing our Thoughts and Ideas and there are times, we feel like we are in a war zone. I have been there too, so I am not minimizing the difference. To receive Daily Notes, send an email to Money @ LivingingOffTheMarket.com (close the spaces) and put Daily Notes Please in the subject line.

We would like to give a shoutout to Ed S., long-time friend and LOTM reader, for his recent pat on the back – Thanks Ed! As you well know, it can get lonely sometimes, Haha.

Tom,

Such a great ten under ten! Don’t want the moment to pass without acknowledgement of how good this portfolio is. Easy for an outsider to take it for granted but for those of us who wonder sometimes if we are just doing a rain dance, it is a tangible statement to the virtue of persistence in a moment of convergence. Well done! (and keep dancing)

ED

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()