Silver and Gold miners took a big hit this week, as dual reasons hit the precious metal industry – These dual thoughts contradict each other and cause doubt, confusion. Maybe, fear of loss reigned.

- The first was the Fed Chair Powell, speaking more aggressively about raising interest rates. This does not bother me very much because when interest rates rise, they will rise in very small increments. We do not see it happening for a while though sometime in 2022 is likely.

- The second is the surprise idea that inflation is not a problem, and the reflation trade is dead. Growth stocks are back, and Value and Inflation hedges are out. We own gold and silver for the loss of purchasing power of the US$. So, for LOTM, our reason to own precious metal related positions, has not changed. They are excellent values based on cash flow, earnings and on future potential for higher silver prices from demand – not inflation.

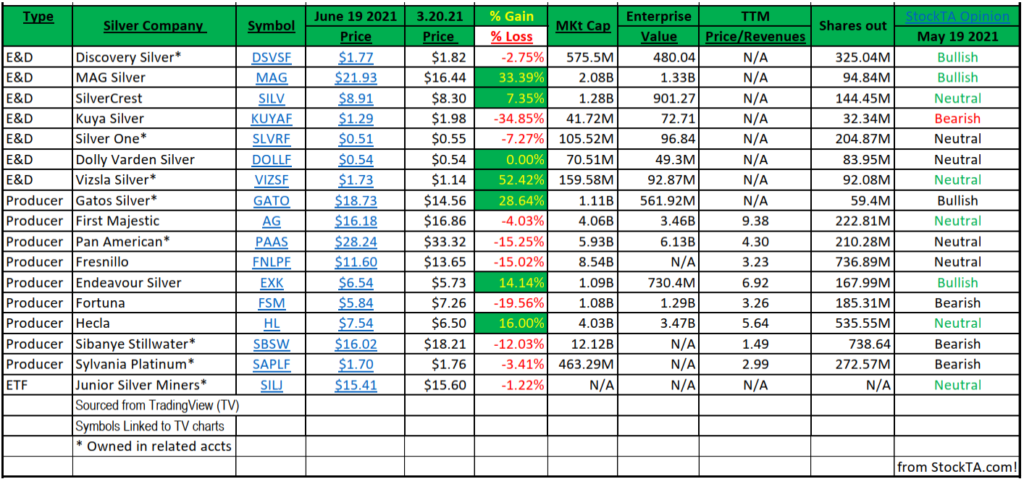

Our favorite E&D (Exploration & Development) positions are Discover Silver, Silver One and Vizsla. I like all three at these prices, so it is hard for me to pick a favorite. In related accounts we own all three. Discover and Vizsla are finding big silver deposits while Silver One is very attractive, but an earlier stage company, developing more slowly and with less PR. Remember in E&P, there is no revenue and most look to de-risk a property and then sell the property to a producer.

Our favorite production companies are Gatos and Pan American Silver.

Pan American is too cheap in my opinion and may be the best single pick of the bunch. Gatos was down at $16.18 area, Thursday, and snapped back very fast to almost unchanged, at $17.98. A really good show of strength and buying interest.

Pan Am is the value deal and Gatos is the momentum stock. Pick your own poison. Both are excellent managed companies, and both are very volatile. We suggest multiple purchases of each over time and especially on weakness.

Pan Am Silver (PAAS)* would be our single best choice for a six month trade idea. They are expected to have a very good earnings in the coming twelve months. They are a volatile trader as well. They are one of the largest silver miners in the world and “the” largest silver miner in the Western Hemisphere. Management is excellent.

At this time, we are still looking for much higher precious metal prices for the next two to four years. We do not want to lose our positions by trying to trade or move in and out. We would rather be accumulators of the shares on weakness.

We are ignoring technical opinions at this time. We are taking the attitude that we saw a knee jerk reaction and it will not last long before the prices snap back.

Profit margins, with physical silver at $25 to $27 an ounce, are very profitable for the miners. We are buying with the expectations of 1) higher physical silver prices, 2) strong company fundamentals and a 3) hedge against a falling US$.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()