This week we added long positions in three new names:

This week we added long positions in three new names:

- Dorsey Wright DWSH)* $8.54 – we hope we lose money in this position haha because it is a short position on the market in general. DWSH is an actively traded ETF. We did not like the Wells Fargo (WFC) news on closing out their unsecured lines of credit. Our guess is that they are not doing this because they want to do it. It is about $25 Billion dollars. Last week saw weakness in interest rates and lots of action in the reverse repo market. We think this could have had a connection to the actions at Wells Fargo.

- The Fed is soaking up nearly $1 trillion from market participants awash in cash and desperate for returns Business Insider July 1, 2021

So. We are putting on a bit of a hedge. We will likely increase positioning in inverse ETFs if market weakness develops. We see internal market weakness under the New Highs on the major indices.

- We added shares in a tiny company, Windfall Geotek (WINKF)* $0.13, who’s business model we love. They are a consulting firm to different industries or governments. Our focus is the Mining industry. They act as a prospect generator for cash but at times stock warrants and/or royalties. In do so they are building assets and years of future cash flows in a very low acquisition manner. This is not a get rich quick game but the compounding of acquired assets over time could be substantial. The company has been around for about 15 years, but new management is shaking things up in a positive and meaningful way. We are excited about what “could” happen at Windfall. Capital needs are low, and overhead is mostly human costs and modest technology expenses. Windfall is a Data Analytics / Artificial Intelligence company. Nothing but limit orders used here! Just because it is cheap don’t go outside the perimeter of your portfolio allocation.

- We can’t stay away from the gold and silver industry. Inflation – Deflation – Geopolitical wars, we think gold and silver and especially the miners are CHEAP. We added share of Kinross (Gold KGC) $6.30 to the portfolio. KGC is a top ten global miner, highly respected, that suffered a fire at of their processing facilities. They are taking the opportunity to expand and modernize the facility. This has added about four months to the repair process and the market is punishing KGC for the delay. No lives were lost due to the fire.

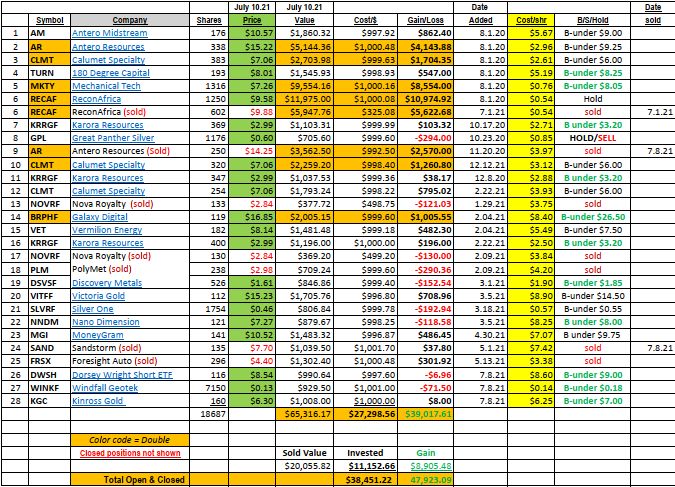

Sold or Reduced positions from the LOTM: Ten Under $10.

- We reduced our position in Anteros Resources (AR)*. Our cost was $3.97 and sale price was $14.25. This was roughly 40% of our position. Great run in eight months. We believe in letting your profits run and limiting your losses so… We want to see where the remaining shares go. We are also seeing a lot of interesting names we want to add to the portfolio so… We are harvesting some cash to reinvest.

- We sold Sandstorm (SAND) for a tiny profit. Sandstorm is an excellent company; management has an excellent reputation. But we see greater upside in other companies in the Mining industry. Two of these are Windfall Geotek and Kinross Gold added this week.

Precious Metal comments.

- The valuations / cash flows within the mining industry are very strong and would still be if physical prices decline. The financial shape of the industry is strong. Debt levels are low or falling. Dividends are rising. If the stock market in general falls, this is a healthy safe haven sector.

- Geopolitical risk is rising. Say what you want about Trump, other national leaders feared or respected his power and were uncertain about his actions. No one is afraid of the Biden Administration, internationally. The odds are high, someone, probably China, will test the USA. It is likely to be over Taiwan. Gold and Silver will be a beneficiary of this action.

- It is possible that the shift from Growth to Value themes, that started in mid-February, continues. If so, the low five to 15 range of “trailing” P/E ratios in the Precious Metals industry, looks very attractive.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()